For those new to new technology, innovation can sometimes seem like an overnight success story. However, in reality, in many cases it takes decades to create.

Currently, we are using four innovative technologies created over several decades: blockchain, AI (artificial intelligence), IoT (Internet of Things), and XR (collective term for VR, AR, MR, etc.). We are now at a precious moment in time when the momentum is rapidly increasing.

These technologies are not separate but related. Just as the term “Internet” has moved from representing a narrow set of technologies to encompassing a wide variety of technologies, business models, cultural upheavals, and social transformations, the term “Web3” also represents progress. will be able to capture the next era.

Financial advisors and investors are exploring the best ways to gain exposure to these disruptive technologies.

Web3 lens

In the mid-1990s, we had the choice of investing in many emerging Internet companies and companies considered central to the first era of the Web, such as Cisco.

Legacy businesses that were considered safe bets, such as Blockbuster, Borders, Compaq, JCPenney and Xerox, haven’t fared so well. What these companies had in common was that they were about to be disrupted or forced out of their role as intermediaries by the first era of the web.

Viewed through the lens of the internet, investors’ evaluations would have been different. Web3 now requires a new lens on the market. Like the early Web in the 90s, Web3 will become an essential technology for business, creating winners and losers.

So far, most of the value has been created in blockchains like Ethereum and private companies like OpenAI. But what about the stock market? Can investors gain exposure to Web3 by purchasing shares?

We believe the answer is yes. Today, dozens of great companies are leveraging the Web3 toolkit to create new products and services, target new customers, and announce new features.

stable coin

First, consider a stablecoin pegged to the US dollar. With the emergence of companies like PayPal, which recently launched its own stablecoin PYUSD, stablecoins will become a ubiquitous payment tool.

For now, PYUSD is only a small part of the stablecoin market, but within the first 100 days or so of its launch, the total supply amounted to approximately $150 million (approximately 22.5 billion yen, at an exchange rate of 150 yen to the dollar). and is growing very rapidly.

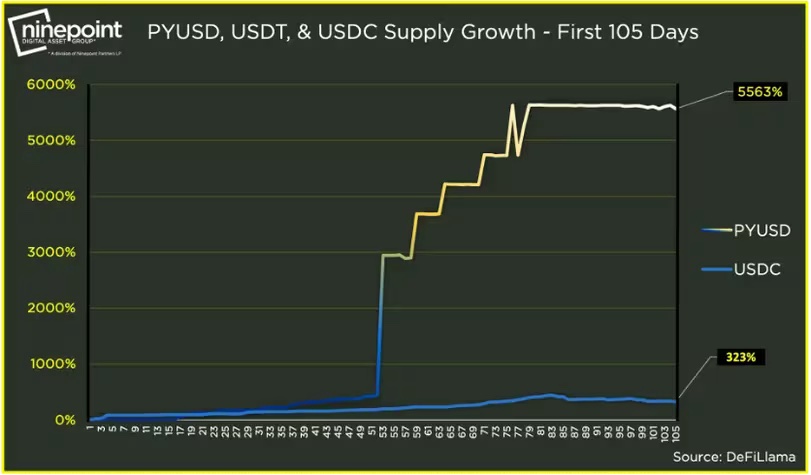

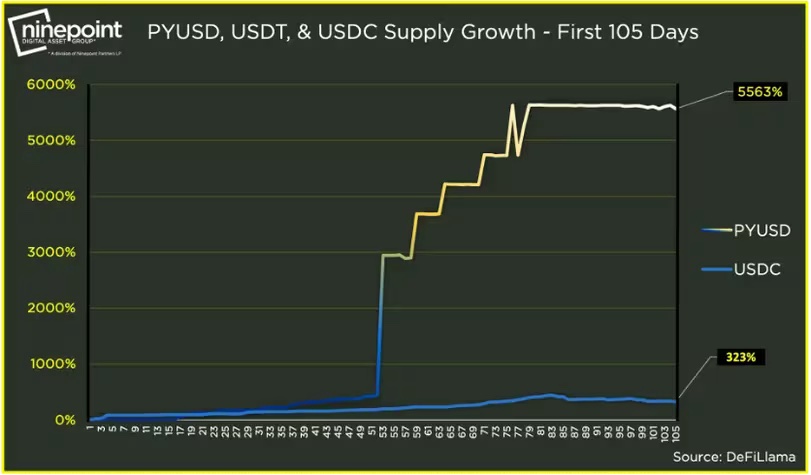

Supply Growth Rate of PYUSD and USDC in First 105 Days (DeFiLlama)

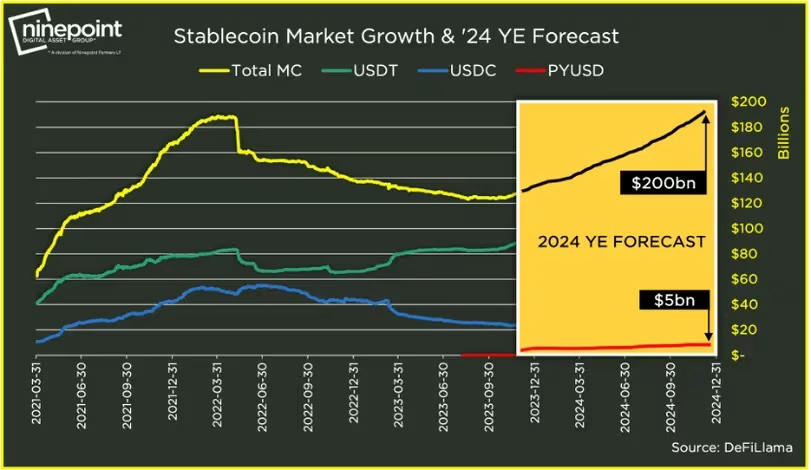

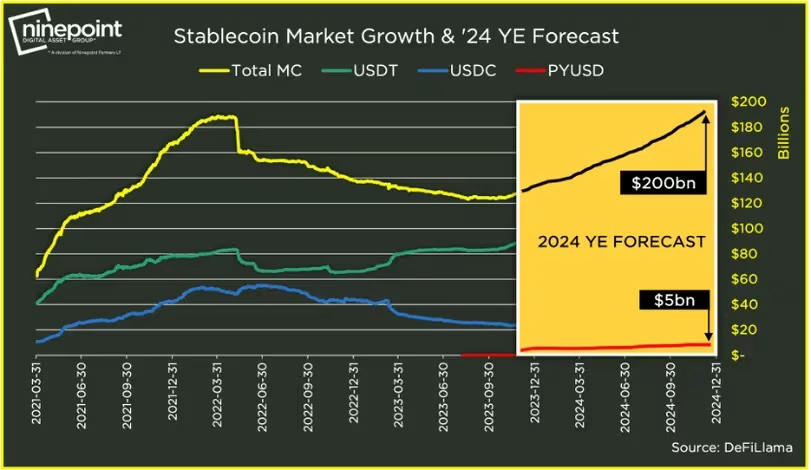

Supply Growth Rate of PYUSD and USDC in First 105 Days (DeFiLlama)We see the stablecoin market growing to $200 billion in 2024 and PYUSD reaching $5 billion. Stablecoins are highly profitable, with issuers investing their deposits in U.S. Treasuries with yields of 4% to 5%.

Circle, a highly innovative global financial technology company with its popular proprietary stablecoin USDC (with over $20 billion in circulation), is considering going public. The expansion of investment targets for pure Web3 companies and those adopting Web3 technology is a tailwind for asset managers and financial advisors.

Stablecoin market growth and growth forecast for 2024 (DeFiLlama)

Stablecoin market growth and growth forecast for 2024 (DeFiLlama)Products that can be invested in the open market or OTC

Second, there are simple and easy ways to invest directly in crypto assets through the US public markets or over-the-counter (OTC) trading products. Grayscale’s Ethereum Trust (ETHE) is attractive because it not only provides exposure to Ethereum (ETH), but also because it sometimes trades at a discount of more than 30%.

We believe that the arrival of an Ethereum ETF is a matter of “when” rather than “if”, and if it happens, ETHE will be converted into an ETF and the discount will almost disappear. Bitcoin and Ethereum ETFs already exist in Canada.

Major companies adopting tokens

Thirdly, more and more companies are accepting tokens and starting to make a lot of money with them. Innovative companies such as Nike have already adopted tokens. For example, Nike has generated $385 million in revenue from 25 NFT collections since December 2021.

Brands following in Nike’s footsteps include Adidas ($150 million in NFT revenue), Dolce & Gabbana ($27 million), Gucci ($16 million), and Tiffany & Co. ($15 million).

Disney also announced a partnership with blockchain company Dapper Labs to launch its own Web3 service. Over time, companies that embrace digital assets will be well positioned to take on the web’s next frontier.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Crypto for Advisors: Investing in Web3

The post How to invest in Web3 through the stock market[US version]| CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·