Event report contribution

On January 17, the Japan Crypto-Asset Business Association (JCBA), which is active for the purpose of improving the business environment and sound development of crypto-assets, blockchain-related digital assets, and Web 3.0, announced the “electronic payment method ( Commentary on Cabinet Ordinances and Draft Cabinet Office Ordinances Concerning Issuance and Intermediation Practices for Stablecoins in Japan” We held an online event to explain.

At the event, Fumiaki Sano, partner of Kataoka Sogo Law Office, Ken Kawai, partner of Anderson, Mori & Tomotsune Foreign Law Office, and Yosuke Shiraishi, CEO of ARIGATOBANK Co., Ltd. Mr. Tomohiro Kitada, Executive Officer of Coincheck Co., Ltd., and Shohei Hamada, General Manager of Treasury Department of bitFlyer Co., Ltd., will take the stage to provide explanations by legal experts, fund settlement business practices, and the perspectives of each person who is familiar with the crypto asset exchange industry. A panel discussion was held with

Stablecoins, whose price is stable at 1 dollar = 1 coin, are used as assets for payment methods and fund procurement on the blockchain, and the market capitalization has already exceeded 137 billion dollars. *

Japan is also moving to improve the distribution environment, and the revised Payment Services Act of 2023 is approaching.

We hope that this system, which is related to a wide range of licenses such as fund transfer business, trust business, and banking business, will serve as a reference for business operators regarding the outlook for circulating stablecoins that are in high demand in the Web 3.0 worldview.

*Coingecko, as of February 16, 2023

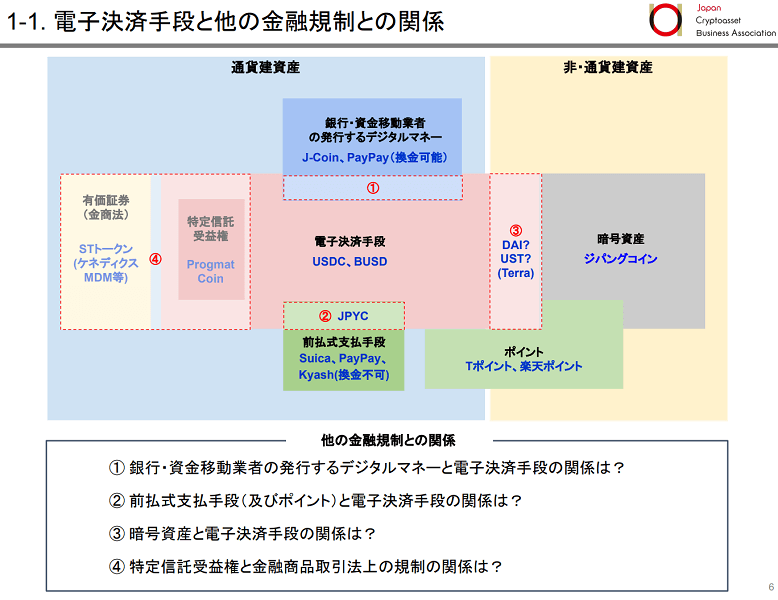

What is Electronic Payment Means? -Comparison with Existing Digital Money, etc.-

Source: Provided by JCBA

In the first part, Mr. Sano and Mr. Kawai commented on legal systems and business regulations related to electronic payment methods.

Mr. Sano first explained the differences between existing crypto assets, digital money and points issued by banks and fund transfer companies.

Electronic payment means are currency-denominated assets organized into deposits and foreign exchange transactions, and can be purchased, sold, and used P2P with unspecified parties, and can only be used within a specific system 1 point = 1 He said that it is different from yen digital money.

In addition, the requirements for category 4 electronic payment instruments include the description that “those specified by the Financial Services Agency in consideration of the usage situation and other circumstances”, and are currently classified as crypto assets under the Payment Services Act. It was explained that there is still room for designation as an electronic payment method when coin transactions expand.

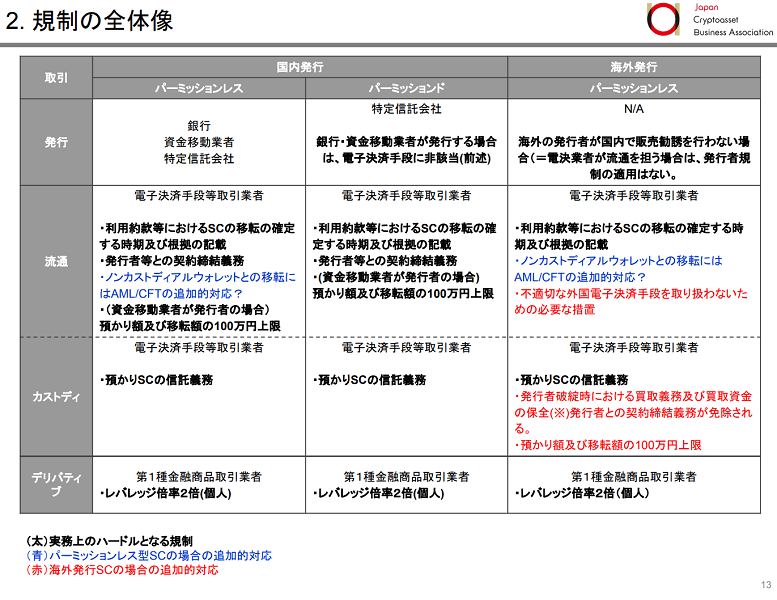

Source: Provided by JCBA

Issuer Regulations – Can USDC be Issued? Issuance of Electronic Payment Instruments by Funds Transfer Service Providers and Trust Companies –

Mr. Kawai explained the issuer system.

Issuance and redemption of electronic payment instruments require a banking business license or fund transfer business registration, and foreign issuers that issue USDC and tethers need to obtain a license in order to solicit in Japan. , I explained that a scheme of wholesale sales to brokers such as electronic payment means that acts as an intermediary is envisioned.

In addition, when issued by a domestic money transfer service, considering the retention restrictions imposed for each type 1 to 3 license and the upper limit on the transfer amount, it is mainly issued by the type 2 money transfer service. He explained the outlook for practical matters such as retention regulations, upper limit regulations for transfers, notification obligations at the time of issuance, and the status of organizing rights.

He said that trust companies can also issue money trusts in the form of trust beneficiary rights and can issue a type of stablecoin as specified trust beneficiary rights if certain requirements are met by holding them in settlement deposits. He explained that there is no need for a separate business registration as a Specified Funds Transfer Service, and if approval can be obtained compared to the Funds Transfer Service, it will be possible to transfer funds that exceed the upper limit of 1 million yen for transfers.

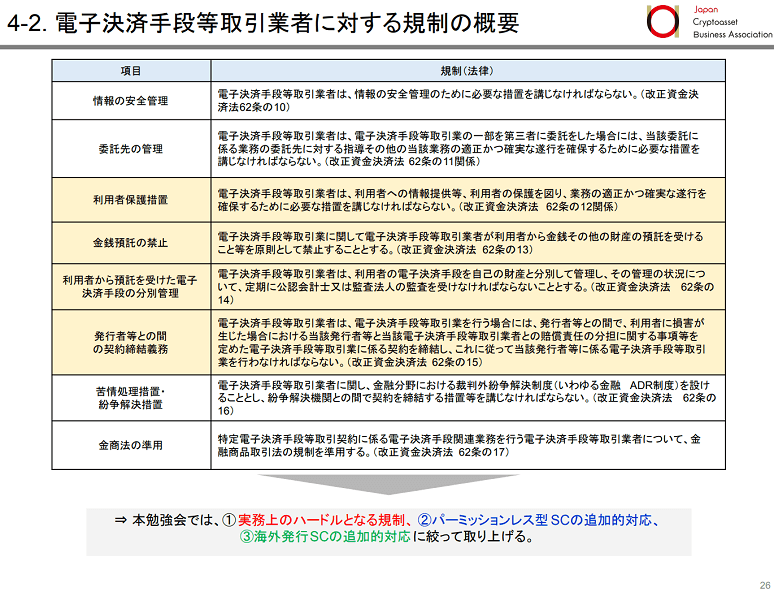

Regulations on intermediaries -Response to segregated management, mediation of overseas issued stablecoins-

Next, Mr. Sano talked about intermediaries (electronic payment instruments transaction business), “(1) regulations that are problematic for stablecoins in general,” and “(2) additional requirements for permissionless stablecoins.” and “(3) What to do when foreign-issued stablecoins are taken up”.

Source: Provided by JCBA

As a general regulation on business operators such as electronic payment methods, money deposits are exempted by separating them from their own property by entrusting money to a trust company. Or, I explained that it is assumed that it will be entrusted to a trust bank or that the authorities will approve the self-trust.

He said that permissionless stablecoins require advanced risk management in terms of AML/CFT.

In the case of overseas-issued stablecoins, the issuer has obtained a license equivalent to that of Japan’s funds transfer business in a regulated country, and is equipped with audits and crisis response to ensure that funds are preserved in accordance with applicable laws. It has been established that the requirement to determine whether or not When foreign-issued stablecoins are handled by business operators such as electronic payment instruments, it is necessary to emphasize the obligation to purchase them in the event of the issuer’s bankruptcy and to protect the purchase funds. said it was an issue.

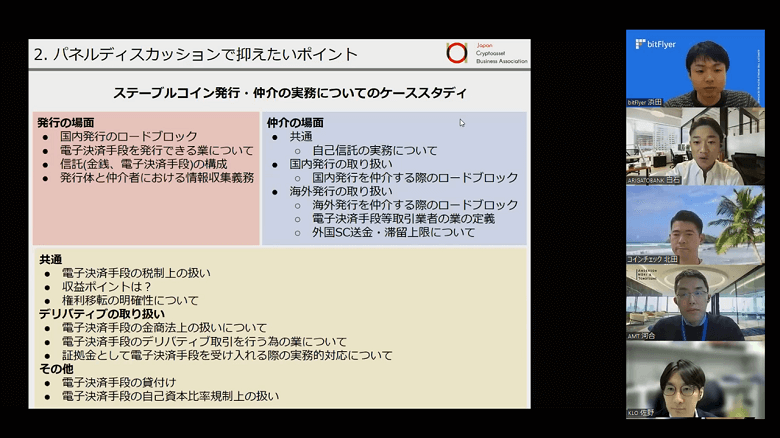

Panel discussion “Case study on stablecoin issuance and intermediary practice” – Requirements for entry, possibility of profit points, product design? ―

Source: Provided by JCBA

Issuance of electronic payment instruments

The panel discussion was moderated by Yosuke Shiraishi, chairman of the Stablecoin Committee, and discussed the individual issues of issuance and intermediation, as well as the common issues of both, from the business and practical perspectives of business operators. rice field.

Mr. Shiraishi posed a question about the possibility of issuing a bank business, and Mr. Kawai said that although the Funds Settlement Act envisions the issuance of a bank, it has not been incorporated into a lower level law, and that deposit insurance He said that he understands that it is necessary to adjust the capital adequacy ratio.

Mr. Kitada asked about the profit points in the issuer license. In the trust structure, the investment of the issuance proceeds is limited to savings or deposits, and in the case of the fund transfer service provider structure, what if a performance security deposit trust is used? compared that the management of certain trust assets such as government bonds is permitted.

In response to this, Mr. Sano said that while funds transfer service providers have the merits of bank guarantees in addition to performance guarantee trusts, they are both merits and demerits because they are limited by the 1 million yen upper limit and retention regulations. .

In addition, Mr. Kitada said that in the trust structure, if there is a certain amount of interest income from deposits denominated in foreign currencies such as dollars, it will be a profit point.

Intermediation of Electronic Payment Means (Transaction Business for Electronic Payment Means, etc.)

Mr. Shiraishi asked about the reason why self-trust, which is allowed for electronic payment crypto-assets in the intermediary business, is not allowed for crypto-assets.

According to Mr. Sano, in the case of crypto assets, preferential claims are legally granted to those held by exchange companies, etc., and are given priority over ordinary bankruptcy creditors at the time of bankruptcy. . On the other hand, since electronic payment means are not given preferential claims, it was established that bankruptcy remoteness should be ensured by a trust. In addition, Mr. Shiraishi said that the Stablecoin Committee proposed self-trust in order to make this bankruptcy isolation work in practice, and that the authorities understood it.

Mr. Kitada asked about the degree of hurdles in notarial deeds and personnel requirements for this self-trust. said a trust practitioner could become virtually necessary.

On the topic of the possibility of handling stablecoins issued by foreign issuers such as USDC and USDT, Mr. Kawai said that the hurdle is that domestic intermediary business operators such as electronic payment means are required to purchase and protect their assets. was mentioned as In addition, compared with other stablecoins, existing overseas issued stablecoins that are operated under a license equivalent to the fund transfer business and trust business in Japan and incorporate freeze design etc. as AML/CFT countermeasures. and may be treated as such.

Mr. Hamada asked about practical measures for fund transfer service providers to comply with the 1 million yen retention regulation. He said that the content is a point that needs to be discussed in the future.

Mr. Hamada threw a theme about derivative products and the possibility of substitution of electronic payment methods, and we would like to discuss the content with the authorities in the future regarding the margin, leverage ratio 2x, and risk calculation in terms of capital adequacy ratio regulations. was stated.

During the question and answer session, Mr. Kawai answered that the act of selling bitcoin and receiving USDC in return requires both a crypto asset exchange business and an electronic payment method business.

knot

Mr. Shiraishi talked about the prospects for dialogue as an industry through public comments and other means regarding points that are still unclear in this guideline.

The Stablecoin Committee, which you spoke about, was established in 2020, and has been conducting research led by business operators and legal experts. Since the enactment of the revised Payment Services Act in June last year, activities have become even more active, and we have been coordinating with governments and ministries every day to develop laws, government orders, and guidelines in order to materialize the system. increase.

Due to the complex system of other business laws, it is difficult to smoothly understand the contents, but we will continue to research and disseminate information to promote the business environment.

Recordings and materials from the day can be viewed on our members-only page.

Disclaimer

- Descriptions of opinions and interpretations in this article are based on the personal views of the presenter and do not represent the views of the association or the affiliated office.

- Opinions and interpretations expressed in this article may not be consistent with the views of governmental authorities.

- Statements of opinion or interpretation in this article do not constitute legal advice.

- When conducting business related to the descriptions in this article, please do not rely on the opinions or interpretations in this material, but instead take into account the views of your own legal advisor, certified public accountant, tax accountant, or other expert.

The post How will electronic payment instruments (stablecoins) be issued and brokered?An expert explains the draft government decree appeared first on Our Bitcoin News.

2 years ago

195

2 years ago

195

English (US) ·

English (US) ·