Traders may be skeptical of the continued health of cryptocurrency exchange Huobi, according to on-chain data.

Huobi Token (HT) has been volatile after Huobi admitted to cutting its workforce by 20%, withdrawing $64 million worth of crypto assets from the exchange in 24 hours. Data from blockchain analytics firm Nansen show that the weekly outflow exceeded $100 million, compared to rival Kraken’s $22 million. is obvious.

Source: Nansen

Source: NansenNansen noted that wallets with high balances, Tether (USDT) and USD Coin (USDC), and Ethereum (ETH), had the most withdrawals.

In the past 24 hours, Huobi has seen a significant increase in net outflows

$60.9M* of the $94.2M* net outflow in the past week occurred in the past day alone

*Contains Ethereum, Avalanche, BNB Chain, Fantom, & Polygon flows pic.twitter.com/JV1Tg13QMY

— Nansen  (@nansen_ai) January 6, 2023

(@nansen_ai) January 6, 2023

Meanwhile, Huobi’s adviser, Tron founder Justin Sun, sent $100 million to Huobi. Sun has withdrawn $100 million in USDT and USDC from Binance, according to on-chain research firm Look On Chain. Further Etherscan data shows that $100 million was sent to Huobi.

Mr. Sun tweeted that the key to Fovey’s success is “ignoring FUD[fear, uncertainty and doubt]and just getting on with it.”

Huobi stablecoin balance is now at $681 million, down 9.5% in a week. Prior to FTX’s bankruptcy in November 2022, stablecoin outflows from FTX surged.

Integrity Concerns Over Huobi Token

“Huobi appears to be in a very vulnerable position right now,” said Ki Young Ju, CEO of analytics firm CryptoQuant.

He noted that while Huobi’s Bitcoin (BTC) reserves have fallen by 90% over the past year, Binance has more than doubled. According to CryptoQuant, Huobi’s active user addresses have also dropped significantly.

“Huobi’s active users have dropped more than 40-fold from their peak in May 2019, and were 20x higher than Binance’s to 1 as of January 3, 2023,” the report said.

A particular concern in this difficult situation is the health of Huobi Token (HT).

As CryptoQuant pointed out in a recent report, Huobi has the “dirtiest” holdings among major exchanges and is heavily dependent on its own Huobi tokens. OKX and Deribit, on the other hand, are the cleanest.

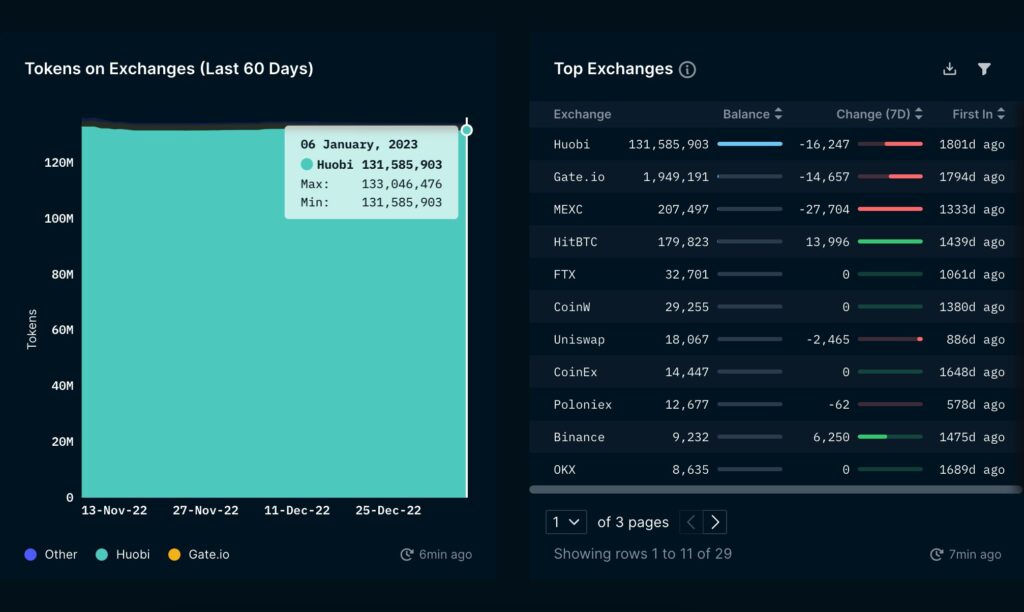

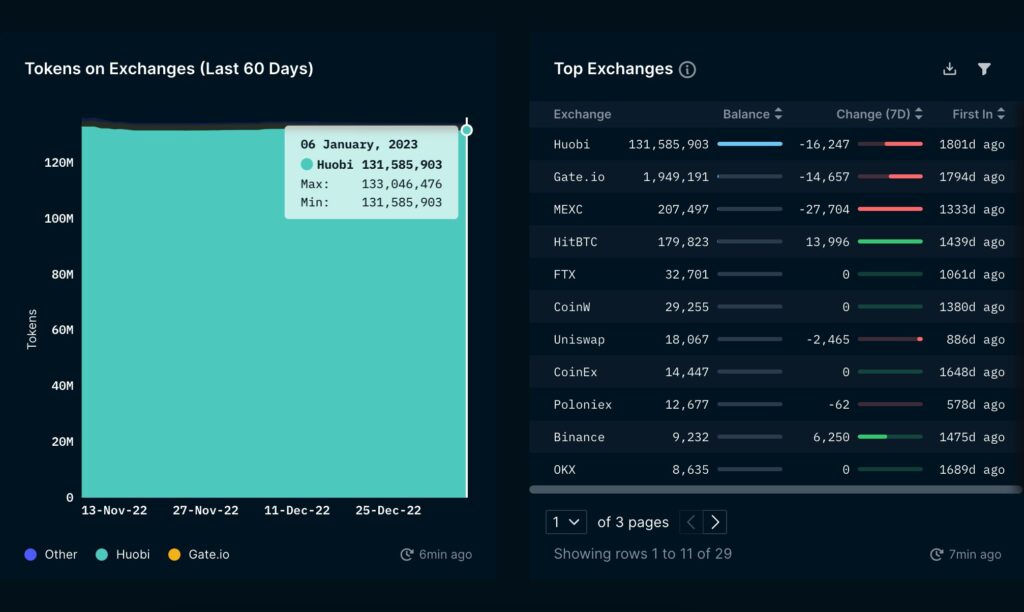

Nansen points out that Huobi owns 81% of the circulating supply of Huobi tokens, or 131.6 million HT out of 162.2 million HT.

Source: Nansen

Source: NansenAccording to CoinGecko data, Huobi token had a 24-hour trading volume of just $21 million against a market cap of $770 million.

The trading volume to market capitalization, the so-called depth (market depth), is just over 2%, which is smaller than other crypto assets with similar market capitalization according to CoinGecko data. In a recent column, Clara Medalie, research director at cryptocurrency data firm Kaiko, said a depth of less than 2% was a red flag for FTX’s exchange token, FTT. pointed out.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Shutterstock

|Original: Crypto Exchange Huobi Experiences Heavy Token Outflows: Nansen

The post Huobi withdraws more than $ 60 million in one day: data | coindesk JAPAN | coin desk Japan appeared first on Our Bitcoin News.

2 years ago

227

2 years ago

227

English (US) ·

English (US) ·