Hyperliquid’s native token, HYPE, is pressing against its ceiling again as platform activity explodes to fresh records.

Moreover, the token now trades a whisker below July’s all-time high, which keeps traders focused on a decisive break over the $50 mark.

The question is not whether momentum exists, but whether it can carry price through resistance and hold.

Record activity lifts sentiment

On August 15, Hyperliquid posted a new platform record with $29 billion in 24-hour trading volume and $7.7 million in fees.

Hyperliquid reached new all-time highs with $29B in 24h volume and $7.7M in 24h fees.

Moreover, HYPE hovered around $48.57 as of press time, which put it roughly 1.1% below the $49.75 peak set on July 14.

Because price sits so close to that milestone, sentiment has turned more assertive, and dip buyers remain active within the day’s $44.40–$49.35 range.

Whales step in

At the same time, on-chain flows show fresh capital rather than recycled liquidity.

Notably, a newly created wallet withdrew $23.51 million in USDC from centralised exchanges and bought 466,000 HYPE worth $21.45 million, while also accumulating $2.16 million in UFART.

一个新创建地址在过去 6 小时里购买了 46.6 万枚 $HYPE ($2145 万)。 这个地址在凌晨创建后从 Binance 跟 Crypto. com 提取了 2351 万 USDC 然后存进 Hyperliquid,购买了 46.6 万枚 $HYPE ($2145 万,价格 $45.69) 和 216 万枚 $UFART ($214 万,价格 $1.02)。 地址:hypurrscan.io/address/0xa523…

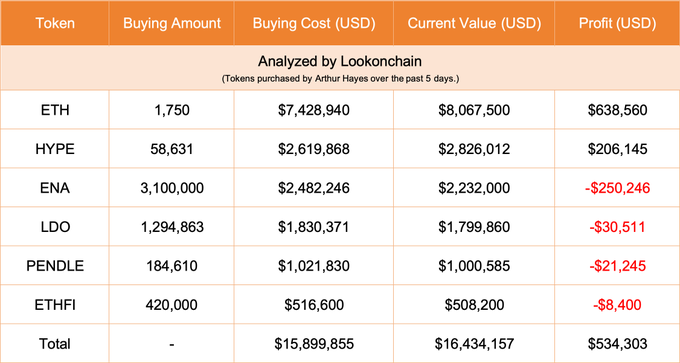

Additionally, Arthur Hayes has purchased a substantial amount of HYPE tokens.

Therefore, whale participation now aligns with the platform’s volume surge, which often precedes continuation moves in trending markets.

Liquidity and institutional tailwinds

Beyond price, underlying liquidity continues to improve.

Hyperliquid’s TVL has climbed from about $460 million in mid-July to roughly $610 million, while July USD inflows jumped from $21.35 million in June to $349.27 million.

Moreover, Circle’s plan to bring native USDC and CCTP V2 to Hyperliquid, along with Anchorage Digital Bank’s custody support for HYPE, strengthens on- and off-ramps for both retail and institutions.

Momentum tilt on the chart

From a technical point of view, the recent breakout from a downward channel, after weeks of compression, and a fresh ascending trendline argue for continuation if buyers defend higher lows.

Furthermore, major moving averages from the 50-day SMA down to the 20-day EMA point to a buy bias, while the RSI sits near 63, which leaves room before overbought territory.

Hyperliquid price chart | Source: TradingView

Hyperliquid price chart | Source: TradingViewAdditionally, the MACD remains positive, and the stochastic indicator near 87.81 signals firm buying interest, even as the Bollinger Bands tighten and the price rides the upper band.

Hyperliquid price forecast: the path to $50

Given the confluence of record platform activity, whale accumulation, and bullish technicals, the base case favours an attempt at $50 and a test of $52.

A daily close above $49.75 with expanding volume and persistent fee strength would likely validate a move toward $55 in the short run.

However, if price stalls beneath $48 and breadth fades, the market could consolidate between $44 and $49 while rebuilding energy.

The post Hyperliquid price forecast: Can it break past $50 as it sets a new ATH? appeared first on Invezz

English (US) ·

English (US) ·