“Do you think ChatGPT will steal your job?” I asked a data scientist friend of mine who works for a major IT company, where layoffs continue.

“No. My work requires a lot of context,” my friend succinctly replied, noting the barriers and moats (against ChatGPT) that companies have created with their own datasets.

Anyway, what does ChatGPT think about crypto? Is ChatGPT a threat to investment writers and strategists?

Consider one thing here. ChatGPT’s views should reflect an “average” opinion based on the information and psychology embedded in the data used for training. It should present some degree of consensus, or collective zeitgeist, born out of advanced statistical training about crypto-assets.

I asked what ChatGPT was thinking.

What is Bitcoin?

──Please explain Bitcoin to high school students.

ChatGPT: Bitcoin is a type of digital money that can be used for online shopping. But instead of being printed or minted like traditional money, they are created using computer code and stored on a public ledger called a blockchain.

Bitcoin is different from regular money currency. Because it is decentralized, i.e. not controlled by any government or financial institution. Transactions are processed directly between users, without the need for intermediaries such as banks or credit card companies.

Because Bitcoin is decentralized, it can offer a level of privacy and security unattainable in traditional financial systems. However, its value is volatile and investment involves risk.

In short, Bitcoin is a new way to transact and store value digitally, and some see it as a hedge against inflation or a store of value like gold.

Decentralization, elimination of intermediaries, store of value, non-governmental control, like gold – these are all common and consistent themes underpinning Bitcoin’s story. Let’s continue.

Are crypto assets useful?

──Are crypto assets useful? Please explain in simple terms.

ChatGPT: Crypto assets can be useful for several reasons. Some of the most common reasons are:

Decentralization: Crypto-assets like Bitcoin and Ethereum are decentralized, meaning they are not controlled by a central authority or government. This makes transactions faster, cheaper and safer.

Global access: Crypto assets can be accessed and used by anyone with an internet connection, anywhere in the world. It is especially useful for those who do not have access to the traditional banking system or who wish to conduct cross-border transactions.

Transparency: Cryptocurrency transactions are recorded on a public ledger called blockchain. In other words, it is transparent and can be verified by anyone. This increases credibility and reduces the risk of fraud.

Programmability: Some crypto assets like Ethereum allow developers to create decentralized applications that can run on the blockchain. These applications can be used for a wide range of purposes including finance, gaming, voting, and supply chain management.

However, it is important to keep in mind that crypto-assets are still a relatively new technology, subject to high volatility and regulatory uncertainty. Additionally, cryptocurrencies are not widely accepted as a means of payment and may not be suitable for everyone. As with any investment or financial decision, it is important to do your own research and consider your own situation before investing in cryptocurrencies.

Similar stories were played out about decentralization, elimination of middlemen, and transparency. But there were caveats about smart contracts, a global perspective, and sound financial risk. Incidentally, please note that ChatGPT’s training data includes information through September 2021. Coincidentally, it was during the peak of the last bull market.

Ask “What is FTX? What is Sam Bankman-Fried?” and you know you still don’t know what happened months ago.

global currency

ChatGPT’s touch on the global nature of crypto assets is that digital assets make cross-border payments easier, a decentralized and reliable open source alternative to local financial services and infrastructure. It reminds us that we can provide

Many people, myself included, take it for granted as part of life in the developed world, so it’s easy to miss such a crucial use case except in the rare banking crisis. Comparing search data for Bitcoin and Ethereum on Google Trends shows the preference for these mundane use cases.

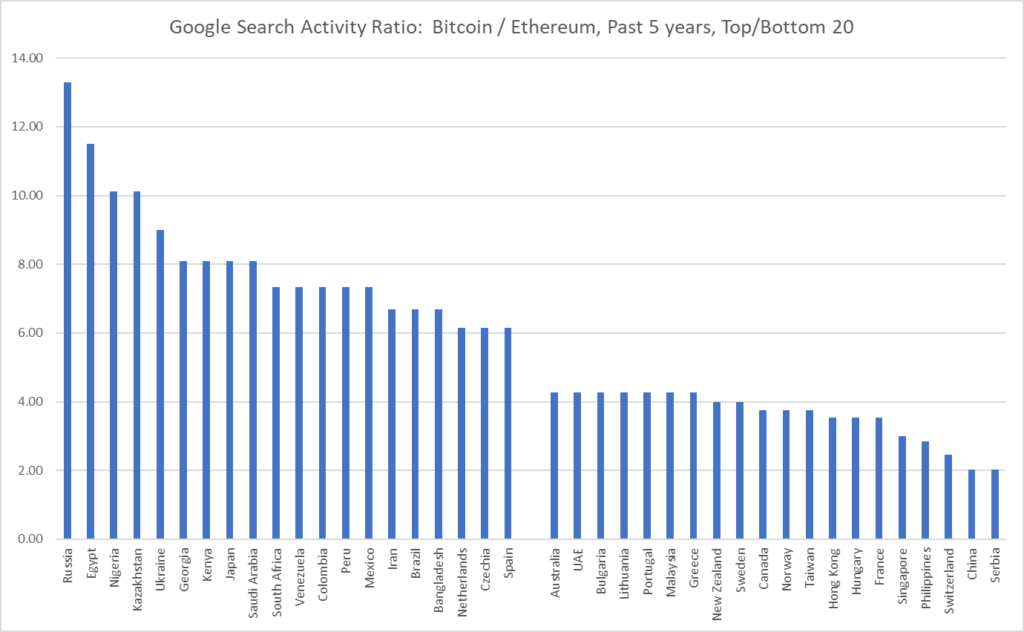

Google Search Ratio: Bitcoin/Ethereum, Last 5 Years, Top/Bottom 20

Google Search Ratio: Bitcoin/Ethereum, Last 5 Years, Top/Bottom 20It attempts to read user interest by combining search behavior for Bitcoin and Ethereum and calculating the relative proportions of search behavior.

If the ratio is 1, search behavior in a country is the same for Bitcoin and Ethereum. At 10, Bitcoin searches are 10 times more than Ethereum. Considering Bitcoin’s market cap is currently about 2.3 times larger than Ethereum’s, it’s no surprise that few numbers fall below that in the chart above. Switzerland at 2.3 is in line with market capitalization expectations (again, neutral).

Concerns that vary by country

Russia, Egypt, and Nigeria are much more interested in Bitcoin than Ethereum, while Serbia, China, and Switzerland (the Ethereum Foundation is in Switzerland) are relatively more interested in Ethereum.

Looking at the top and bottom countries in terms of Bitcoin/Ethereum search behavior, developing countries and emerging economies focus on store of value and convenience as a decentralized payment system, while developed countries We can conclude that they are interested in improving and upgrading existing financial technology infrastructure through blockchain and smart contract platforms.

Finally, we asked ChatGPT about one of the most frequently asked questions.

Will AI take away investment analyst jobs?

ChatGPT: AI can help with analysis, but it can’t replace that skill. We still need humans.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: What ChatGPT Thinks About Digital Assets

The post I asked ChatGPT about crypto assets | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

99

2 years ago

99

English (US) ·

English (US) ·