Virtual currency market price this week from 11/25 (Sat) to 12/01 (Fri)

Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, illustrates this week’s Bitcoin chart and deciphers the future outlook.

table of contents

- Bitcoin on-chain data

- bitbank contribution

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other services

bitbank analyst analysis (contributed by Tomoya Hasegawa)

Weekly report from 11/25 (Sat) to 12/01 (Fri):

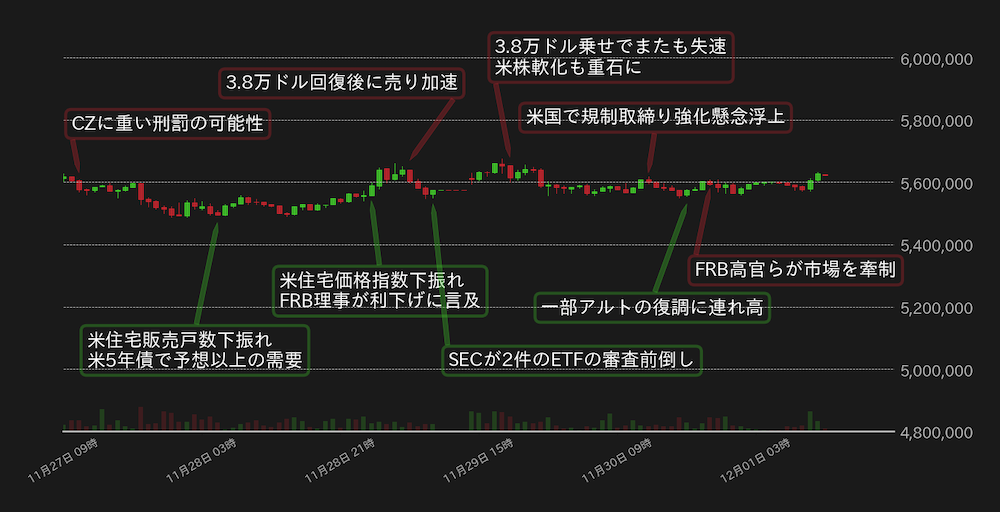

This week, Bitcoin (BTC) vs. the yen has been in a tussle around 5.6 million yen, and is struggling to break out above the level of around $38,000 (≒ 5.61 million yen).

As the possibility of Binance’s CZ being sentenced to about 10 years in prison in the United States has emerged, and uncertainty about the company’s operations has reignited, BTC has weakened slightly from 5.6 million yen at the beginning of the week, falling below 5.5 million yen. It started with a surprising development.

However, due to the downturn in US home sales announced that day and the confirmation of higher-than-expected demand in the auction for US 5-year bonds, US bond yields fell and BTC stopped falling.

The following day, on the 28th, BTC recovered to 5.6 million yen as the US housing price index declined and US Federal Reserve Board Director Waller mentioned the possibility of interest rate cuts in the next few months. However, when the price recovered to $38,000 in dollar terms, selling became dominant and the rate of increase was reduced.

Meanwhile, on this day, the U.S. Securities and Exchange Commission (SEC) postponed its decision on the Franklin Templeton and HashDex physical Bitcoin exchange traded fund (ETF) and began soliciting public comments.

The next decision deadline for the two ETFs was set to be January 1, 2024, but as the SEC brought forward the review, the market expected the ETFs to be approved in January, and the deadline was January 29, Tokyo time. BTC once again recovered to 5.6 million yen.

On the other hand, when the market price reached $38,000 in dollar terms, it stalled again. Tighter regulations in the United States also weighed on the market, and the BTC yen failed to maintain the 5.6 million yen level. However, the slowdown in consumption and inflation in the United States has helped the market, and BTC has remained steady at around 5.6 million yen.

Figure 1: BTC vs. Yen chart (1 hour timeframe) Source: Created from bitbank.cc

Regarding Bitcoin ETFs, the possibility of simultaneous approval of all Bitcoin ETFs in January (next year) has been raised, and the market is stagnant despite reports that the SEC is holding interviews with companies applying for ETFs. It can be seen that the sensitivity is becoming lower. In fact, it is speculated that the SEC is unlikely to make a decision on approval of the Franklin and HashDex ETFs while soliciting public comments, so we can’t expect anything exciting regarding the ETFs until January.

However, the fundamentals of the U.S. economy, such as the downturn in September home sales in the U.S., the downward revision of consumer spending in the third quarter, and the downturn in the October Personal Consumption Expenditures (PCE) price index, do not reflect the Fed’s suspension of interest rate hikes. This can be said to justify the market’s expectation that interest rates will be cut in the first half of next year, and if the data continues to show that US economic activity is slowing down, we believe that it is only a matter of time before the rate rises above $38,000.

On November 30th, while the October US PCE price index was down, the dollar and US Treasury yields suddenly rebounded, but this was due to a rebound from the recent strong push on both sides, and the It has been pointed out that this is due to position adjustments, and the impact on the BTC market is likely to be limited.

If BTC succeeds in breaking above $38,000, the price will likely rise to $40,000 (≒5,923,000 yen), where open interest is concentrated in the options market.

connection:bitbank_markets official website

Previous report:Bitcoin struggles with high prices, and market expectations for early approval of ETFs fade away?

The post If the US economy continues to slow down, is it only a matter of time before Bitcoin breaks out? | Contributed by a bitbank analyst appeared first on Our Bitcoin News.

1 year ago

184

1 year ago

184

English (US) ·

English (US) ·