Bitcoin's price has exceeded $50,000 (approximately 7.5 million yen, equivalent to 150 yen to the dollar) due to an influx of new entrants through the Bitcoin ETF that started in January. The fourth halving is expected to occur in mid-April.

Bitcoin halving refers to a periodic event that halves the reward miners are paid in Bitcoin for validating transactions and creating new blocks on the blockchain.

Halvings occur approximately every four years, specifically every time 210,000 blocks are created on the Bitcoin blockchain.

Halvings are intended to periodically reduce the pace at which new Bitcoins are supplied to maintain their scarcity. Eventually, after 21 million Bitcoins have been mined, there will be no new supply of Bitcoins.

Impact on price

The general consensus is that halvings are positive for Bitcoin prices, and historically have been. Halvings often create optimism among crypto investors, leading to positive price movements afterwards.

The positive price movement is due to several factors. First, a decline in the issuance rate of Bitcoin highlights its scarcity, increases demand, and ultimately leads to an increase in price. Additionally, halvings draw attention to crypto assets, attracting new investors and increasing trading activity.

However, it should be noted that while halvings have led to price increases so far, the magnitude of the increase has been decreasing.

To better understand the impact of the Bitcoin halving on returns, we used CoinDesk Index's Bitcoin Price Index to look back from July 2010 to February 2024, We compared weekly returns for each half-life period.

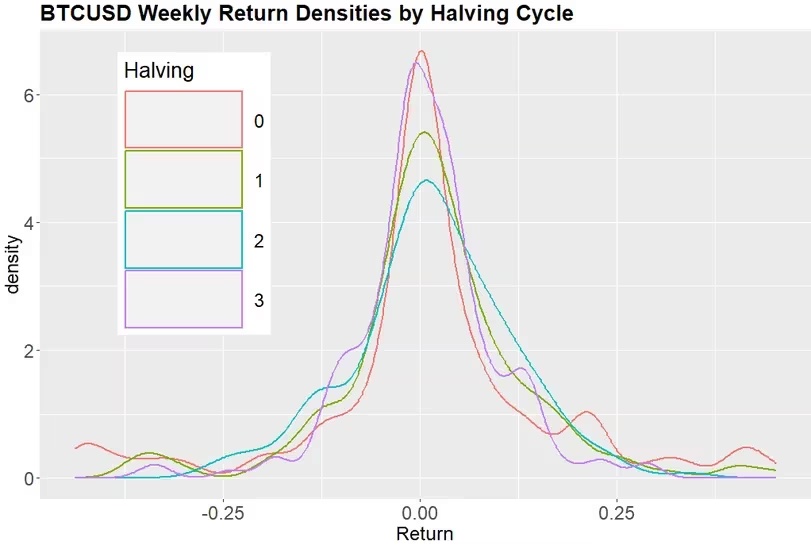

(Weekly return distribution by halving, source: CoinDesk Indices, Investing.com)

(Weekly return distribution by halving, source: CoinDesk Indices, Investing.com)*From July 2010 to October 2014, Investing.com's BTCUSD was used. 0.5% and 99.5% of return outliers are excluded.

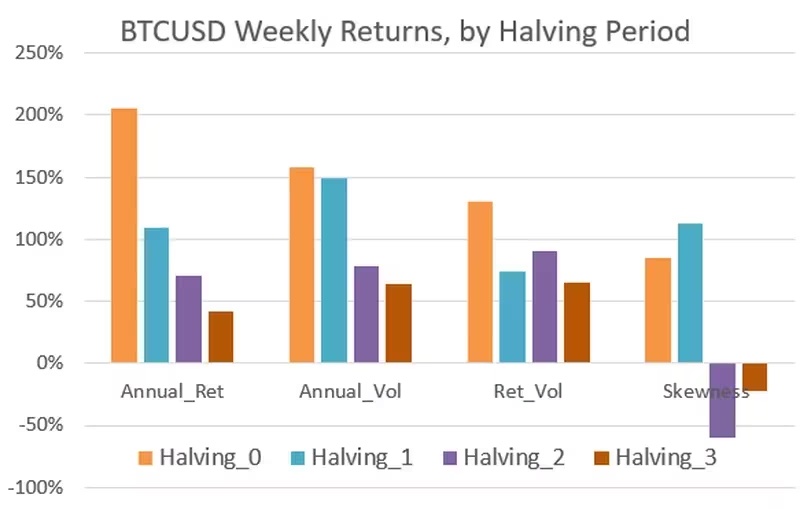

(Weekly returns per halving cycle, Source: CoinDesk Indices, Investing.com)

(Weekly returns per halving cycle, Source: CoinDesk Indices, Investing.com)Overlaying these distributions and comparing annual returns and volatility shows that as the Bitcoin market matures from a hobby for crypto enthusiasts to a bona fide asset attracting institutional investor interest, the return distribution narrows. I know that there is.

This evolution can also be seen in the decline in both returns and volatility with each halving. Meanwhile, the return per volatility remains constant after the initial halving.

This evolution shows that we should not expect Bitcoin to perform like it experienced before 2012, when the market was in its infancy.

Impact on miners

One of the market participants directly affected by the halving is Bitcoin miners, whose rewards for new blocks will be halved.

Halving mining rewards could impact miners' profitability. Miners face increased competition and higher operating costs, which could lead to industry consolidation.

Smaller miners may struggle to remain profitable, while larger players with greater resources, cheaper power sources, and economies of scale may dominate the industry.

Looking beyond the halving, the future of Bitcoin mining will eventually depend solely on transaction fees once all 21 million Bitcoins have been mined.

This transition is planned approximately 31 years after Bitcoin was created. Miners will need to adapt to this change, relying solely on transaction fees, but it will also be a gradual change with each halving.

Innovations in the crypto asset space, such as protocols and tokens that coexist with Bitcoin (such as Ordinals), may provide opportunities for miners to diversify and optimize their operations to maintain revenue beyond Bitcoin block rewards. There is.

Bitcoin has come a long way from a hobby for cypherpunks and crypto technology enthusiasts to a digitally scarce store of value with Bitcoin ETFs and regulated derivatives markets.

That said, Bitcoin's volatility has decreased through market cycles and market capitalization growth. The situation for Bitcoin holders is very different from the situation for holders in 2010, and we need to be conservative when analyzing past halvings.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: How the 'Halving' Could Impact Bitcoin

The post Impact of halving on Bitcoin | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

76

1 year ago

76

English (US) ·

English (US) ·