As 2023 draws to a close, the crypto market is bouncing back from failed ventures and outright scams, and is making real progress toward mainstream adoption. As global tensions rise and regional banks stall, Bitcoin (BTC) is regaining its status as a reliable store of value.

On the other hand, traditional financial giants applying for Bitcoin spot exchange-traded funds (ETFs) and tokenizing real-world assets (RWAs) represent a convergence of two worlds. The year 2024, 15 years after the birth of crypto assets, is expected to be a decisive moment in the evolution of crypto assets.

The recent surge in Bitcoin prices could be the prelude to a bull market expected in 2024. And several other factors are in place to set the stage for a crypto resurgence.

Macro factors:Global liquidity has been on an upward trend since October 2023. The Federal Reserve’s change in tone at the Federal Open Market Committee (FOMC) meeting in December confirmed market expectations that a rate cut could occur in early 2024, raising the risk Conditions are now more favorable for assets.

Mainstream adoption: The arrival of spot ETFs (expected to be approved as early as January) and tokenization mark a pivotal moment in the integration of crypto assets into the broader financial landscape. Allocating just a small portion of U.S. assets under management to a Bitcoin ETF could make the ETF extremely large. At the same time, decentralized finance (DeFi) protocols are diversifying their revenue streams into RWAs like US Treasuries, attracting more crypto-native capital.

Advances in technology: Blockchain’s scalability and major upgrades in UI/UX development are breaking down the barriers to transitioning from Web2 to Web3. With Web3-based apps offering the ease of use found in Web2, coupled with the benefits of self-responsibility, user migration is inevitable.

Are crypto assets headed for democratization, or are they experiencing irrational exaltation? Three plausible scenarios have emerged for 2024.

- Cambrian explosion: BTC hit a new all-time high (over $69,000) in January 2024, and some sectors are seeing price movements reminiscent of the “Summer of DeFi” in 2021.

- Steady growth: BTC will follow a similar pattern as in 2023, rising 20-50% on positive news, intermittently leveling off, and ultimately achieving a 50-100% return.

- Reset and rebuild: A major market correction occurs and the BTC price drops below $30,000.

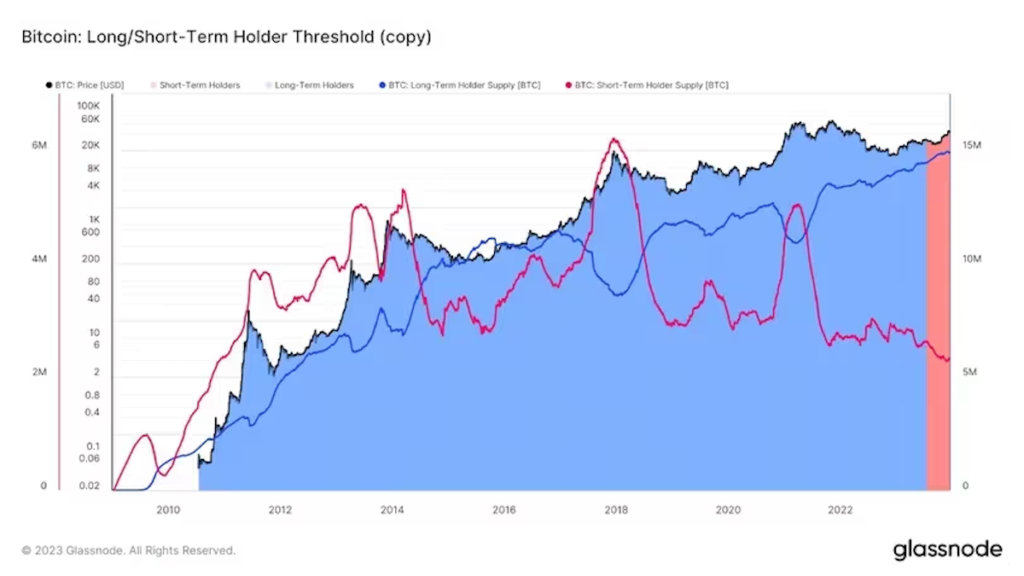

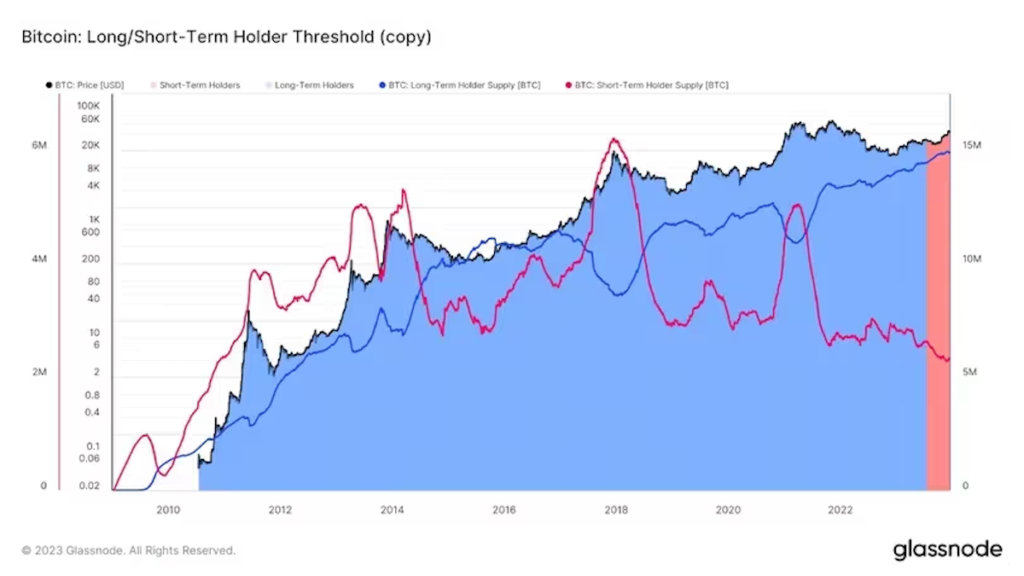

Supported by macro tailwinds, mainstream adoption, and technological advances, one of the first two scenarios seems likely. Additionally, long-term BTC holders continue to accumulate and stablecoin supply is recovering, indicating the potential for external capital to flow into crypto assets.

Looking ahead, the winners of past cycles may not be in the driver’s seat this time around. Successful projects often boast a strong community of developers and users, like the exciting themes below.

- Solana Renaissance: Overshadowed by FTX, Solana has captivated developers and users with its high-performance blockchain and established the flying wheel effect. Solana’s “summer of mini-DeFi” is evident from the fact that the monthly trading volume of decentralized exchanges (DEX) has surged about 10 times since the beginning of this year.

- DeFi 2.0: Although DeFi is a mature area of crypto assets, it is ripe for innovation. Derivatives DEXs could shorten settlement times and reduce costs, potentially challenging the dominance of centralized exchanges (CEXs) in this space. Tokenized assets and restaking could once again make DeFi yields attractive compared to US Treasuries.

- Web3 games: Past venture capital (VC) investments in Web3 games are bearing fruit. Platforms like IMX have network effects, providing technology and resources to a thriving Web3 gaming community.

Thus, 2024 is destined to be exciting for crypto investors and developers!

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: Tis the Season To Be Jolly About the Crypto Market in 2024

The post In 2024, crypto assets will finally establish themselves as the future of finance | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

68

1 year ago

68

English (US) ·

English (US) ·