Abu Dhabi Investment Authority is backing the Indian social commerce startup DealShare, the two said Thursday, joining a roster of marquee investors doubling down on India’s fast-growing e-commerce market.

A wholly-owned subsidiary of Emirates’ sovereign wealth fund is investing $45 million in DealShare, extending the size of the Jaipur-headquartered startup’s recently unveiled Series E financing round to $210 million. The round, which TechCrunch first reported about in late October, values DealShare at $1.7 billion and pushes its all-time raise to $393 million.

DealShare, which counts Tiger Global and Alpha Wave Global among its investors, operates a so-called social commerce startup through which it is serving customers in over 100 Indian cities and towns where the likes of Amazon and Flipkart have made little to no inroad.

To reach the masses, DealShare is “gamifying and socialising the elements of purchases,” said Rajat Shikhar, the startup’s co-founder and chief product officer, in an interview with TechCrunch. These strategies include incentivizing customers to buy in a group and inviting their friends as well as “bargaining” on prices, he said.

“We provide very high engagement on the platform because we are serving customers who are not so tech-savvy and have historically not made online purchases,” he said.

By giving incentive to customers to get their friends on the platform, DealShare has been able to considerably reduce its customer acquisition and order fulfilling costs, he added. On the platform, customers also negotiate on prices with the system, replicating a behaviour that is a norm in physical shops.

The startup also works with local brands and also operates its own ecosystem of in-house private labels to make its offering affordable to customers, he said. Three-year-old DealShare processes over 400,000 orders a day and is in “touching distance of hitting $1B of gross revenue run rate.”

“We aim to democratize online shopping for Bharat users with unmatched service and experience by developing innovative products and tech solutions. This will be supported by building our teams across the country and hiring new tech talent at all levels,” said Vineet Rao, co-founder and chief executive of DealShare, in a statement.

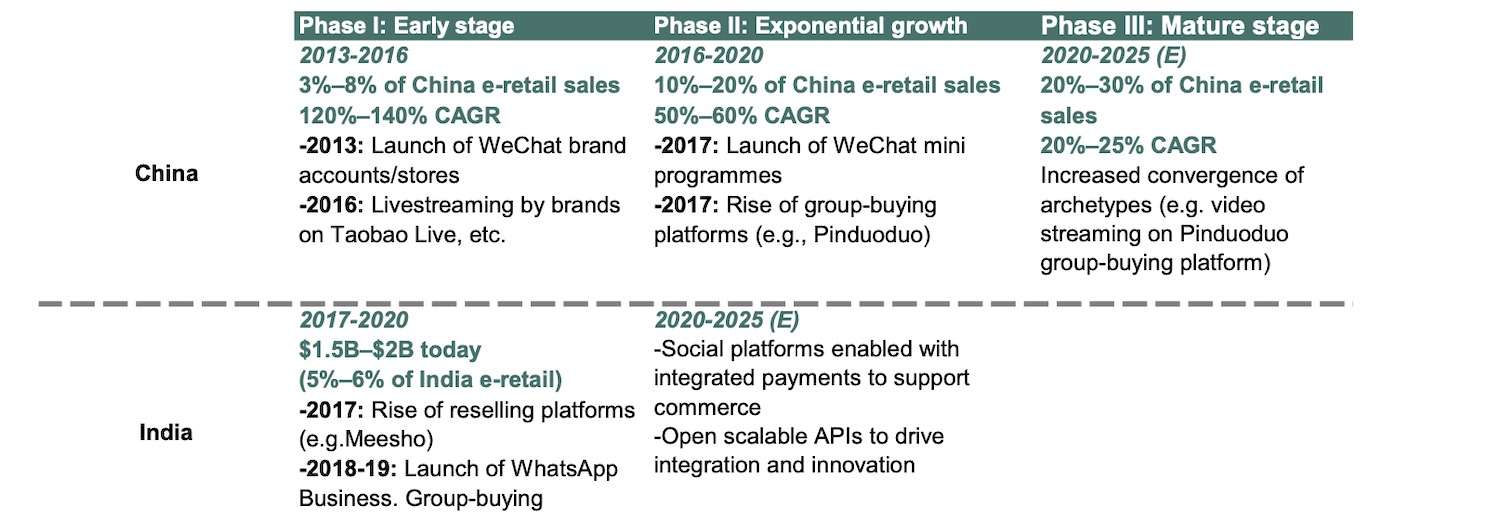

A look at the social commerce market in India and China, where this new e-commerce trend first took shape. (Image Credits: Bernstein)

At stake is the world’s second-largest internet market, where e-commerce has hardly made any dent to the overall retail.

The social commerce market alone is expected to be worth up to $20 billion in value by 2025, up from about $1 billion to $1.5 billion last year, analysts at Sanford C. Bernstein said last year. “Social commerce has the ability to empower more than 40 million small entrepreneurs across India. Today, 85% of sellers using social commerce are small, offline-oriented retailers who use social channels to open up new growth opportunities,” they wrote in a report clients.

DealShare kickstarted its journey the day Walmart acquired Flipkart. The startup began as an e-commerce platform on WhatsApp, where it offered hundreds of products to consumers.

DealShare is additionally also planning to expand to several international markets including the United Arab Emirates, Saudi Arabia, Qatar, Oman, Kuwait and Bahrain, it said. “We are likely to hit $3B of gross revenue run rate in the next 12 months,” said Sourjyendu Medda, co-founder and chief business officer, in a statement.

“India’s e-commerce ecosystem is developing rapidly, and DealShare is addressing an underserved and growing segment within it. This investment aligns with our approach of backing innovative businesses with differentiated business models to execute on their growth strategies,” said Hamad Shahwan Al Dhaheri, Executive Director of the Private Equities Department at ADIA, in a statement.

English (US) ·

English (US) ·