Conor Burke spent much of his career in the back office of a big bank in Ireland. His team was tasked with digitizing the onboarding process — particularly document-heavy manual review workflows — that were costing the bank millions of dollars every year and not catching fraud. According to him, the biggest challenge was figuring how to remove the human element without compromising risk and fraud controls.

Inspired by this, Burke and his twin brother, Ronan Burke, launched Inscribe, an AI-powered document fraud detection service. Built for fraud, risk and operations teams in the fintech and finance industries, Inscribe taps AI trained on hundreds of millions of data points to return results, Ronan says.

“Tedious document reviews add friction to account opening and underwriting processes, but automation alone isn’t the answer,” Ronan told TechCrunch in an email interview. “We believe automation without fraud detection is reckless, which is why Inscribe is the total package that helps companies detect fraud, automate processes, and understand creditworthiness so they can approve more customers, faster.”

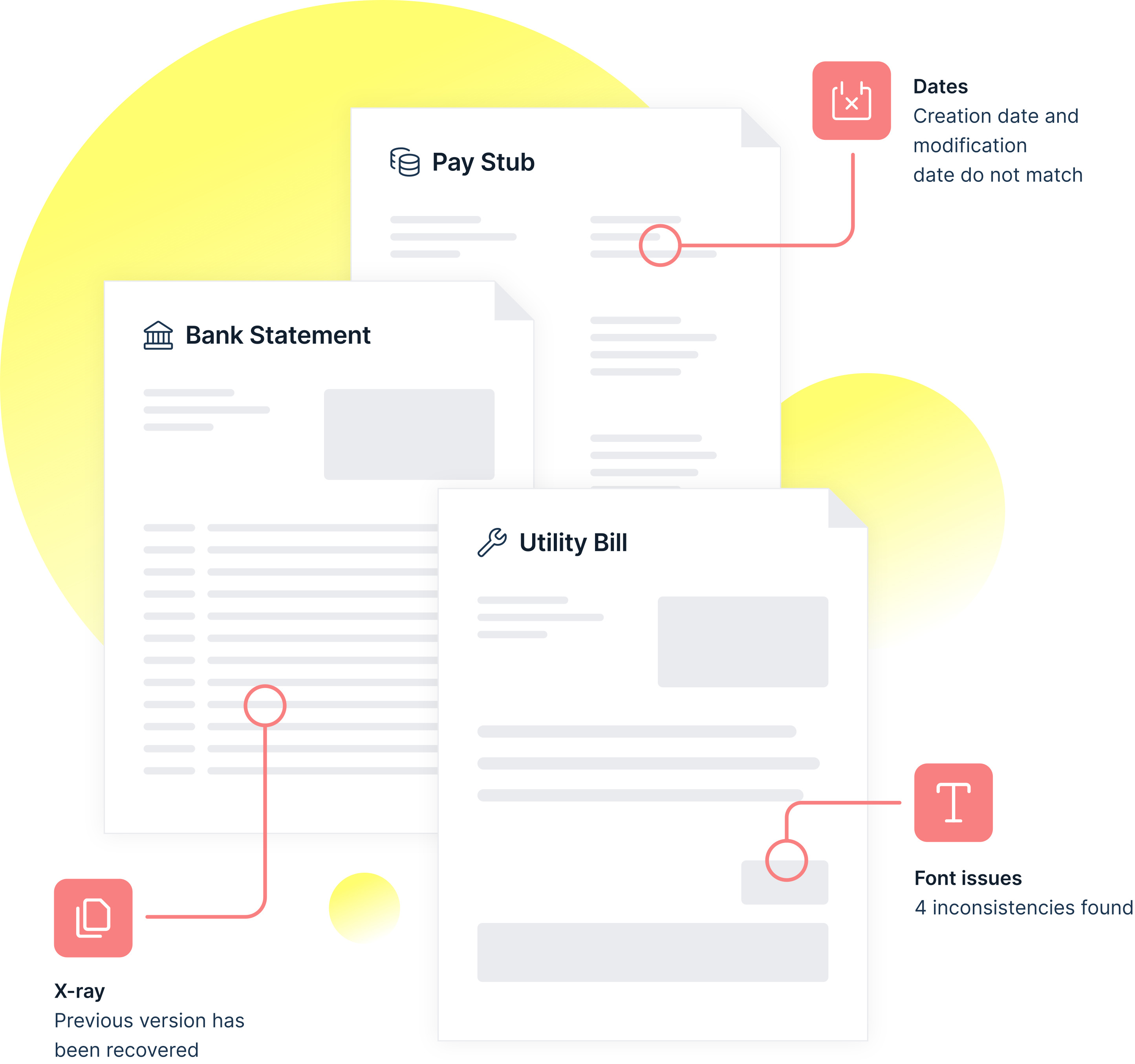

Inscribe parses, classifies and data-matches financial onboarding documents, highlighting any differences between the documents provided and documents recovered using its AI-powered fraud detection. Document details including names, addresses and bank statement transactions are digitized automatically to generate individual customer risk profiles that include snapshots of bank statements and transactions.

Last September, Inscribe rolled out a credit analysis and bank statement automation component that provides most of the data points needed to make lending decisions, including cash flow details from bank statements, transaction parsing and pay stub parsing. Ronan claims that Inscribe can extract and then return key details including names, addresses, dates, transactions and salaries in seconds.

Image Credits: Inscribe

In the features that it offers, Inscribe is similar to many of the other anti-fraud tools out there, like Resistant AI (which raised $16.6 million n October 2021) and Smile Identity (which raised $7 million in July of that same year). Ronan argues that it’s differentiated by its AI-first approach, however, which hinges on original data collected through previous partnerships with customers.

“We’d seen fraud detection and document automation companies in our space try to build a perfect solution right out of the gate without talking to customers — but they had since shut down. They weren’t able to get over the cold start problem; they weren’t able to build a product from the ground up because they didn’t have access to the data their customers were using,” Ronan said. “This comes back to the first rule of machine learning: Start with data, not machine learning. If you don’t have a good data set, you’re wasting your time. You’ll end up either choosing the wrong model or training a model on data that won’t perform the way that you expect.”

AI is by no stretch of the imagination perfect — history’s shown that much to be true. For example, during the pandemic, fraud detection systems that home in on anomalous behavior were confused by new shopping and spending habits. Elsewhere, automated algorithms designed to detect welfare fraud have been shown to be error-prone and designed in ways that essentially punish the poor for being poor.

But setting aside the veracity of Ronan’s claims, there’s evidently something about Inscribe’s platform that’s attracting high-profile customers. TripActions, Ramp, Bluevine and Shift are among the startup’s clients.

Investors, in turn, have been won over. Just this week, Inscribe closed a $25 million Series B funding round led Threshold Ventures with participation from Crosslink Capital, Foundry, Uncork Capital, Box co-founder Dillon Smith and Intercom co-founder Des Traynor. The infusion brings the startup’s total raised to date to $38 million, inclusive of a $10.5 million Series A round closed in April 2021.

Perhaps it’s the comparative ease with which Inscribe’s solution can be deployed. As Ronan rightly notes, Inscribe solves the problem of having to build an in-house fraud detection solution or hire a large data science team.

“AI and machine learning models benefit from as much data as possible, but each individual company is limited to only their own data set. So a homegrown solution simply can’t be as effective as one that pulls from numerous data sources,” Ronan said. “That’s why companies partner with document fraud detection solutions instead: Criminals commit fraud in different ways, and those solutions are pulling data from across their customer base to identify coordinated attacks and emerging trends faster.”

Fearmongering is likely helping, too. One recent survey suggests that the average U.S. fintech loses $51 million to fraud every year, a stat Ronan quoted to me during our interview.

“In an increasingly digital, geographically dispersed, and faster world makes it more difficult than ever to know who you’re doing business with — leaving companies uncertain about which potential customers are trustworthy,” Ronan said. “Fintechs have been able to build for an online world, but traditional financial institutions are faced with the challenge of moving away from legacy systems and embracing true digital transformation. And they have to do it all while reducing fraud and friction in order to have competitive customer experiences.”

Asked about expansion plans, Ronan says that Inscribe will likely double the size of its 50-person workforce over the next 12 to 18 months.

Inscribe bags $25M to fight financial fraud with AI by Kyle Wiggers originally published on TechCrunch

English (US) ·

English (US) ·