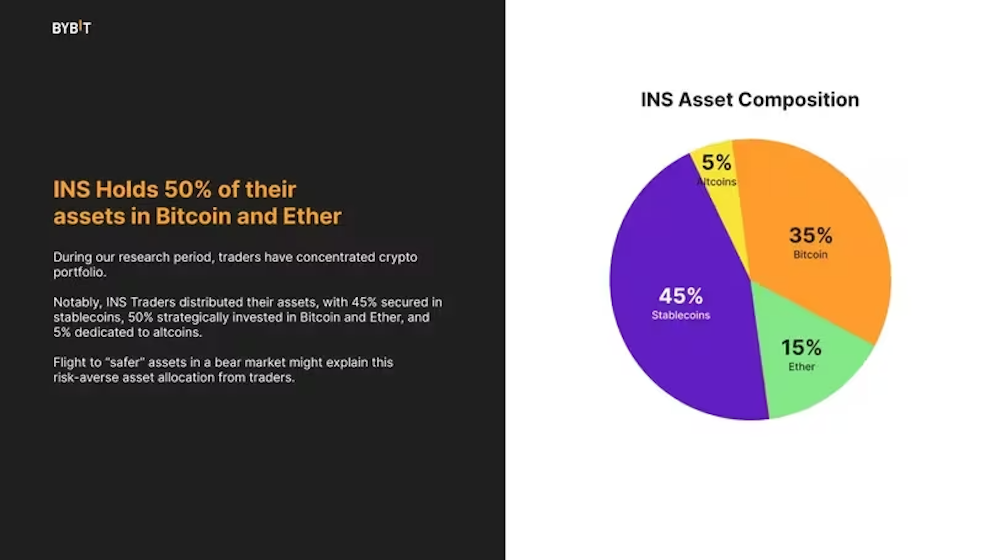

Institutional traders are bullish on Bitcoin (BTC), mixed on Ethereum (ETH) and skeptical of altcoins, a new report from Bybit Research reveals.

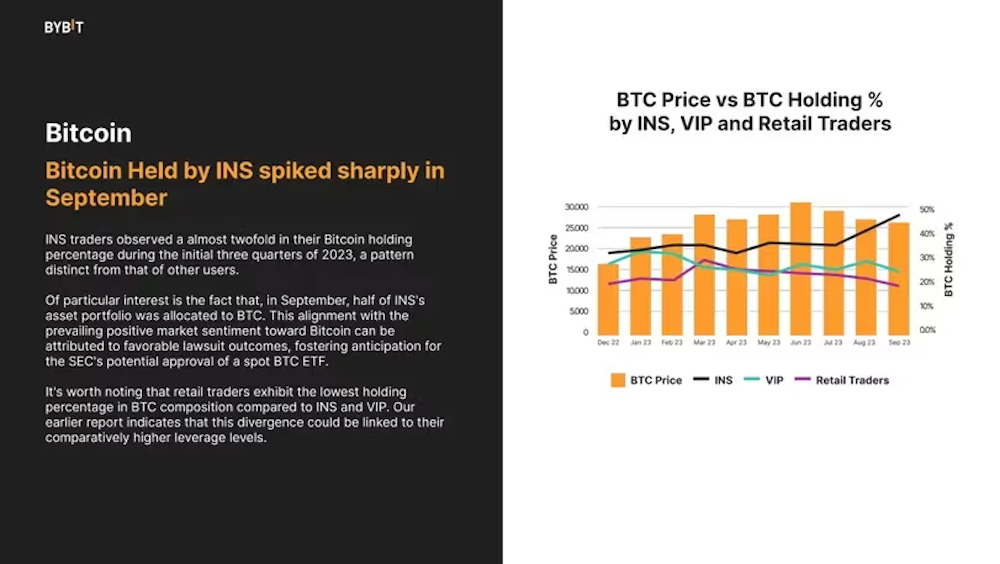

From Q1 to Q3 of 2023, institutional traders nearly doubled their Bitcoin holdings. As of September, half of their assets were up to It was built with crypto assets. Their stance is in contrast to retail traders’ lower BTC holdings, likely due to their higher leverage levels, the Bybit report said.

Institutional investors and whales (large Bitcoin holders) are skeptical of altcoins, and despite a temporary rally in May, these traders’ altcoin holdings have generally declined. shown in the data. Among institutional investors in particular, there has been a notable decline since August, reflecting a cautious attitude towards volatile assets.

ETH holdings have generally remained flat since the Ethereum blockchain’s Shappera upgrade, with the exception of a spike among institutional investors in September as ETF news excited the market and the outlook for crypto assets turned positive. Data shows that this is decreasing.

Bitcoin prices are up about 140% year-to-date, while Ethereum is up 87%.

In October, K33 Research issued a report advising investors to change their asset allocation stance and shift their focus back to Bitcoin since July 2022 due to the long-term underperformance of ETH against BTC. , it also notes that the response to the newly launched futures-based Ethereum ETF has been slow.

“As Ethereum continues to perform poorly, we believe it is time to put the brakes on ETH and move back to BTC,” they wrote.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: Institutional Traders Split Between Bitcoin, Ether: Bybit Research

The post Institutional investors are largely ignoring altcoins in favor of BTC and ETH: research report | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

84

1 year ago

84

English (US) ·

English (US) ·