A March-May 2023 survey by Binance, the world’s largest cryptocurrency exchange, found that its institutional clients were optimistic about the prospects for crypto assets next year and beyond. It is said that

The survey was conducted by Binance Research and the Binance VIP & Institutional Investor Team with 208 of the company’s clients between March 31st and May 15th. More than half of respondents, 52%, have crypto assets under management (AUM) of less than $25 million, and 22.6% have AUM of $100 million or more. rice field.

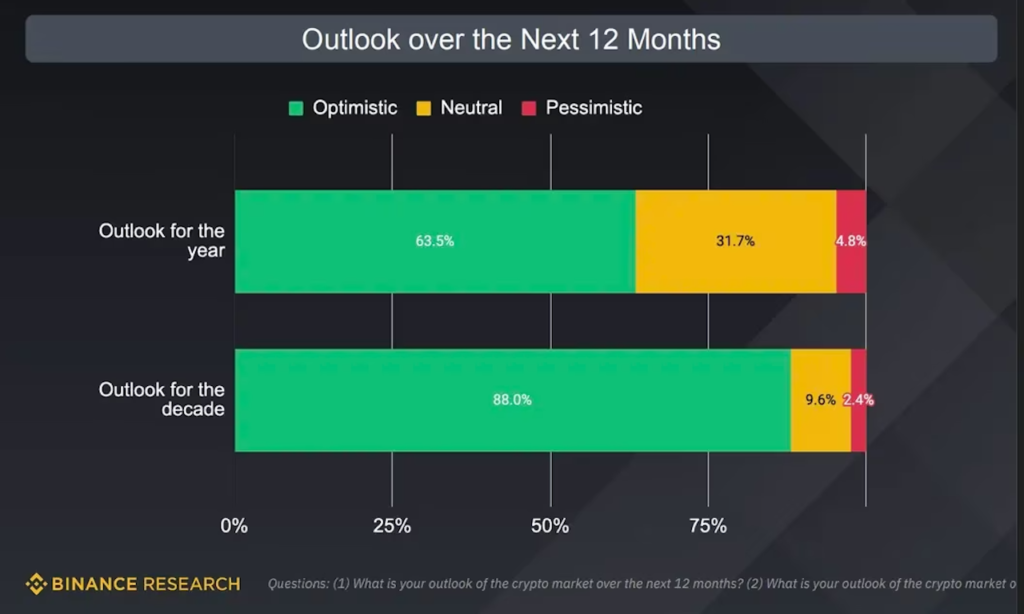

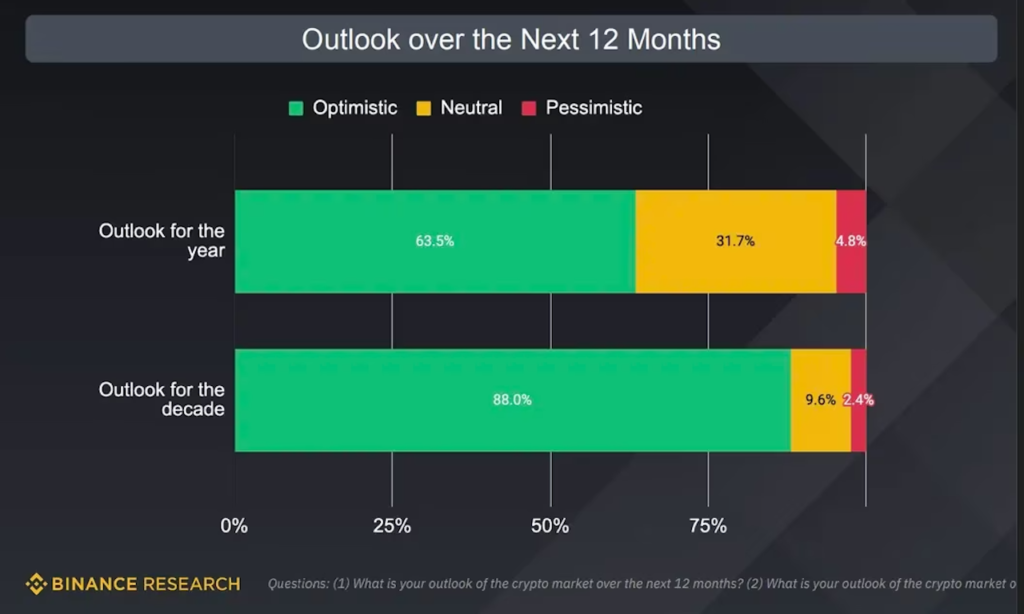

According to the survey report, 63.5% of respondents said they were positive about the outlook for crypto assets over the next year, and 88% said they were optimistic about the next decade.

Binance institutional clients are positive about the future of crypto assets. (Binance)

Binance institutional clients are positive about the future of crypto assets. (Binance)The survey also found that respondents maintained their allocation to crypto assets despite negative market events over the past year. 47% of institutional investors maintained their crypto allocations over the past year, while more than a third increased their allocations. Only 4.3% said they would reduce their allocation to crypto assets over the next 12 months.

In early June, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance and Coinbase, and despite a bear market that has continued since last year, Binance’s investigation shows institutional investors’ Customers are showing a positive attitude.

When it comes to areas of investment interest, 54% of investors see infrastructure as the most important, followed closely by Layer 1 and Layer 2 projects at 48% and 44% respectively.

(Binance)

(Binance)Web3 infrastructure has been in the spotlight of investors since the beginning of the year following the FTX bankruptcy last year. The term infrastructure is used broadly and can range from inter-blockchain portals to on-chain wallets.

Most recently, blockchain infrastructure provider LayerZero Labs raised $120 million in a Series B funding round at a $3 billion valuation. However, it has tripled its valuation since its March 2022 round, which brought in $135 million.

Conversely, the areas of least interest to institutional investors were NFTs, the Metaverse, and gaming.

NFTs and the Metaverse will skyrocket in popularity during the 2021 bull market, with eye-popping NFT sales like “Beeple’s Everydays: The First 5000 Days” and Facebook’s focus on the Metaverse. Rebranded to Meta. The hype then subsided as NFT trading volumes declined and the metaverse continued a bear market of stagnant growth.

But the announcement of Apple’s mixed reality headset has brought a temporary return of optimism to the metaverse industry.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

|Image: Binance

|Original: Binance’s Institutional Clients Remain Optimistic on Crypto Amid Tough Market

The post Institutional investors are optimistic about the future of crypto assets: Binance survey | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

108

1 year ago

108

English (US) ·

English (US) ·