USDC Worry Could Spur Diamond Demand

Over the weekend, trading volumes for tokenized diamonds surged 300%, it was revealed today, June 14.

This is a case in a private market with a daily trading volume of about 100 million yen ($840,000), and since past data has not been made public, there are some uncertainties, but diamonds are being reconsidered as a means of diversified investment. There seems to be

At that time, Silicon Valley Bank and Signature Bank in the United States were closed by regulators, causing the major stablecoin USDCoin (USDC) to lose its peg to the US dollar.

Tokenized diamond has been spotlighted as crypto investors seek a safer haven for their assets.

Diamond Standard, a US-based company that issues tokenized diamonds with regulatory approval, made the announcement.

This Just In: “Diamond Standard Shines Bright During Banking Crisis” press release is now live.

>>> READ: https://t.co/IkLPQNXPrV pic.twitter.com/0y0IwFyIUT

—Diamond Standard Co. (@DiamondStdCo) March 13, 2023

Around noon on the 11th (Japan time), Circle, Inc., which issues the US dollar-linked stablecoin USDC, had an unprocessed withdrawal request of about 445 billion yen (3.3 billion dollars) to Silicon Valley Bank (SVB). announced that $3.3 billion is about 8% of USDC reserves (about $40 billion).

The USDC liquidity problem has caused credit anxiety to spread throughout the cryptocurrency market. Several cryptocurrency exchanges, including Coinbase in the United States, have suspended the USDC exchange function. On Thursday, regulators decided to shut down signature banks in a guise of curbing the risk of spreading fears that could lead to a financial system crisis.

After the bank closed, the spot market for Diamond Standard, which trades in USDC, reported a surge in trading volume. The figure of 300% was revealed by an interview with US virtual currency media CoinDesk. Diamond Standard founder and CEO Cormac Kinney said:

Combining the best of gold and bitcoin, the Diamond Standard commodity has performed as expected, maintaining its value and liquidity during the most recent banking crisis.

connection:US Circle puts transfer of $3.3 billion USDC reserves pending at Silicon Valley Bank

diversified investment options

During periods of market volatility, investors seek refuge in hard assets such as cash, government bonds, commodities (gold and silver), and real estate to protect their money from extreme volatility. Gold, a leading safe haven asset, is up about 5% since the end of the week.

Diamond Standard announced in September 2022 that it had raised about 4 billion yen ($30 million) in a series A round. The company aims to bring transparency and efficiency to the diamond supply chain, while providing investors with diversification, inflation protection and new store-of-value options.

Source: Diamond Standard

The company stores physical coins and bars, including 8-9 diamonds, in a vault and tokenizes them using this as collateral. There are two types: BCC tokens (for Diamond Standard Coins) and BCB tokens (for Diamond Standard Bars).

Holders of these tokens retain ownership of diamond products stored in vaults. Transaction history is stored on a wireless computer chip within the physical product.

According to Kinney, the company’s clients often have gold in their portfolios. Diamonds, on the other hand, have historically tended to be poorly correlated with other assets, making them a “diversification and hedging opportunity,” he said. Investor interest has increased as diamond prices have historically been near their lows and lagged behind other precious metals on the rise, he added.

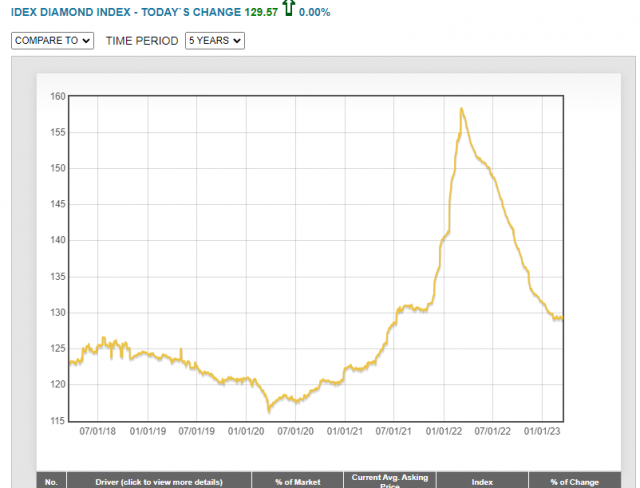

The Diamond Index has fallen about 20% over the past year, according to major online diamond trading platform IDEX, but has bottomed out since February.

Source: IDEX

In the rough market, diamond prices are reportedly improving. According to diamond mining and sales company Petra, the selling price of rough diamonds in the March 2011 auction was 12.5% higher than in December 2010. The diamond market is expected to remain firm over the medium to long term, as demand from China is recovering despite a structural supply shortage.

connection:Bitcoin investment trust GBTC’s “negative divergence”, the background of the rebound

The post Interest in Tokenized Diamonds Increases Amid U.S. Banking Crisis appeared first on Our Bitcoin News.

2 years ago

179

2 years ago

179

English (US) ·

English (US) ·