Complex virtual currency market

Crypto asset (virtual currency) exchange Bybit released an investment report on the 1st.

The research period for the report was from December 2022 to September 2023. The study examines how each type of investor allocates their investment funds.

The price of Bitcoin remained in the $16,000 range in December 2022, and rose to $26,917 on September 30, 2023 (see CoinGecko). Bybit explained that this research was conducted during a period of large price fluctuations, and “shows how each investor responded to price fluctuations from the perspective of capital allocation.”

In this report, “Altcoins” are defined as stocks other than Bitcoin (BTC), Ethereum (ETH), and stablecoins. Investors are classified into the following three categories.

- INS: Institutional Investor

- VIP: Individual trader with more than $50,000

- Retail traders: Users other than the above two

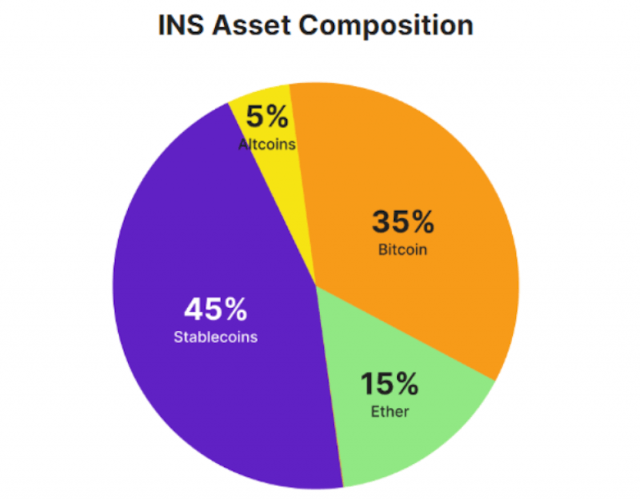

First, during the research period mentioned above, institutional investors allocated 45% of their funds to stablecoins, 35% to Bitcoin, and 15% to Ethereum. Bybit expressed the view that this is due to allocation being made to avoid risk, and that institutional investors may be placing importance on high liquidity.

Source: Bybit

Data by stock

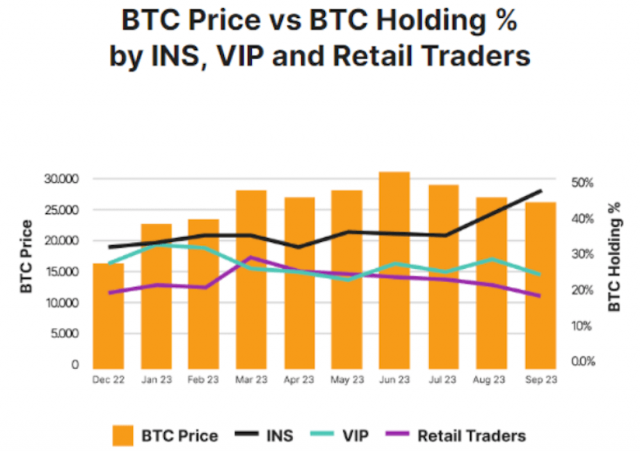

Regarding Bitcoin, the allocation of INS (institutional investors) has increased compared to VIPs and retail traders. The black line in the graph below indicates INS (right axis).

Source: Bybit

There has been a particularly rapid increase since before September, and Bybit points out that this is due to a lawsuit with the U.S. Securities and Exchange Commission (SEC). Specifically, he appears to be referring to the lawsuit between the SEC and major virtual currency management company Grayscale, and said, “This has heightened expectations for U.S. approval of Bitcoin spot ETFs (exchange traded funds).”

connection: Grayscale explains the conversion of “GBTC” to Bitcoin ETF on blog

What is an ETF?

Abbreviation for “Exchange Traded Fund”, which is an investment trust listed on a financial instruments exchange.

Virtual currency glossary

Virtual currency glossary

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Ethereum

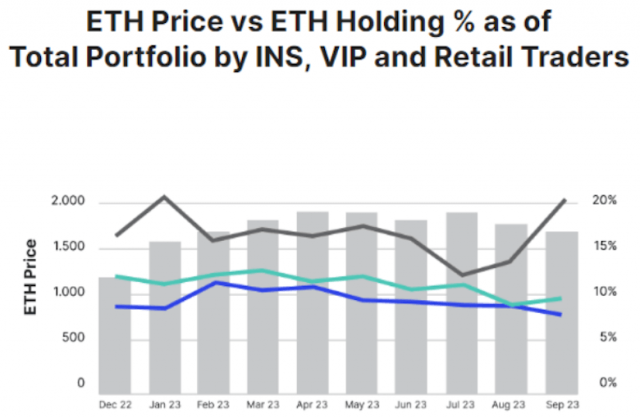

Regarding Ethereum, the holding percentage increased at the beginning of this year due to expectations for the large-scale upgrade “Shapella (Shanghai + Capella = Shapella)” implemented in April, but since then, the holding percentage has started to decline among all investors. There is.

Source: Bybit

However, only institutional investors’ holdings increased sharply through September. Bybit noted that this increase was above normal levels and attributed it to changes in sentiment towards cryptocurrencies. Particularly in September, applications for Ethereum spot ETFs increased in the United States.

connection: ARK Invest applies for first spot-based Ethereum ETF | Summary of important news from the morning of the 7th

Although institutional investor interest in Ethereum seems to have increased during this period, Bybit also points out that Ethereum’s rival Solana (SOL) has outperformed. He also said that Ethereum may need major upgrades to attract more interest from institutional investors.

Regarding this report, Ben Zhou, CEO of the company, commented as follows:

It’s important to understand how market participants navigate complex periods of bull and bear markets.

We believe that this research will not only be useful to traders, but will also help the broader crypto community understand the market.

connection: U.S. Coinbase customers receive Bybit-related “subpoena” notices, focusing on CFTC actions

Bitcoin ETF review list Source: Bloomberg Intelligence

Bitcoin ETF special feature

The post “Investigating the allocation of funds by institutional investors in Bitcoin, Ethereum, and Altcoins” Bybit report appeared first on Our Bitcoin News.

1 year ago

71

1 year ago

71

English (US) ·

English (US) ·