The post Is a Bitcoin Bull Run Coming? Retail Accumulation Hits Record High! appeared first on Coinpedia Fintech News

The Bitcoin market has been in an accumulation phase since it touched its peak in mid-March. Initially, this phase was driven by institutional investors or long-term investors. Now, it seems that retail investors or short-term investors are stepping in to sustain this trend.

Small Investors Are Growing Their Bitcoin Holdings: Why It Matters

At least 88,000 BTC have been accumulated by investors in the past 30 days alone. Of this total, at least 35,000 BTC – nearly 40% – have been accumulated by ‘Crabs’ – investors with only between 1 to 10 BTC – and ‘Shrimps’ – investors with less than 1 BTC.

As ‘Crabs’ and ‘Shrimps’ play a major role in determining the market sentiment in the retail sector, the new trend highlights the growing confidence of retail investors in the future of Bitcoin.

Why Does Bitcoin Leaving Exchanges Signal a Bullish Market?

As many as 40,000 BTC have been removed from exchange wallets.

The removal will likely affect the liquidity of the market. What could worsen the liquidity situation is the fact that the current BTC accumulation rate is at least seven times higher than the monthly bitcoin issuance of 13,500 BTC.

As per the latest data, only 26% of the circulating BTC supply is liquid.

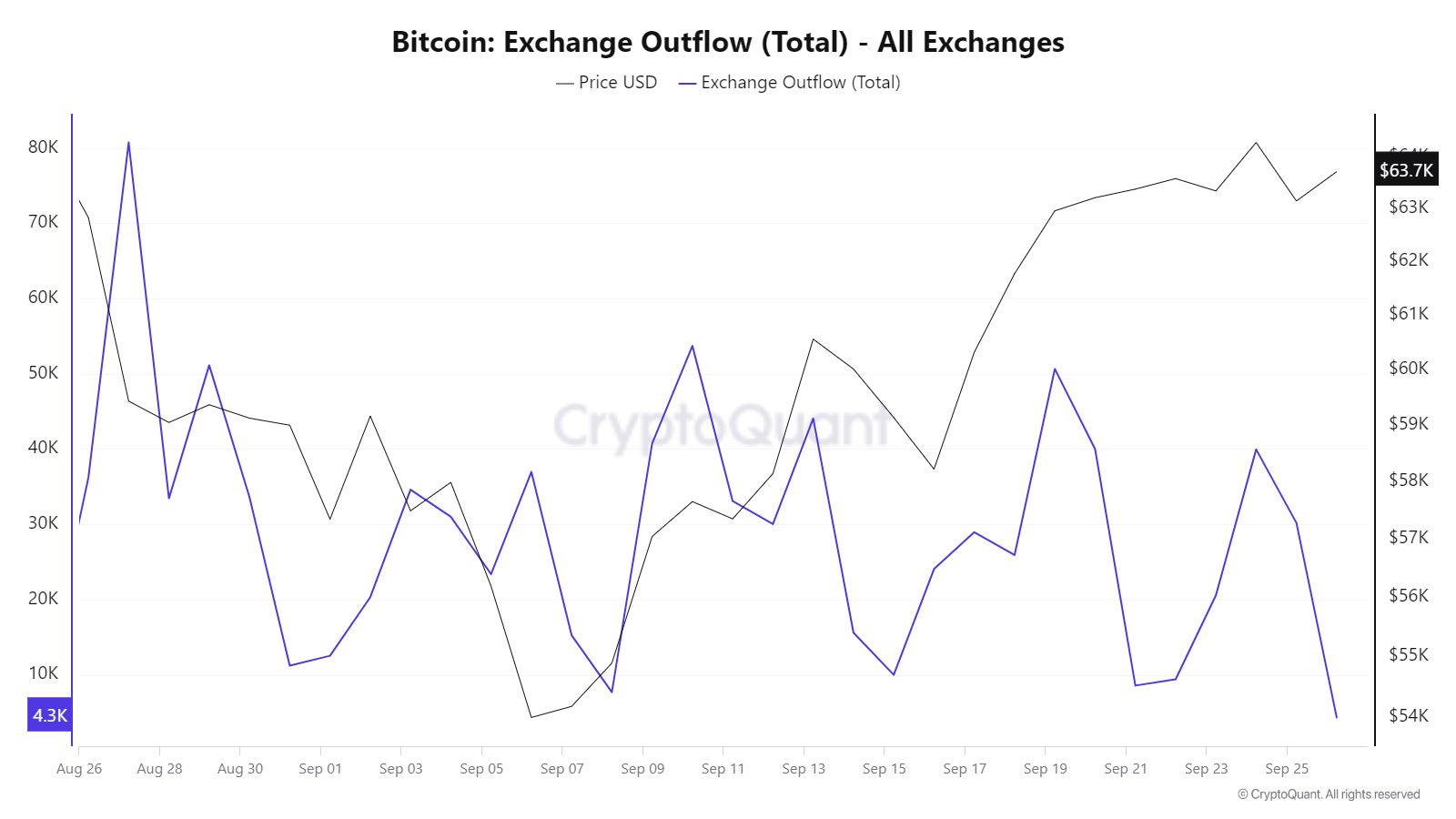

Bitcoin Exchange Outflow: A Short Overview

On August 27, the BTC exchange outflow was 80,740.199. At the start of September, it was 12,532.97. This month, it has majorly oscillated inside the range of 53,709.400 and 8,574.31. As of now, it remains at 4,401.74.

In conclusion, the combination of strong retail accumulation and reduced bitcoin liquidity points to a bullish future for Bitcoin in the coming months.

11 months ago

37

11 months ago

37

English (US) ·

English (US) ·