Institutional selling related to recently launched exchange-traded funds (ETFs) weighed on Bitcoin (BTC) prices, with major tokens continuing to decline on January 23rd, and some tokens falling over the past week. It fell more than 20%.

In the past 24 hours, Solana (SOL) is down 7% and Avalanche (AVAX) is down 9%, as both ecosystems made a memecoin-led comeback in December, sending token prices to their then-year highs. Spit out profits.

Some of the two networks’ most popular tokens fell further. BONK, Solana’s flagship meme token, fell 10%, and JOE, Trader Joe’s token, an avalanche-based decentralized exchange (DEX), fell 12%.

Dogecoin (DOGE) traded at 6 cents, completely reversing a weekend move that had seen it rise to 9 cents on speculation that it would be adopted in X payments.

The CoinDesk 20 (a liquidity index that tracks the top tokens by market capitalization) fell 4%, indicating that the entire crypto asset (virtual currency) market is generally in decline.

The few tokens that showed gains were FTX’s FTT, which was supported by expectations for a revival;Upcoming product launchesIt was Uma Network’s UMA that was bought up by X market influencers over the past week.

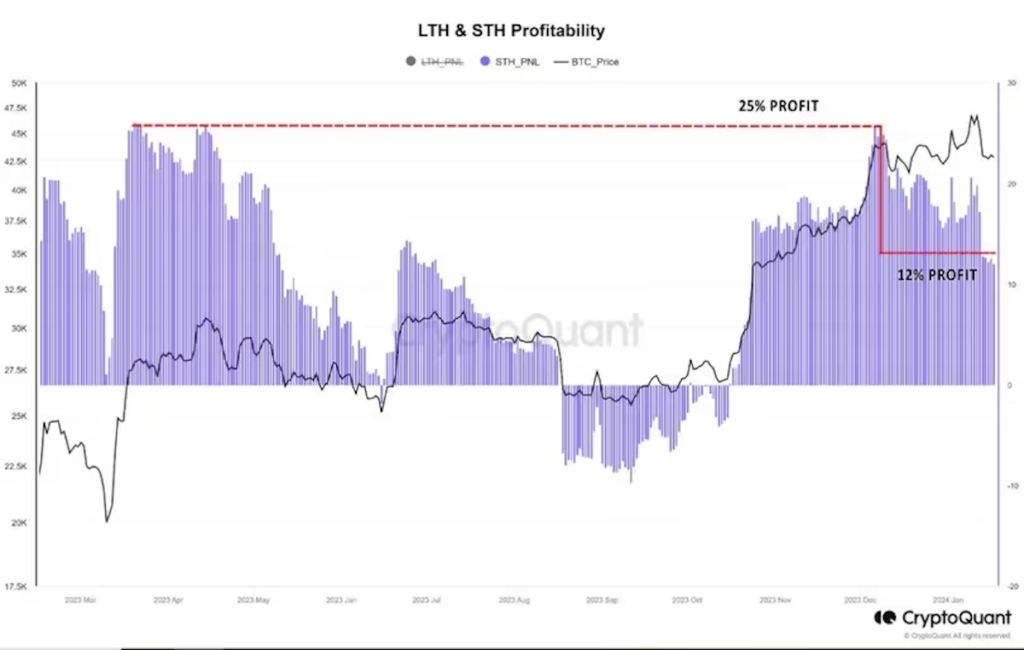

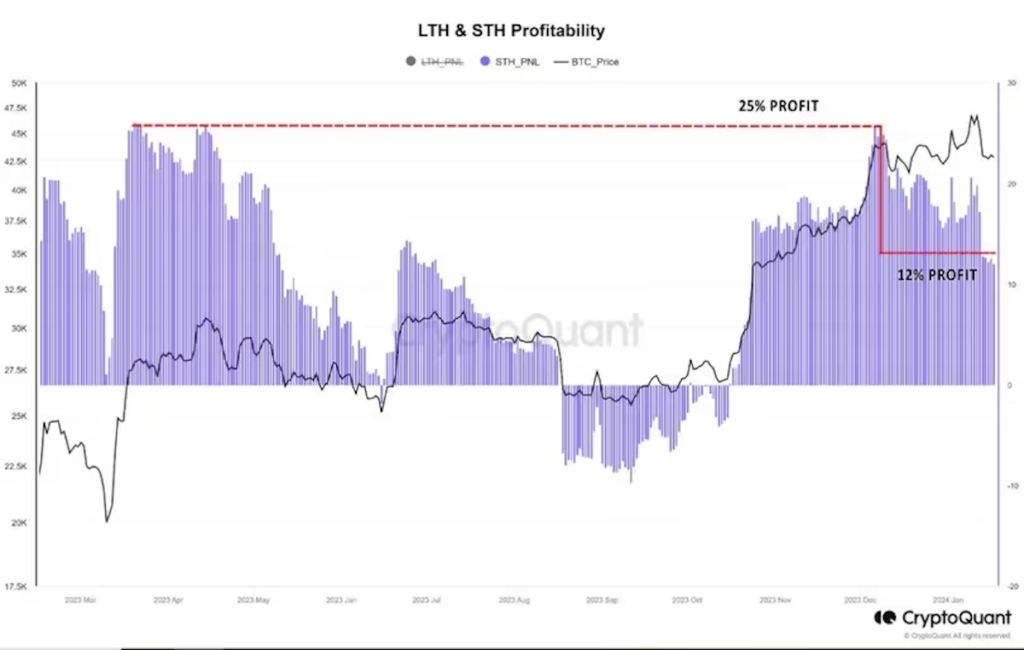

Meanwhile, analysts at crypto exchange Bitfinex said in a note on Tuesday that the recent slump in Bitcoin prices has wiped out gains for short-term investors, increasing the level of realized losses and causing market declines. He said it spurred him on.

Short-term Bitcoin holders are exiting with losses. (CryptoQuant)

Short-term Bitcoin holders are exiting with losses. (CryptoQuant)“Below $43,000, more than half of the profits accumulated by short-term holders will be wiped out. Many holders, especially those who have acquired BTC for less than a month, are currently losing money and exiting the market. is out,” said a Bitfinex analyst. “Such a significant decline in average returns for short-term holders, who tend to be more responsive to short-term market fluctuations, could be a precursor to selling pressure and liquidity withdrawal.”

Bitfinex said that “the overall market is likely to see a further significant price correction from current levels”, reflecting the growing number of traders who expect Bitcoin to fall to $38,000 in the coming weeks. It’s not surprising,” he added.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: CryptoQuant

|Original text: Solana, Avalanche Tokens Slide as Bitcoin Traders Target Eye Support at $38K

The post Is Bitcoin’s next support level at $38,000? SOL and AVAX have fallen significantly | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

110

1 year ago

110

English (US) ·

English (US) ·