The post Is Bitcoin The Next Apple In The Making? Analyst Draws Parallels appeared first on Coinpedia Fintech News

In a series of tweets, Jurrien Timmer, the global macro director at Fidelity Investments, drew parallels between the crypto market and the tech bubble of the late 1990s. Timmer suggests that just as some tech stocks emerged as winners from the dot-com bubble, certain digital assets in the crypto industry will rise while others may fade away.

Note that even stalwarts like Apple suffered a large draw-down when the bubble burst, but recovered to become a dominant force, while so many also-rans fell into oblivion. Time will tell what’s in store for Bitcoin. /6

— Jurrien Timmer (@TimmerFidelity) May 31, 2023Could Bitcoin be the “Apple” of digital assets, beating the odds and ushering in a new era of dominance? Read on!

The New Apple Of The Crypto World

Timmer specifically highlights Bitcoin (BTC) as a potential “Apple” of the crypto world. He explains that similar to how Apple and Amazon survived and thrived after the tech bubble, Bitcoin could also not only survive but also take market share from other digital assets.

Crypto's boom-bust cycle can be compared to the dot-com bubble of the late 1990s. The internet bubble took many unqualified stocks to astronomical heights, only to see them lose most or all their value when the bubble burst. /3

— Jurrien Timmer (@TimmerFidelity) May 31, 2023

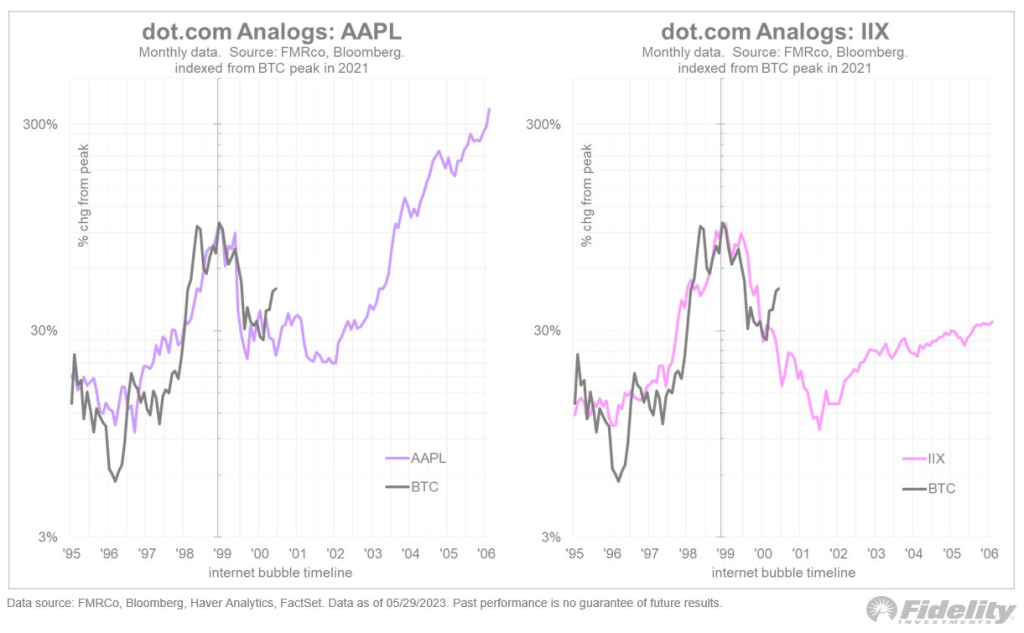

To illustrate his point, Timmer overlays Bitcoin’s current chart with that of Apple’s stock and an internet stock index from two decades ago. The charts seem to exhibit similar price patterns, implying a possible correlation between Bitcoin and the successful trajectory of Apple during the dot-com bubble.

Read: Analyst Predict BTC Price Can Surge 200% Ahead of Bitcoin Halving – Coinpedia Fintech News

A Bumpy Road To Dominance

He further notes that even Apple experienced a significant decline during the bubble burst, but ultimately recovered and became a dominant force in the tech industry. Whether Bitcoin will follow a similar path remains to be seen.

As of the writing, Apple (AAPL), trading at $0.22 in 2002, has risen to $177.25, reflecting a staggering gain of approximately 80,345%.

Below, I show an overlay of Bitcoin today vs. Apple two decades ago (left), and Bitcoin vs the Interactive Internet Index (IIX) on the right. The IIX was a now-defunct index of internet stocks that saw its value come full circle from nothing to bubble back to nothing. /5 pic.twitter.com/GCpoODZKuK

— Jurrien Timmer (@TimmerFidelity) May 31, 2023

2 years ago

110

2 years ago

110

English (US) ·

English (US) ·