Virtual currency market this week (7/3 (Sat) – 7/9 (Fri))

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 7/3 (Sat) to 7/9 (Fri):

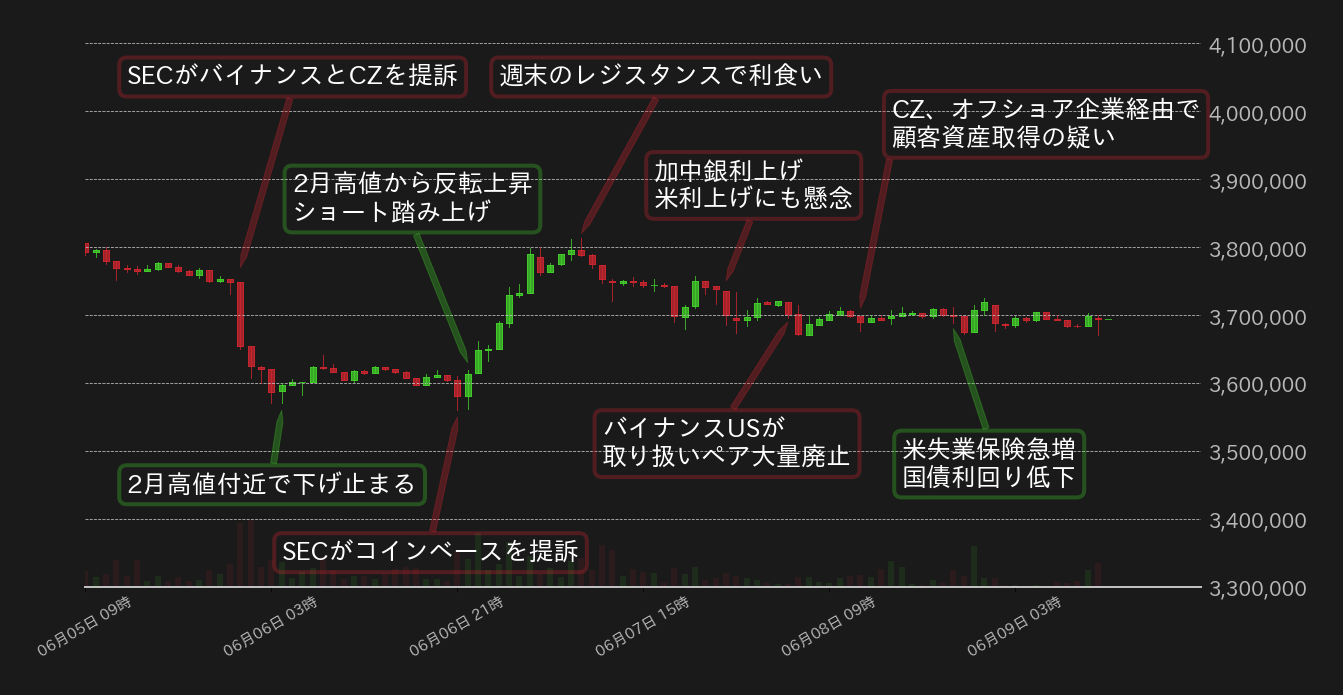

This week’s Bitcoin (BTC) vs. Japanese Yen exchange rate has risen from 3.75 million yen to a February high of 360 on a dollar-denominated basis as the U.S. Securities and Exchange Commission (SEC) sued Binance and its CEO CZ from the beginning of the week. It started with a sharp drop to around 10,000 yen.

Meanwhile, on Tuesday, the SEC this time sued Coinbase, and the market temporarily tried to break below the February highs, but after reversing in a dip-buying pattern, the market took a short position to undo the previous day’s losses.

However, after that, BTC slowed down due to the weekend resistance, and the Bank of Canada’s decision to raise interest rates raised concerns about the rate hike at the Federal Open Market Committee (FOMC) next week. It announced the abolition of handling of crypto assets (virtual currency) pairs exceeding 3.7 million yen.

However, from the second half of the week, some alts have rebounded due to oversold sentiment, and BTC has stopped declining around 3.7 million yen.

Figure 1: BTC vs Yen chart (1 hour) Source: Created from bitbank.cc

On Thursday, SEC court filings revealed that CZ had been receiving client assets through its own offshore firms, but a series of litigation-related woes appear to have made the market increasingly resilient. However, the recent altcoin rally may end in a retracement, so we cannot rest easy.

Next week, we will finally have the US Consumer Price Index (CPI) and FOMC in May. The attention of the FOMC this month can be said to be whether there will be an interest rate hike and the interest rate forecast at the end of the year in the Summary of Economic Projections.

Markets are pricing in a no June rate hike and a July rate hike, but given that core inflation has remained flat and high in recent months, there is little justification for a temporary pause in rate hikes. It seems so.

However, even if we assume that interest rates will be raised by the end of the year according to the current economic outlook, we do not expect a dramatic increase due to concerns about the economy and the financial sector. Do you think the situation will continue where it is difficult for the BTC market to show a sense of direction?

connection:bitbank_markets official website

Last report:Bitcoin declines due to worsening sentiment, expectations for bottoming out against the background of US funds

The post Is the basis for the suspension of the FOMC rate hike weak, and BTC is expected to continue to develop uneasy | bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

177

2 years ago

177

English (US) ·

English (US) ·