- Federal Reserve Board minutes released on January 3 indicate that policymakers may cut interest rates later this year.

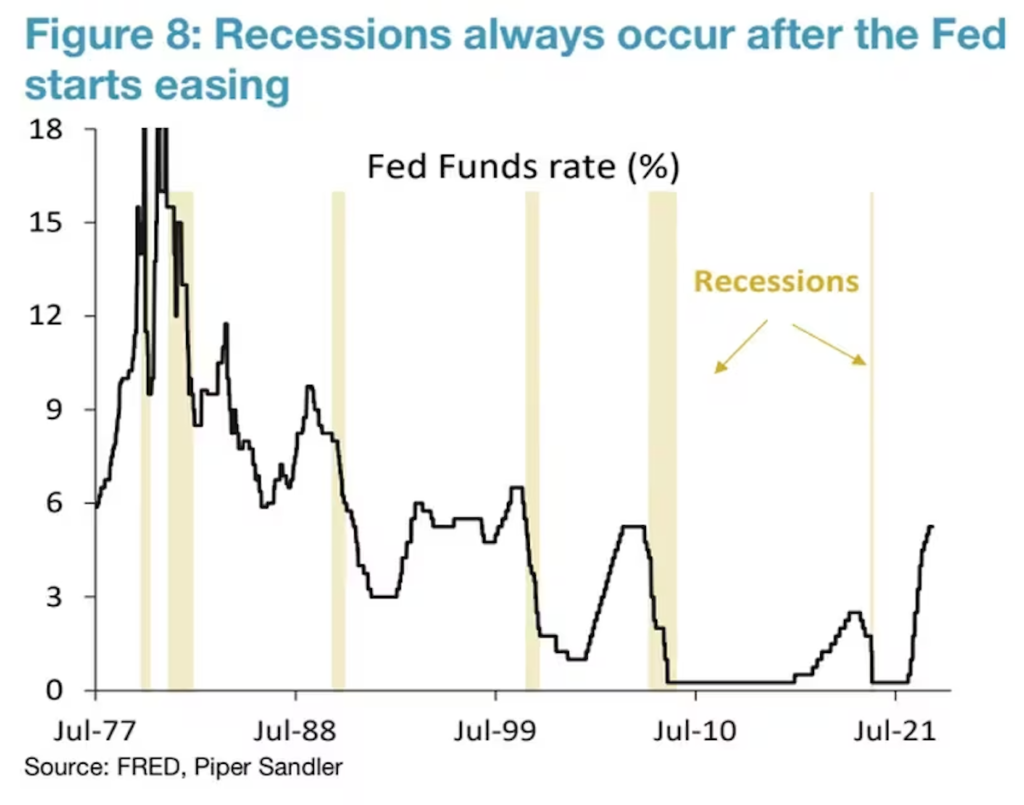

- Historical data shows that when the Fed starts cutting interest rates, economies tend to fall into recession.

Minutes of the US Federal Reserve’s December meeting, released on January 3, indicate that a rate cut is likely in 2024.

The long-awaited liquidity easing is a key bullish tailwind for Bitcoin (BTC), along with the impending launch of spot exchange-traded funds (ETFs) and the once-in-four-year mining fee halving on the Bitcoin blockchain. has received wide attention as

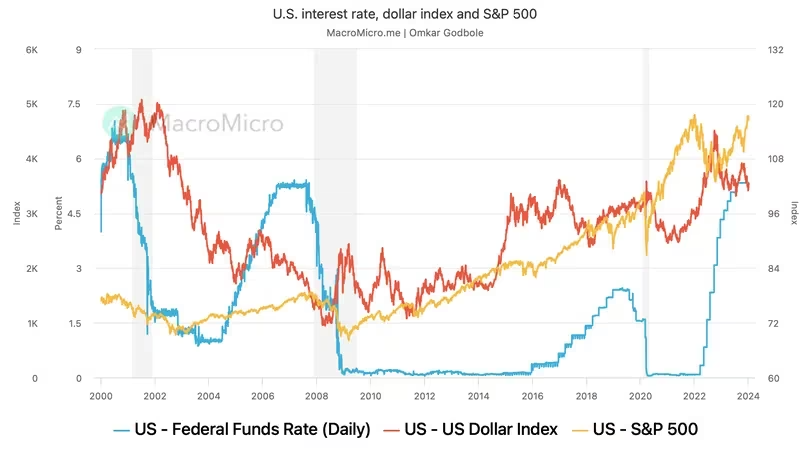

However, there is a problem with this. Historical data from MacroMicro shows that the early stages of the Fed’s supposedly stimulative rate-cutting cycles often occur when economies are on the brink of recession, supported by the world’s largest and most liquid government bond market. The US dollar, the world’s key currency, is characterized by a short period of significant appreciation.

In other words, if history is any guide, Bitcoin could see a short period of intense risk aversion in 2024 after the Fed starts lowering interest rates.

A recession is a prolonged period of declining economic output and rising unemployment. If left to market forces, a recession will sharply reduce investors’ ability to take risks, leading to deflation in asset prices. As a result, central banks often respond with monetary stimulus measures.

The dollar is the world’s reserve currency, playing a major role in global trade, international debt, and non-bank borrowing. When the dollar value rises, companies with dollar borrowings face higher debt service costs. This will lead to financial strain and investors will reduce their exposure to risky assets like Bitcoin.

Charts of US interest rates, dollar index, and S&P500. (MarcroMicro)

Charts of US interest rates, dollar index, and S&P500. (MarcroMicro) The dollar index, which measures the U.S. dollar against major currencies, initially rose after the Federal Reserve began rate-cutting cycles in mid-2000, September 2007, and August 2019. The S&P 500 index, which measures the risk appetite of investors around the world, showed signs of risk aversion in the early stages of the rate cut cycle.

The shaded area in the chart above indicates that the recession occurred after the Fed pivoted to lower interest rates.

Will a recession follow a rate cut?

Historically, the Fed has only cut interest rates when a recession is imminent. As a result, forward-thinking markets saw interest rate cuts as a harbinger of bad news and sought the safety of the dollar.

Over the past 60 years, recessions have consistently followed the start of easing cycles, according to data tracked by investment firm Piper Sandler.

“The Fed tends to overshoot by raising and maintaining interest rates higher than necessary, inadvertently suppressing economic growth. Rate cuts typically result in a measurable decline in the economy and rising unemployment. “At that point, a recession is usually inevitable,” Piper Sandler said in a Jan. 2 note to clients.

“The same pattern is likely to repeat this time, with the Fed remaining more hawkish than necessary,” Piper Sandler added.

According to some observers, the market is now focusing on the U.S. economy’s ability to avoid recession following the Fed’s fast-paced rate hike cycle, which has seen borrowing costs jump to 5.25% in the 16 months ending July 2022. is overestimated. As a result, the market may react negatively to the possibility of a recession.

Recessions in the US always occur after the Fed begins to ease. (FRED, Piper Sandler)

Recessions in the US always occur after the Fed begins to ease. (FRED, Piper Sandler)|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: FRED, Piper Sandler

|Original text: Expected Fed Rate Cuts Support Bull Case in Bitcoin, But There is a Catch

The post Is the Fed’s interest rate cut a bullish factor for Bitcoin? –Economic recession always comes after easing | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

64

1 year ago

64

English (US) ·

English (US) ·