Many crypto investors are getting excited as Bitcoin (BTC) approaches the ‘Golden Cross’. A golden cross is when the short-term moving average (often 50 days) crosses above the long-term moving average (often 200 days).

In front of the Golden Cross

The golden cross is a common indicator often used by technical analysts and is considered a sign of a new emerging bull market. As a technical analyst myself, I definitely pay attention to the moving average crossings.

Why is this cross so suggestive? Because it puts the moment in perspective and raises questions such as, “What short-term changes accelerated price action? Will it continue?”

But how good are they as predictive tools? Finding a moving average cross and declaring that it is bullish is one thing.

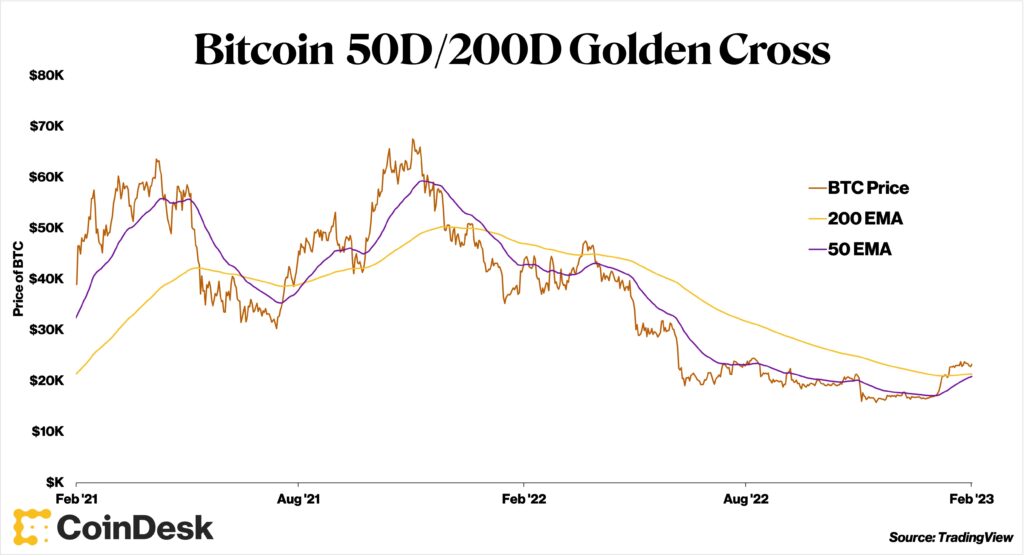

Looking back at the history of Bitcoin, the most eye-catching thing is that the number of golden crosses has been extremely low. Since January 1, 2015, the 50-day exponential moving average (EMA) has crossed above the 200-day EMA only six times.

The EMA puts weight on the most recent price. A Simple Moving Average (SMA), on the other hand, weights all data points equally. Which one to use is a matter of personal preference.

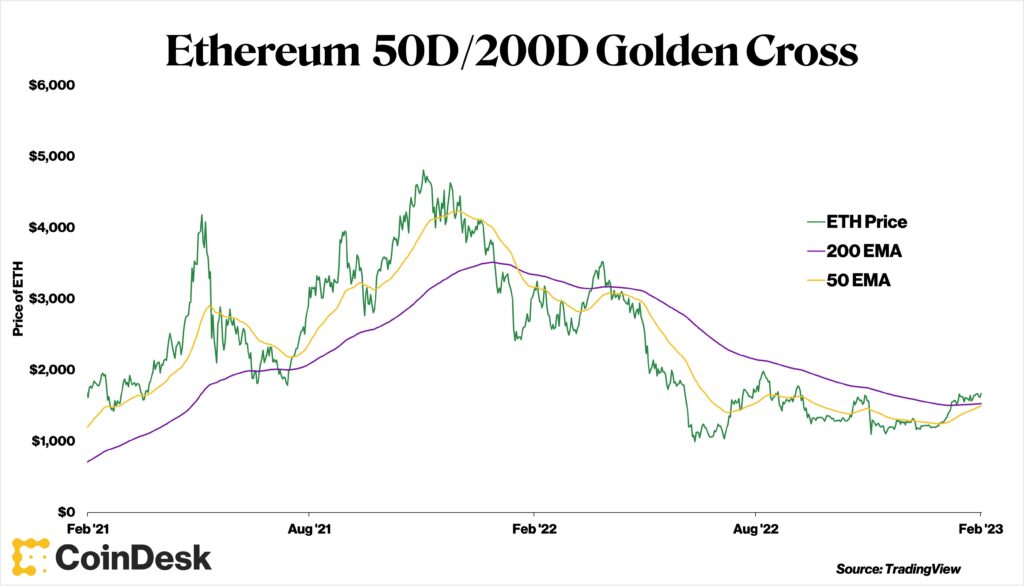

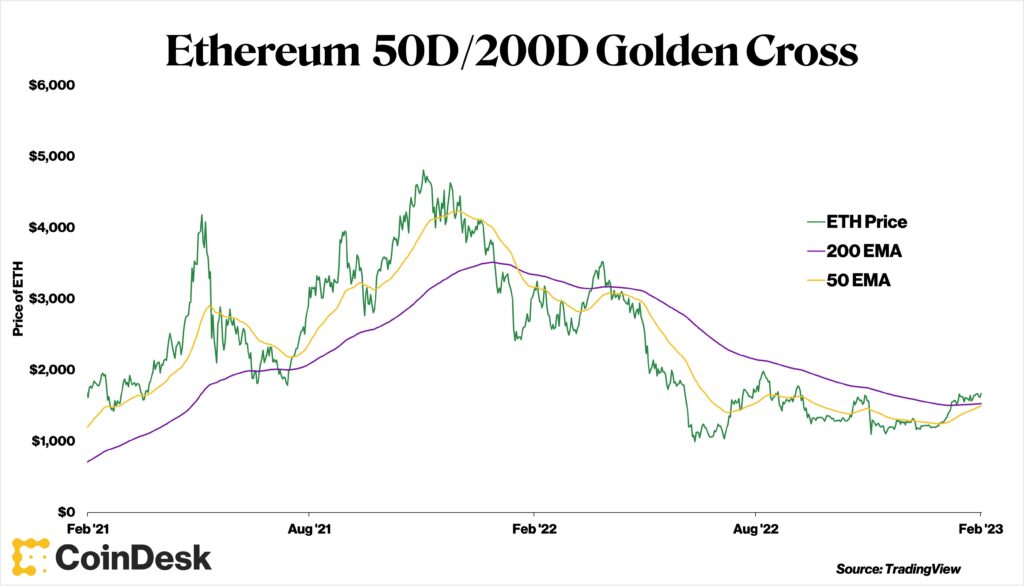

Golden crosses are even rarer on Ethereum (ETH), having happened only three times since 2017.

Bitcoin price (brown), 200-day EMA (yellow), 50-day EMA (purple)

Bitcoin price (brown), 200-day EMA (yellow), 50-day EMA (purple)Source: TradingView

However, at the time of this writing, Bitcoin is only 2.4% away from the Golden Cross and Ethereum is only 2.1% away, both of which appear to be nearing a Golden Cross. .

The key now is to determine if the two crypto assets are getting close to something worthy of attention, or if this is just one topic. The results are interesting.

A bullish indicator pointing to the upside?

Looking at the past 50/200-day golden crosses, Bitcoin rose 4.4% over the next seven days and 9.6% over the next 30 days. But you can’t say for sure without comparing it to something else.

How does Bitcoin perform over the 7-day and 30-day periods? Up 1.6% for 7 days and 7.5% for 30 days. In other words, the numbers are lower than after the Golden Cross. The Golden Cross certainly has historical strengths.

The biggest 30-day gain after the Golden Cross was in April-May 2019, when it rose 67%. Conversely, the worst price movement occurred in May-June 2018, when it fell 18.2%.

ETH price (green), 200-day EMA (purple), 50-day EMA (yellow)

ETH price (green), 200-day EMA (purple), 50-day EMA (yellow)Source: TradingView

As for Ethereum, the golden cross is not a bullish sign. The average 7-day and 30-day price movements after the golden cross are down 2% and 8% respectively. Meanwhile, the average 7-day and 30-day price movements over the entire period are up 1.5% and 7.3%, respectively. A simple buy-and-hold strategy, rather than triggered by moving average crosses, made more sense for Ethereum.

For traditional asset classes

Surprisingly, golden crosses are fairly rare, even in traditional asset classes. Take, for example, the three major US stock market indices: the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

The S&P 500 has had a golden cross three times since 2015, and the other two indexes five times. Both rose in the 30 days after the Golden Cross. The Nasdaq gained the most at 1.5%, followed by the S&P 500 at 1.15% and the Dow Jones at 1.13%. None of that would be too exciting, though.

All in all, it’s impressive that 4 out of the 5 we looked at (other than Ethereum) saw price increases in the 30 days after the Golden Cross. If patterns exist, it would make sense to apply the same process to different crypto assets to identify patterns.

Frankly, though, I’m not convinced of the importance of the Golden Cross for crypto. It is my view that the traditional 50/200 day average timeframe would make more sense in traditional finance than in crypto. The final decision will take time.

We also have to wonder if the rarity of the Golden Cross means it deserves more attention, or not at all. The answer is probably somewhere in between.

One thing they all have in common is that you shouldn’t look at just one metric in isolation.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Crypto Long & Short: Bitcoin’s ‘Golden Cross’ Explained

The post Is the “Golden Cross” Important? | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

177

2 years ago

177

English (US) ·

English (US) ·