The post Is the Trump Family Involved in a Crypto Scam? appeared first on Coinpedia Fintech News

Donald Trump on August 29, posted a video about the World Liberty Financial project. However, as the excitement builds around this project, there are alot of concerns rising. This follows the bizarre hacking of Trump family X accounts and promoting a fake WLFI project.

The Trump Family’s Crypto Adventure

For weeks, Donald Trump and his sons have been teasing the launch of World Liberty Financial.

Most of the details of the project were kept hidden. Somebody quietly circulated a white paper among potential investors. This project that is described as a decentralized finance platform is presented to offer a borrowing and lending service. This is similar to the recently hacked Dough Finance app.

This project is also notable for involving the entire Trump family, with all three of Trump’s sons-Eric, Donald Jr., and even 18-year-old Barron-playing significant roles. According to the white paper, World Liberty Financial will introduce a new cryptocurrency called WLFI, a non-transferable governance token. They designed the token to allow users to suggest and vote on new features or blockchain integrations.The whitepaper shows a huge suspicious thing. WLFI will have configuration that could make it challenging for speculators to trade.

The team behind the WLFI project is a mix of Trump family members and some crypto veterans. Along with Donald Trump, Eric and Donald Jr, there are Zachary Folkman and Chase Herro who have a history with troubled Dough Finance app. This raises concerns about the project’s security originality.

The Hacks and the Scams

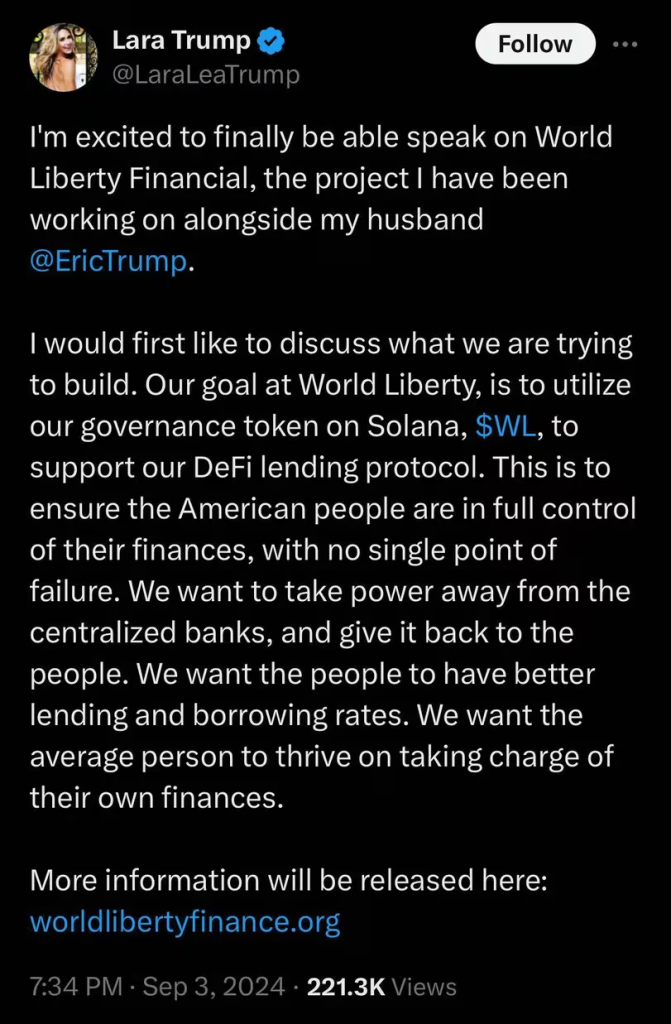

As the buzz around World Liberty Financial grew, things took a strange turn. On September 3, hackers compromised the X (formerly Twitter) accounts of Trump’s daughter-in-law, Lara Trump, and his daughter, Tiffany Trump. These accounts then promoted a token falsely claimed to be tied to World Liberty Financial. They shared blockchain addresses, urging followers to invest in what they called “the only official” World Liberty token.

Eric Trump quickly exposed the scam through his own X account. He informed that the profiles had been compromised and that the addresses are part of a scam. World Liberty Financial’s official account also confirmed the hack, urging followers to avoid clicking on any links or purchasing any tokens shared from Lara or Tiffany’s profiles.

This isn’t the first time that a token allegedly linked to the Trump family has appeared. Earlier, a DJT token, which convicted fraudster Martin Shkreli claimed was launched with Barron Trump, briefly made headlines. Another token, Restore the Republic (RTR), also saw a meteoric rise before crashing. In both cases, the Trump family denied any involvement.

What Does This Mean for World Liberty Financial?

The endorsement of World Liberty Financial by Donald Trump has undoubtedly drawn attention to the project, but it has also raised several red flags. The connection to the troubled Dough Finance app, the involvement of controversial figures like Folkman and Herro, and the recent hacking incidents all contribute to a sense of unease surrounding the project. While Trump’s move into the crypto space could energize his base and attract new supporters, it also exposes the project to significant risks and scrutiny.

Looking Ahead

As Trump continues his bid for the presidency, his venture into cryptocurrency is likely to remain a topic of interest and debate. There are people who believe that Trump’s sole motive to be vocal and supportive towards crypto is to capture crypto voters. Among so many hacks that crypto ecosystem is facing, project with such players creates suspecions.

It would be very interesting to see whether World Liberty Financial becomes a legitimate player in the DeFi space or just another failed experiment. All this will depend on how the project navigates these early challenges and whether it can build trust among potential users.

11 months ago

43

11 months ago

43

English (US) ·

English (US) ·