Macroeconomics and financial markets

On the US New York stock market on the 24th, the Dow Jones Industrial Average closed 36,577 points (0.48%) higher than the previous day, while the Nasdaq index closed 100.9 points (0.7%) lower.

Although the CPI (U.S. Consumer Price Index) announced last night was within the expected range, he rejected the market’s expectations for an early interest rate cut. With the announcement of the results of the US Federal Open Market Committee (FOMC) pending, it is likely that there will be a wait-and-see tone.

connection:The persistent CPI also pushes US stock indexes to new year-to-date highs; FOMC interest rate announcement tomorrow morning | 13th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 2.1% from the previous day to 1 BTC = $41,012.

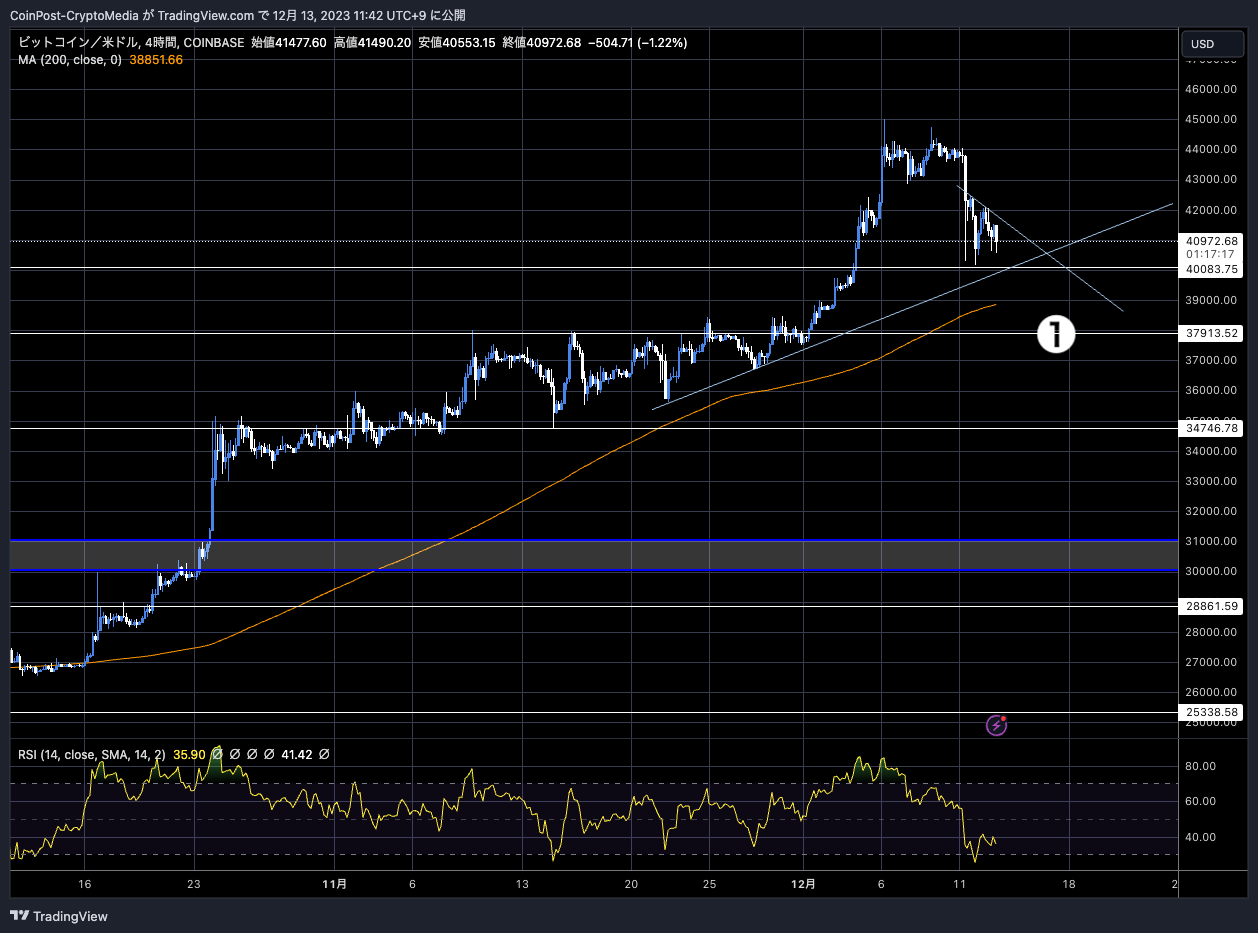

BTC/USD 4 hours

The top price has been lowered using the $40,000 milestone as support, and if it breaks down, the $38,000 level (①) will be in sight.

Analysts at CryptoSlate pointed to this as a sign of profit-taking by traders. According to Glassnode’s on-chain data, $2 billion worth of Bitcoin was transferred to cryptocurrency exchanges, the highest daily amount since the Tera Shock in May 2022. Become.

New Bitcoin investors (short-term holders) have been seen taking profits following the significant price rise in recent months. Last week’s stronger-than-expected U.S. jobs report, as well as stronger-than-expected non-farm payroll growth and unemployment rates, appeared to dampen expectations for U.S. monetary policy rate cuts. There is also.

#Bitcoin performed a round-trip this week, rallying to new yearly highs before selling off back towards its weekly open. After such a powerful 2023 thus far, the rally seems to have met resistance, with several indicators suggesting a degree of near-term exhaustion.

Discover… pic.twitter.com/KSnJI3x8Ch

— glassnode (@glassnode) December 12, 2023

On the other hand, according to observations from on-chain analysts, whales (large investors) who hold over 1,000 BTC are steadily increasing their purchases.

In the wake of the recent #Bitcoin price dip, there’s been a noticeable uptick in entities holding 1,000 $BTC or more. This increase suggests that #BTC whales are seizing the opportunity to accumulate more. pic.twitter.com/cQ8G76eIAO

— Ali (@ali_charts) December 12, 2023

Funds flowing into some altos

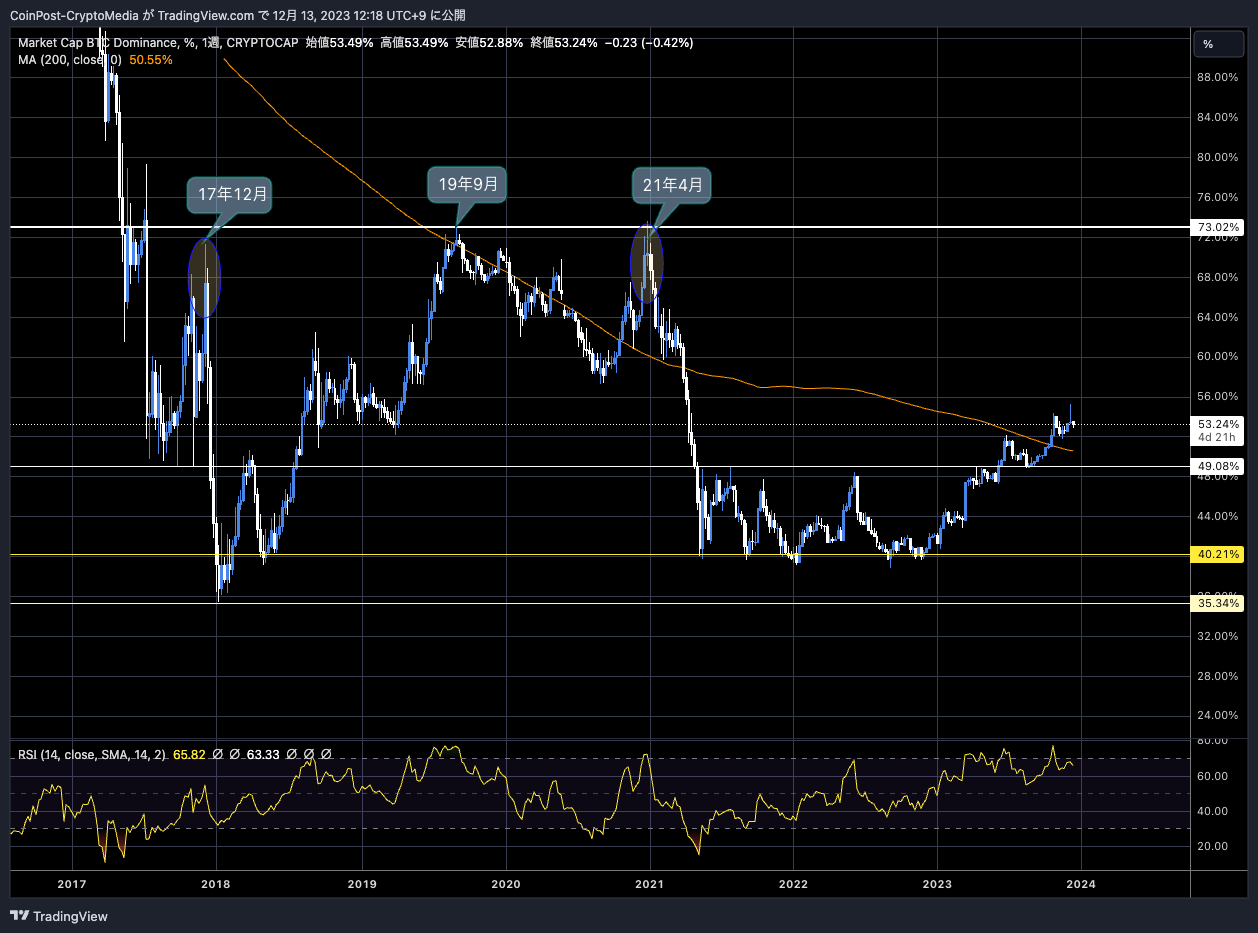

Bitcoin dominance, which indicates market share, reached a year-to-date high of 55.3% on the 6th, but it temporarily declined.

Looks bearish for sure.

Coming up to support though but if it breaks below 53% then alt coins can party hard pic.twitter.com/BoAqJe24sm

— Nebraskangooner (@Nebraskangooner) December 11, 2023

The reason behind this is the inflow of funds into some altcoins.

Among middle-cap alts with market capitalization between $1 billion and $10 billion, Cosmos (ATOM) rose 8.08% from the previous day, Aptos (APT) rose 7.19%, VeChain rose 3.5%, and Hedera Hashgraph (HBAR) rose 2.0%. It became.

On the 13th, Coinbase, a major US crypto asset (virtual currency) exchange, announced the listing of Solana (SOL) standard SPL token on BONK, leading to a sharp rise in the price. BONK is said to be a type of dog meme coin like Dogecoin (DOGE) and Shiba Inu Token (SHIB).

Asset added to the roadmap today: Bonk (BONK)https://t.co/rRB9d3hSr2

— Coinbase Assets

(@CoinbaseAssets) December 13, 2023

(@CoinbaseAssets) December 13, 2023

connection:“Altcoin season” has arrived, with meme coins BONK, ORDI, PoW-based KAS, etc. achieving record increases

On the other hand, as of the 11th, the TD Sequential Index showed a sell signal, and there is a growing sense of caution after the sharp rise.

Flashback to just before $BONK‘s 8,422.58% bull run – the TD Sequential indicator had presented a buy signal on the weekly chart!

Now, the same indicator is showing a sell signal. #BONK might be heading into a correction period lasting one to four weeks. pic.twitter.com/qjEHO9ss0o

— Ali (@ali_charts) December 11, 2023

Among large-cap alts, Solana (SOL) fell sharply by 7.2% and Avalanche (AVAX) by 17.7%, while among mid-caps Synthetix (SNX) fell by 17.1%, Algorand (ALGO) fell by 11.1%, and Chainlink (LINK) fell 6.4%.

Profit-taking selling is accelerating due to the continued decline in Bitcoin, and volatility (price fluctuation) may continue for the time being.

connection:Solana’s mSOL temporarily fell 18% due to selling by large investors, what is the reasoning behind it?

However, in the big picture, Bitcoin dominance remains the same.

It seems likely that the Bitcoin ETF (Exchange Traded Fund) will be approved for listing around January next year and that speculation about the halving, which is scheduled for around April next year, will continue.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Bitcoin ETF special feature

Due to the soaring price of Bitcoin, the number of downloads and MAU of the CoinPost official app is rapidly increasing.

In addition to virtual currency news, crypto indicators can also cover future materials. By using the My Coin function and Crypto Alert, you can quickly check for sudden rises and falls in altcoins.

■Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (virtual currency media) (@coin_post) December 6, 2023

[Recruitment]

CoinPost, Japan’s largest crypto asset media, is currently recruiting human resources due to business expansion (possible full-time positions)

Editorial Department: Student interns interested in web3 and writers familiar with crypto assets

Sales department: Those who are good at English conversation and those with sales experience are welcome.

webX management: People who have strong research skills and are good at English conversation https://t.co/UsJp3v7P39

— CoinPost (virtual currency media) (@coin_post) November 24, 2023

Click here for a list of past market reports

The post Is the virtual currency market, including Bitcoin weak, on a wait-and-see tone with the FOMC? appeared first on Our Bitcoin News.

1 year ago

159

1 year ago

159

English (US) ·

English (US) ·