Another blockbuster year for the space industry draws to a close. In fact, 2022 may have been the most blockbuster year for space in recent memory – since 1969, at least. The historic cadence of SpaceX, the launch of Space Launch System and the return of the Orion capsule, big technical demonstrations, ispace’s fully private moon mission…it’s been a momentous year.

There’s a lot to look forward to – so much, that next year could even outdo this one as the biggest for the space industry yet. But many questions still remain, especially about the shorter-term economic outlook, ongoing geopolitical instability, and (ahem) some announced timelines that may or may not come to fruition. Here are our predictions for the space industry in 2023.

1. More pressure on launch

It seems clear that there will be increasing pressure on the launch market as even more next-gen vehicles come online. We’re not just looking out for the heavy-lift rockets – like SpaceX’s Starship and United Launch Alliance’s Vulcan – but a whole slew of smaller and medium-lift launch vehicles that are aiming for low cost and high cadence. These include Relativity’s Terran 1, Astra’s Rocket 4, RS1 from ABL Space Systems, Rocket Factory Augsburg’s One launcher, and Orbex’s Prime microlauncher. As we mentioned above, space industry timelines are notoriously tricky (and this caveat applies to the whole post) but it’s likely that at least a handful of new rockets will fly for the first time next year.

Proving new vehicles drives prices down and increases inventory, meaning more launches and dates are available to private and government concerns — and incumbent players will need to work hard to keep the lead they’ve established.

2. Big developments from the UK, China, and India

The international space scene will continue to grow. While there’s much to look forward to from Europe, we’ve got our eyes on the United Kingdom, China and India. From the U.K., we expect to see the country’s first-ever space launch with Virgin Orbit’s “Start Me Up” mission from Spaceport Cornwall. We are also expecting a lot of activity from the Indian Space Research Organization, as well as the launch startup Skyroot there. China had a big 2022 – including completing its own space station in orbit and sending up multiple crews of taikonauts – and we predict there will be no slowdown next year as the country’s seeks to keep pace with American industrial growth.

How exactly the decentralizing of private space beyond a handful of major launch providers and locations will affect the industry is difficult to say, but it will definitely help diversify the projects and stakeholders going to orbit.

3. Continued growth for satcom and earth observation

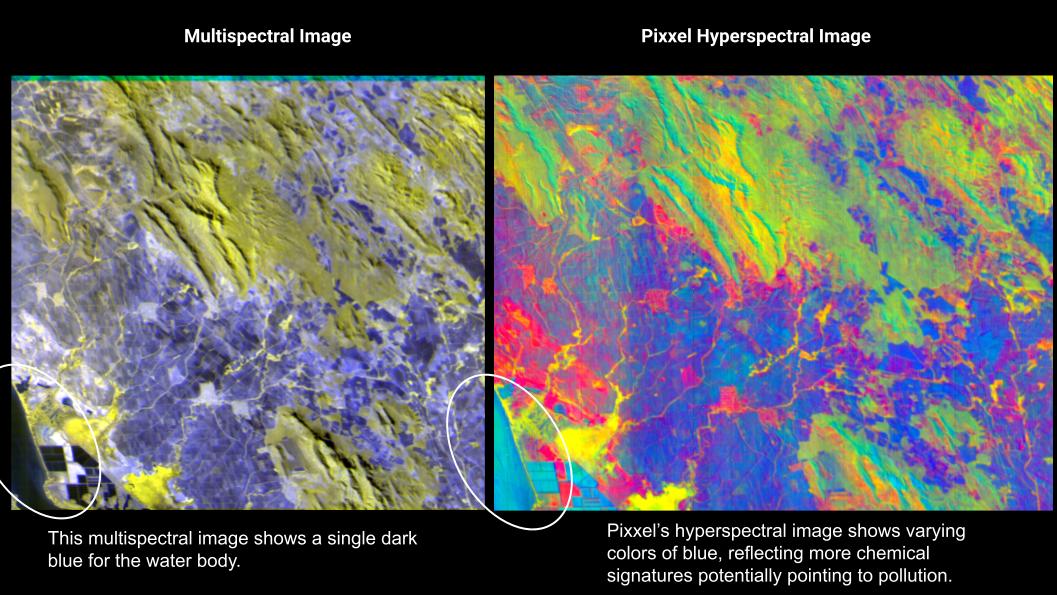

Image Credits: Pixxel

Similar to launch, we’ll be seeing even more large and small satellite constellations going up next year that will put pressure on the satcom and earth observation (EO) industries. Just two examples: Amazon’s long-awaited Project Kuiper will likely see its first launches next year, and Pixxel will be launching 6 high-resolution hyperspectral imagery satellites in the latter half of the year.

Most estimates assume that both satcom and EO will experience more growth throughout the decade, so we’re not expecting newer entrants to squeeze out existing players. But we do think that we’ll see even greater adoption of, say, Starlink or sat-to-cell services here on Earth, as well as even greater relevance for earth observation technologies in sectors like agriculture and mining, and for understanding climate change.

4. Capital management will help decide winners and losers

The macroeconomic environment is poor. High inflation, high interest rates, and high risk-aversion means that cash is more expensive than ever. We see this trend slightly abating, but not completely, so we predict that capital management will be a huge determining factor in startup survival. Investors will also be looking for technical differentiators and real market potential more than ever before.

“One thing the market has changed a bit is, when you’re when you’re doing your technical diligence, I think it’s more important than ever that the company that you’re backing has a very clear technical differentiator and advantage,” Emily Henriksson of Root Ventures said on-stage during TC Sessions: Space earlier this month.

In the space industry especially, we saw a real investment slowdown in 2022. Many space companies that went public via SPAC merger continue to underperform. In 2023, it will be all about managing debt, institutional bloat (and possibly, sadly, more layoffs), and capital management.

5. Private astronauts will hit record numbers

Image Credits: Mario Tama / Staff / Getty Images

Private…astronauts? Ten years ago, that phrase would’ve been nonsensical. But no more: in 2022 alone, nearly 20 people went to suborbital space aboard Blue Origin’s New Shepard rocket and four people flew to the International Space Station with Axiom Space’s Ax-1 mission. Next year, we anticipate these numbers will be even higher. Not only will Polaris Dawn, billionaire Jared Isaacson’s private spaceflight program, make its maiden mission; Axiom will be conducting its second private launch to the ISS early next year.

In 2021 a ticket to space barely existed; in 2022 it became merely unusual; in 2023 we will probably get tired of hearing about it! Expect to hear more about the next big milestone in space tourism, privately accessible space stations, next year as well, but don’t expect any serious movement there until companies figure out how to make the business work.

6. More activity on the moon and cislunar space

This year is coming to a close with ispace’s Mission 1, the world’s first fully privately funded and built moon lander mission. But that’s just the beginning. Next year, look out for even more landers heading to the moon – we’ve got eyes on Firefly Aerospace’s Blue Ghost lander and Astrobotic’s Peregrine – and even more infrastructure moves to cislunar space.

As more lunar tech companies make progress on their goals, the ones that don’t will become even more conspicuous. Mergers and acquisitions in this space would not be a surprise.

7. Even more emphasis on American manufacturing as supply chain crisis continues

Our final prediction is a broader one, but has big implications for the space industry. We see investors and founders placing an even greater emphasis on domestic supply chains and manufacturing in 2023, and this will likely only intensify if relations between the U.S. and foreign governments, China in particular, further sour.

It was a big year for the space industry. 2023 will be even bigger. by Aria Alamalhodaei originally published on TechCrunch

English (US) ·

English (US) ·