Since the Federal Reserve (Fed) began aggressive interest rate hikes in March 2022, the Japanese yen has fallen sharply, marking the most violent exchange rate fluctuations in history.

The volatility has caused traders on Japanese cryptocurrency exchanges to turn to Bitcoin (BTC), which is widely viewed as a hedge against traditional finance.

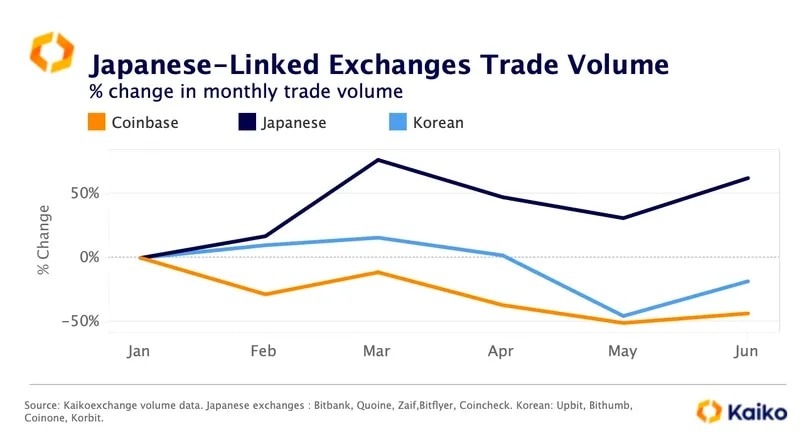

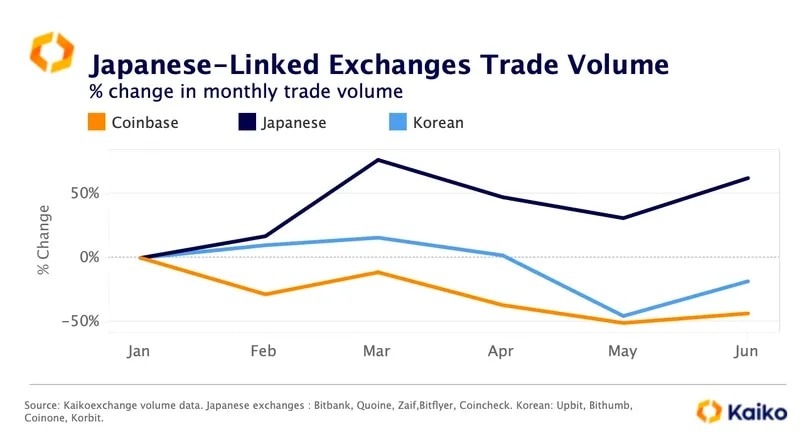

According to data from Paris-based data analytics firm Kaiko, the share of bitcoin trading volume on Japanese exchanges rose from 69% to 80% in the first half of this year. Trading volume hit $4 billion in June, up 60% year-to-date.

The Bitcoin/Japanese Yen (BTC/JPY) trading pair’s share of the Bitcoin/fiat currency trading pair also rose from 4% to 11% this year.

“It shows rising demand in the Japanese market,” Kaiko research analyst Dessislava Aubert said in an email. Kaiko’s figures are aggregating data from bitFlyer, Coincheck, bitbank, FTX Japan, and Zaif.

Bitcoin is widely considered to be the “digi-gold” hedge against traditional finance and fiat currencies. Citizens of countries facing inflation and fiat currency volatility have long embraced cryptocurrencies.

Bitcoin has risen 84% to over $30,000 this year while trading at a premium on Japanese exchanges (around $30,000 to $29,840 around 7:00 Japan time on the 21st).

“Bitcoin has generally traded at a premium of 0.5% to 1.25% in the Japanese market this year,” said Ober.

The Japanese yen has fallen 6.3% against the US dollar this year and has fallen nearly 14% over the past year. The main reason for the depreciation of the yen is the difference in the monetary policies of the Bank of Japan, which maintains an easing stance amid global monetary tightening, and the Fed.

Looking at the above chart, it can be seen that trading on Japanese exchanges has recovered faster than the Korean market and Coinbase, a major US exchange.

Given that Japan already has a regulatory framework in place, this trend may continue for some time. In America, authorities still rely on enforcement to oversee the industry. In June, the revised Payment Services Act came into effect in Japan, making it possible to issue stablecoins.

The Japanese yen’s volatility is likely to continue as speculation spreads that the Bank of Japan may announce a hawkish policy change as soon as next week.

Inflation has peaked in the United States, but it is still on an upward trend in Japan, with May’s index excluding fresh food and energy rising for the first time in 41 years and 11 months. As inflationary pressures mount after decades of chronic deflation, demand for alternatives like Bitcoin may rise even further.

|Translation: CoinDesk JAPAN

|Editing: Takayuki Masuda

|Image: Kaiko

|Original: Bitcoin Trading in Japan Rises as Yen Turns Volatile

The post Japan’s bitcoin trading volume increases ─ Yen depreciation hedge movement | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

141

2 years ago

141

English (US) ·

English (US) ·