The Leader of Japan’s Democratic Party for the People (DPP), Yuichiro Tamaki, has pledged to reform the country’s crypto taxation if elected.

His proposal, which he announced via a tweet on Sunday, aims to shift from treating digital assets as miscellaneous income to a flat 20% tax rate.

The plan also includes eliminating taxes on transactions involving exchanges of one crypto asset for another.

This reform could have significant implications for Japan’s Web3 ecosystem, potentially positioning the country as a hub for digital assets and innovation.

【拡散希望】 暗号資産に関して明確な減税&規制改革を打ち出しているのが国民民主党です。 暗号資産を雑所得ではなく分離課税20%にすべきと考える人は国民民主党に入れてください。暗号資産同士の交換時には税金をかけません。 こうした国民民主党の公約を拡散していただければ幸いです。…

How will Japan’s tax changes impact the token economy?

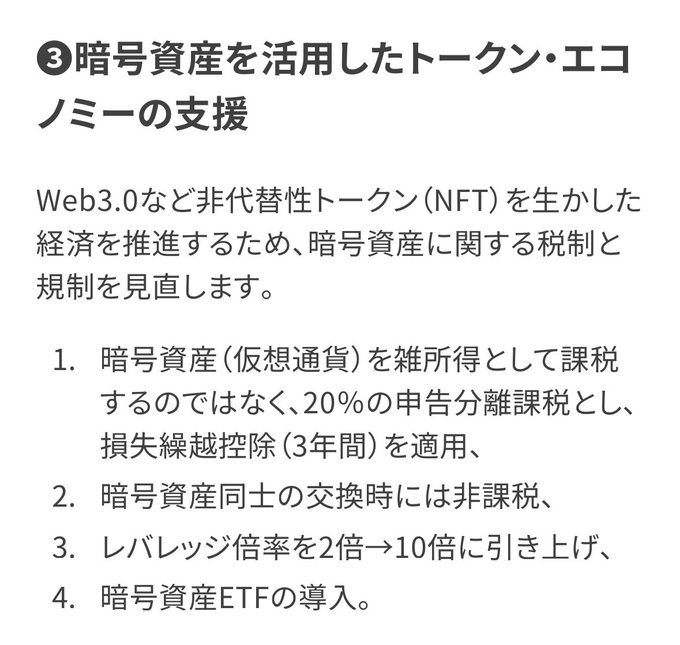

Tamaki’s proposal, titled “supporting the token economy using crypto assets,” seeks to provide a clear regulatory framework for digital assets in Japan.

It aims to promote the growth of an economy that leverages Web3 and NFTs.

The DPP’s policy includes raising the leverage ratio from 2x to 10x and introducing cryptocurrency exchange-traded funds (ETFs) in the Japanese market. The proposed measures could attract investors and companies to Japan, particularly those looking for a more favorable tax regime for digital asset trading.

This is not the first time Tamaki has pushed for changes in Japan’s crypto tax laws. Last year, he argued that Japan needed to “promote Web3” and the “token economy” by adopting a flat-rate tax structure for digital assets.

He highlighted the need to act swiftly to “prevent the outflow of human resources and businesses overseas.”

Tamaki’s consistent advocacy suggests a long-term vision for creating a more competitive environment for digital assets in Japan, aligning with global trends toward crypto regulation.

Will crypto ETFs reshape Japan’s investment market?

The introduction of crypto ETFs is a key aspect of the DPP’s pledge, which could provide Japanese investors with new avenues for diversifying their portfolios.

By offering regulated access to digital assets, the proposed ETFs could help integrate cryptocurrencies into Japan’s mainstream financial ecosystem.

This shift may encourage retail and institutional investors to explore opportunities in the Web3 space, potentially revitalizing Japan’s status as a financial innovation hub.

The DPP is not alone in calling for crypto tax reforms. The ruling Liberal Democratic Party (LDP) has also shown interest in reducing tax-related barriers on Web3.

The LDP established an NFT policy task force, known as the “NFT Policy Review Project Team,” aiming to make Japan a leader in the Web3 era.

Last year, an LDP MP released a white paper emphasizing the need for Japan to “drive innovation in the Web 3.0 era.”

The document outlined the importance of positioning the NFT sector as a new growth engine for the Japanese economy.

Tamaki’s broader economic vision includes converting the yen into an electronic currency and promoting the issuance of a digital local currency or central bank digital currency (CBDC).

This aligns with global trends where several countries are exploring or launching digital versions of their currencies.

A CBDC could offer greater efficiency in transactions and bring more transparency to Japan’s financial system, potentially positioning the country at the forefront of digital currency adoption in the Asia-Pacific region.

The post Japan’s DPP leader promises crypto tax cuts and regulatory reforms ahead of elections appeared first on Invezz

English (US) ·

English (US) ·