Secondary market for digital securities “START”

On the 25th, Osaka Digital Exchange Co., Ltd. (ODX) opened Japan’s first digital securities (ST) secondary market, START. Security token (ST) trading has started on ODX’s private trading system (PTS).

Digital securities (or security tokens) are financial products issued using blockchain technology. These tokens are backed by the value of securities and are expected to reduce transaction costs, speed up transactions, expand access to unlisted financial products, and improve market liquidity.

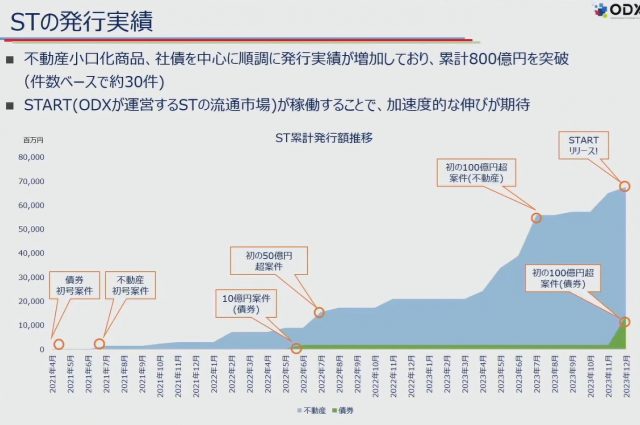

In May 2020, Japan’s Financial Instruments and Exchange Act was revised, making the handling of digital securities more clear. According to ODX President and Representative Director Jinio Amane, as of December 2023, a total of 80 billion yen worth of publicly offered digital securities have been created in Japan.

Source: ODX

The digital securities market is in the process of forming a new financial market, but until now the main transactions have been carried out within securities companies such as SBI Securities and Nomura Securities, and there is no general secondary market. It wasn’t. ODX’s “START” was introduced as an important step to change this. This system is expected to create a trading environment comparable to the stock market and accelerate the spread of ST.

The initial stocks handled by START are two publicly offered real estate security tokens: Kenedix Realty Token Dormy Inn Kobe Motomachi and Ichigo Residence Token. Each of these is backed by a specific asset and provides investors with new investment opportunities.

Trading participants include SBI Securities Co., Ltd., Daiwa Securities Co., Ltd., SMBC Nikko Securities Co., Ltd. (during 2024), and Nomura Securities Co., Ltd. (spring 2024). Investors can trade START’s digital securities through these brokerages.

connection:Digital securities market trends and future outlook in 2023

START details

“Kenedix Realty Token Dormy Inn Kobe Motomachi” is backed by a hotel called “Natural Hot Spring Romanyu Dormy Inn Kobe Motomachi” owned by SMFL Mirai Partners. The total amount of this token issued is 3.52 billion yen, and the investment amount for one unit is 100,000 yen.

On the other hand, “Ichigo Residence Token” is issued by Ichigo Owners Co., Ltd. and provides investment in six rental residential properties located in the city center that were newly constructed within two years. The total amount of this token issued is 2.925 billion yen, and the investment amount for one unit is 100,000 yen.

Regarding START trading details, the garnishing method and setturikai (Itayose method) are adopted, and two trading sessions are set per day. There are two types of trades: limit orders and market orders, and clearing and settlement will take place two business days after the trade contract date.

As Japan’s first secondary ST market, START aims to provide companies with flexible financing opportunities and investors with a variety of investment opportunities. Furthermore, the matching system uses cloud services from Amazon Web Services (AWS) and aims to realize an efficient transaction process with an eye toward collaboration with blockchain in the future.

What is ODX?

ODX, which was established in June 2022, has SBI Holdings as its main investor with a 70% stake. Additionally, we have raised funds from Sumitomo Mitsui, Nomura Holdings, and Daiwa Securities Group. In August 2023, ODX moved its headquarters from Tokyo to Osaka. The purpose of this relocation is to contribute to the “International Financial City” initiative. Furthermore, ODX is working to deepen its collaboration with Osaka Prefecture and build an innovative financial market by utilizing the “sandbox system” that aims to ease regulations.

connection:What is Osaka Digital Exchange, the new PTS market led by SBI? A thorough explanation of its relationship with digital securities

CoinPost Digital Securities Special Feature

The post Japan’s first digital securities secondary market “START” opened and trading of two stocks, Kenedix and Ichigo, started appeared first on Our Bitcoin News.

1 year ago

145

1 year ago

145

English (US) ·

English (US) ·