The Japan Crypto Asset Business Association (JCBA) announced on December 26th the “Proposals regarding the acquisition and holding of crypto assets by LPS” aimed at amending the LPS (Limited Liability Partnership for Investment) Law. The recommendations were created mainly by the association’s web3 Business Rules Review Task Force (web3TF), and are based on the results of a “survey on the actual situation of Web3.0-based startups and Web3.0-based VCs” conducted in order to make effective recommendations. was also announced.

According to the JCBA, current laws do not allow LPS to hold crypto assets and other tokens, and domestic venture capital firms (VCs) are unable to invest in Web 3.0 startups aiming to raise funds with tokens. Furthermore, due to this market environment, there are many cases in which entrepreneurs in the Web 3.0 field choose to start a business overseas. The Ministry of Economy, Trade and Industry is considering amending the law to allow LPS to acquire and hold crypto assets, and the recommendations are based on this background.

The contents of the JCBA’s recommendations are as follows.

- Acquisition, holding and operation of crypto assets (excluding those for the purpose of payment)

- Acquisition, possession and operation of NFTs

- Acquisition and possession of crypto assets for the purpose of payment use

- Acquisition and possession of electronic payment instruments

- Crypto asset lending

The results of the fact-finding survey conducted to make the recommendations are as follows (partial excerpts).

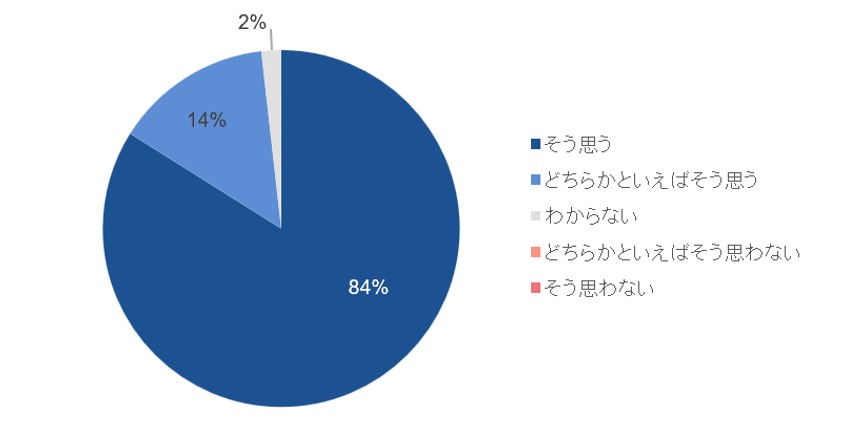

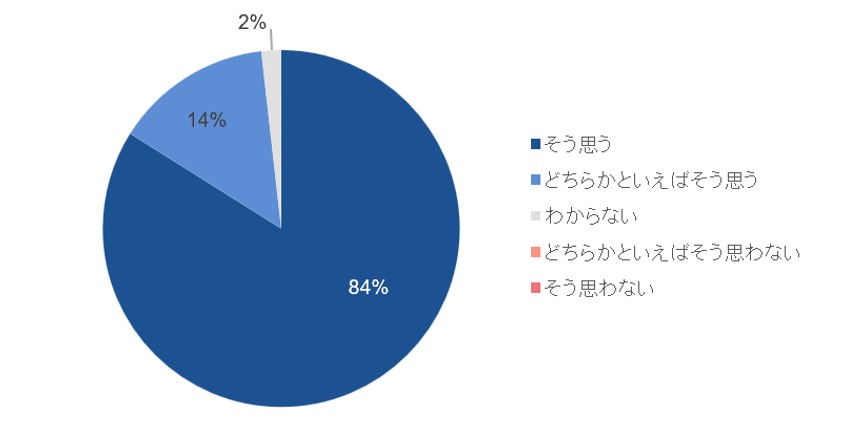

When asked whether they think LPS should be allowed to acquire and hold crypto assets, most respondents answered in the affirmative, with 82% saying yes and 14% saying they somewhat agree. occupied.

Provided by JCBA

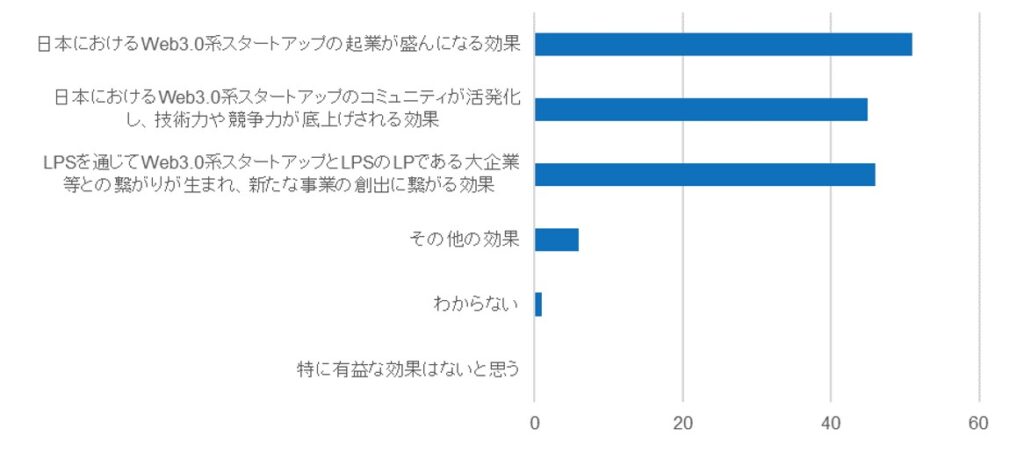

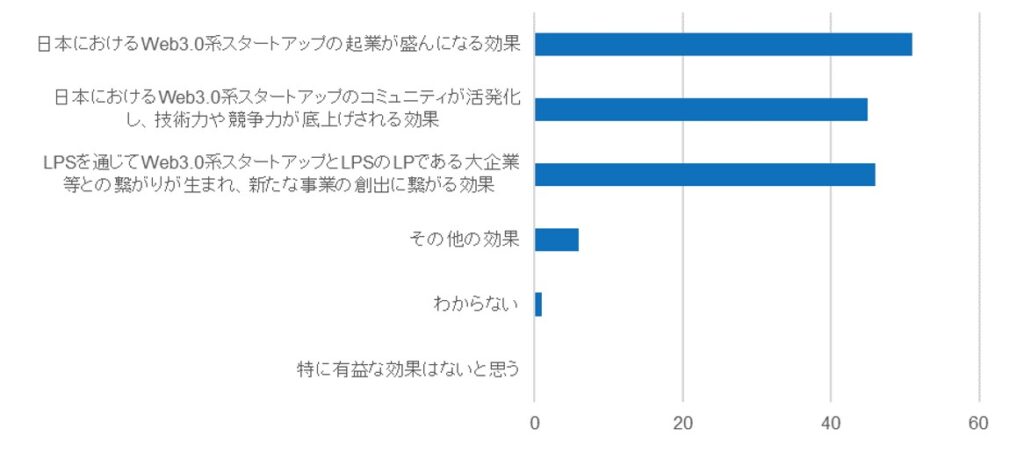

Provided by JCBAIn addition, the most frequently cited effect was “the effect of increasing the number of Web 3.0 startups in Japan.” Next, “LPS creates connections between Web 3.0 startups and large companies that are LPs of LPS, leading to the creation of new businesses,” and “The Web 3.0 startup community in Japan is revitalized and technological capabilities The effect of raising the level of competitiveness and competitiveness continued.

Provided by JCBA

Provided by JCBA■About actual situation survey

Target audience: VCs, Web3-based startups, crypto asset exchange companies, law firms, auditing corporations, tax accountant corporations, etc., and other Web3.0-related businesses, etc.

Response collection period: November 8, 2023 to November 30, 2023

Number of responses: 56 (VC: 11, Web3.0 startups: 19, crypto asset exchange companies: 7, law firms, auditing corporations, tax accountants, etc.: 8, others: 11)

|Text: CoinDesk JAPAN Editorial Department

|Image: From the release

The post JCBA makes a proposal to the Ministry of Economy, Trade and Industry to revise the LPS Act – “Enabling the acquisition and possession of crypto assets” | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·