The post John Deaton Anticipates a Lower Fine Than Legal Fees in the Ripple vs. SEC Battle appeared first on Coinpedia Fintech News

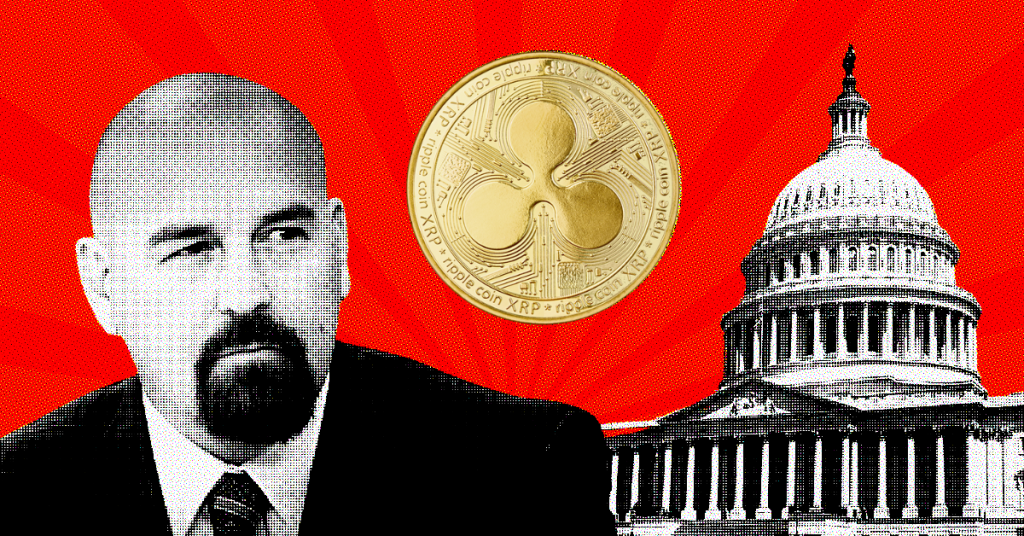

In a recent appearance on X (twitter) with CryptoLaw, well-known lawyer and legal expert John Deaton predicted that Ripple’s SEC fine would be lesser than the amount spent on legal fees.

Deaton, who is defending Ripple in its ongoing lawsuit against the SEC, said that he believes the SEC will be “very conservative” in any fine it imposes on Ripple. Deaton seems seamlessly confident that the Ripple would not pay more than $770 million in the closure.

“Whatever the ultimate number [of the disgorgement] is, it will be less than what Ripple paid in attorney fees,” he predicted.

Deadline By Judge Torres for Remedies Phase in Ripple Vs SEC

In response to Judge Analisa Torres’ order regarding the remedies phase of the SEC v. Ripple case, John Deaton speculated that Ripple would not pay the $770 million in disgorgement demanded by the SEC.

Deaton’s opinion is based on the fact that Ripple has maintained its stance that XRP is not a security and has argued that the SEC’s charges against the company are unfounded. With the timeline for the remedies phase now set, both parties must complete all discovery related to remedies by February 12, 2024. The SEC is scheduled to file its brief by March 13, 2024, and Ripple’s opposition is due by April 12, 2024.

The remedies phase will determine the fine Ripple will pay for allegedly violating securities laws by selling $770 million worth of XRP to institutional clients. The outcome of this phase will bring closure to one of the most high-profile legal battles in the cryptocurrency industry.

Potential Factors That Could Lower Ripple’s Penalty Amount

John Deaton, in his interaction with CryptoLaw, said that there are some major reasons why he believes Ripple might need to pay a lower penalty instead of paying a $770 million fine, and one of the major factors is known to be the Supreme Court’s Morrison Ruling, which allows Ripple to exclude XRP institutional sales conducted outside of the United States.

Ripple executives Brad Garlinghouse and Chris Larsen made disclosures regarding their personal XRP sales that a significant portion of Ripple’s XRP transactions may have occurred outside the SEC’s regulatory purview. This hypothesis is based on the fact that 95% of Garlinghouse and Larsen’s XRP sales were conducted outside the United States. This is why Deaton suggests that a considerable portion of Ripple’s XRP sales could also be subject to foreign jurisdictions, potentially reducing the scope of SEC oversight.

Deaton: Up to 90% of Potential Ripple Fine Could Be Avoided

As per Deaton’s estimation, up to 90% of the $770 million at issue in the SEC’s lawsuit against Ripple could be covered by transactions that are not subject to disgorgement and two legal precedents, Liu v. SEC and SEC v. Govil, which requires disgorgement to be paid to victims who suffered substantial financial harm.

Ripple could only pay disgorgement to XRP investors who bought the coin above the current price of $0.634. However, he believes that a large portion of Ripple’s institutional sales of XRP were below this price. He also suggested that Ripple may attempt to exclude legitimate business expenses, such as tax, legal, and travel fees, from the disgorgement amount.

Garlinghouse recently reported that the blockchain company had spent a significant $150 million defending the SEC lawsuit. And now it is still unclear how much Ripple would spend on this ongoing drama with SEC.

1 year ago

107

1 year ago

107

English (US) ·

English (US) ·