Started considering issuing JPYC (trust type)

Mitsubishi UFJ Trust and Banking, Progmat, and JPYC announced on the 28th that they have begun a joint study on the issuance of a stable coin “JPYC (trust type)” using the “Progmat Coin” platform.

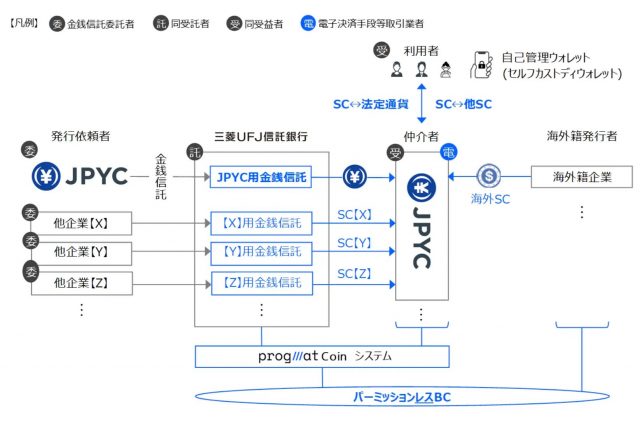

Furthermore, JPYC plans to function as an intermediary between various domestic SCs and overseas SCs issued using Progmat Coin. If realized, it is expected that investors will be able to connect self-managed wallets such as Metamask to JPYC’s services and easily exchange various stablecoins and stablecoins with fiat currency.

Source: JPYC

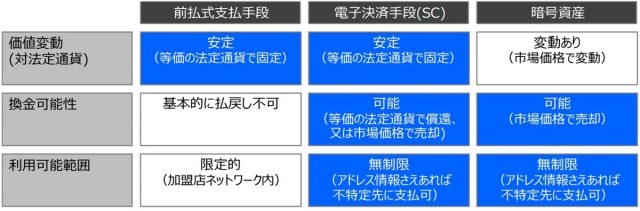

“JPYC” is a Japanese yen-based stablecoin issued on a public blockchain, and its issuance began in January 2021. As of November 2023, the cumulative amount issued is over 2.3 billion yen. The current model is classified as a “prepaid payment method” under the Payment Services Act, and as a general rule there are restrictions such as the inability to refund money.

The newly issued “JPYC (trust type)” will have Mitsubishi UFJ Trust and Banking as the trustee and will function as an electronic payment method. It becomes a model that can be standardized and horizontally expanded, as it allows cash refunds, removes restrictions on remittance amounts, and allows remittances of 1 million yen or more.

JPYC aims to issue “JPYC (trust type)” in the summer of 2024. The specific structure of “JPYC (trust type)” is as follows:

- Electronic payment method type: Type 3 electronic payment method (specific trust beneficiary rights)

- Issuer: JPYC Co., Ltd.

- Publisher: Mitsubishi UFJ Trust and Banking

- Underlying asset management destination: Any financial institution

- Handling intermediary: JPYC Co., Ltd.

- Backing currency type: Yen-denominated stable coin

- Stablecoin name: JPYC (JPY Coin)

- Connected blockchain: Planned expansion to multiple chains including Ethereum

connection:What is the outlook for “Slash Payment with JPYC Pay”, which allows instant conversion of Japanese yen through crypto asset payments?[Original interview]

JPYC enters the stablecoin exchange industry

JPYC is also in the process of planning a new business development as a stablecoin exchange company. In cooperation with “Progmat Coin”, we aim to enable mutual exchange with various domestically produced stable coins (SC) issued on the same platform and overseas stable coins.

Source: JPYC

In order to provide such an exchange function in collaboration with Progmat Coin, the intermediary must obtain a license as an “electronic payment instrument transaction operator,” and JPYC is currently working toward obtaining this license. There is.

Noritaka Okabe, representative director of JPYC, announced his intention to proceed with joint discussions with Mitsubishi UFJ Trust and Banking and Progmat through his X account. “Exchanges between each trust-type stablecoin on Progmat and foreign stablecoins such as USDC will be carried out efficiently. We will connect stablecoins around the world.”

connection:Mitsubishi UFJ Trust and six other companies begin joint consideration of cross-industry stable coins “XJPY” and “XUSD”

What is Progmat Coin?

“Progmat Coin” is an infrastructure for issuing stable coins jointly developed by Mitsubishi UFJ Trust and Banking and Progmat, and complies with the revised Fund Settlement Act that came into effect in June 2023. This platform will serve as a common basis for issuance and management of various SCs, including JPYC (trust type).

Progmat as a whole is a general term for a system that handles security tokens (ST), utility tokens (UT), and stable coins (SC) on different blockchains. Security tokens as digital securities will be handled by Corda-based Progmat ST, and utility tokens will be handled by Quorum-based Progmat UT.

“Progmat Coin” is designed based on Ethereum and may expand to support other blockchains in the future. SCs issued through the Progmat Coin system and overseas SCs such as USDC operate on the same blockchain and have unified smart contract specifications, so they are designed to facilitate mutual transfer and exchange.

We will partner with JPYC to realize mutual exchange with overseas stable coins such as USDC!

We will also issue “JPYC (trust type)” through Progmat!

▼Press release https://t.co/vOEMbbQWEA

▼Explanation (note)

[Quick explanation]What does it mean that Progmat and JPYC are teaming up? List including USDC etc. https://t.co/JJgtdpESG3 https://t.co/sQ24RKS4JZ pic.twitter.com/tmwATi7XmF

— Tatsuya Saito | Progmat (@tatsu_s1203) November 28, 2023

According to Tatsuya Saito, representative director and CEO of Progmat, the stable coins to be issued with Progmat Coin include one whose name has not yet been determined in collaboration with Binance Japan, and XJPY, which is being developed with Ginco.

connection:Mitsubishi UFJ Trust and Banking to consider new stable coin in collaboration with Binance Japan

The post JPYC plans to partner with Mitsubishi UFJ Trust and Progmat to expand stable coins and enter the domestic and international SC exchange industry appeared first on Our Bitcoin News.

1 year ago

115

1 year ago

115

English (US) ·

English (US) ·