Increased taxation on cryptocurrency mining

In 2022, the government of Kazakhstan received about 930 million yen (3.07 billion tenge) in taxes from miners of crypto assets (virtual currencies) such as Bitcoin (BTC). Local media HALYQUNI reported.

The Tenge (KZT) is the legal tender of Kazakhstan.

From January 1, 2022, Kazakhstan will impose a tax of 1 tenge (0.3 yen) per kWh on electricity used for cryptocurrency mining.

As for 2023, tax payment of approximately 73 million yen (240 million tenge) was made by April 27.

Mining situation in Kazakhstan

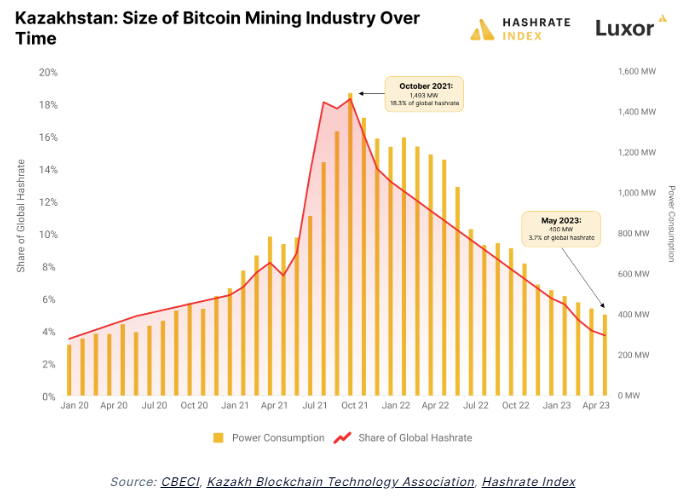

Kazakhstan has become one of the destinations for miners to relocate as the Chinese government tightens its crackdown on mining operations in 2021. In the background of the tightening of the tax, power shortages in Kazakhstan became more serious due to the sharp increase in power consumption by miners in 2021, and public dissatisfaction increased.

connection: Kazakhstan forcibly closes cryptocurrency mining companies due to power shortage

Source: Luxor

According to the statistics of CCAF (Cambridge Center for Alternative Finance), which is affiliated with the University of Cambridge, UK, as of January 2010, Kazakhstan’s bitcoin hash rate has grown to the third highest in the world (about 13%).

However, since then, the government has restricted the power supply to cryptocurrency mining operators, and in May 2023, its share of the global hash rate has fallen to about 4%.

What is hash rate

Mining mining speed. In Japanese, it is expressed as “mining speed”. The unit is “hash/s”. “s” stands for “second”, which means “how many calculations can be done per second”. It is used as an index to show the processing power of mining equipment and how fast cryptocurrency mining is done.

Cryptocurrency Glossary

Cryptocurrency Glossary

tightening regulations

Kazakhstan tightens regulations on cryptocurrencies.

First, the new bill requires miners to sell their mined cryptocurrencies through licensed cryptocurrency exchanges as a measure to reduce the potential for tax evasion.

As for the timing of the introduction, businesses will be obliged to sell 50% of mined cryptocurrencies by 2024 and 75% by 2025.

In addition, a bill to impose a license registration on cryptocurrency issuers and make them subject to oversight under existing laws to prevent money laundering and terrorism financing came into effect on April 1 this year.

While promoting regulation, the Kazakhstan government is also working on a digitalization policy in cooperation with major cryptocurrency exchange Binance.

Binance will help Kazakhstan test its central bank digital currency (CBDC) by providing an environment for its own blockchain, BNB Chain. According to a report released in February, Digital Tenge is already in the stage of pilot testing with consumers and merchants.

connection: Binance Provides BNB Chain Environment for Kazakhstan CBDC Test

What are CBDCs

A digital currency issued by the central bank of a country or region. It stands for “Central Bank Digital Currency”. The big difference from virtual currency is that CBDC is a legal tender. While it is expected to reduce costs and improve efficiency in currency management and settlement, there are many issues to be considered, such as protection of personal information and privacy, security measures, and impact on the financial system.

Cryptocurrency Glossary

Cryptocurrency Glossary

The post Kazakhstan introduces tax on miners, tax revenue of 900 million yen in 2022 appeared first on Our Bitcoin News.

2 years ago

87

2 years ago

87

English (US) ·

English (US) ·