- Key indicators based on Bitcoin futures and options point to excessive levels of leverage in the market and the possibility of a washout.

- Bitcoin has been confined to a narrow range in recent weeks, waiting for a breakout.

Bitcoin (BTC) indicators suggest speculative froth is building up in the market, often leading to leverage washouts and sudden price drops. .

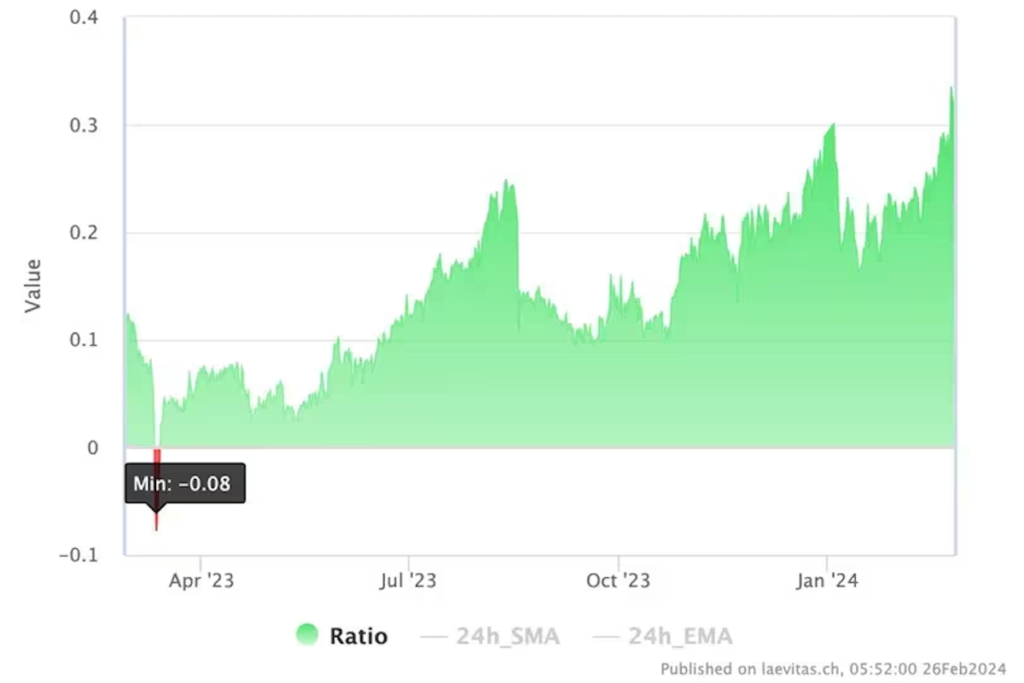

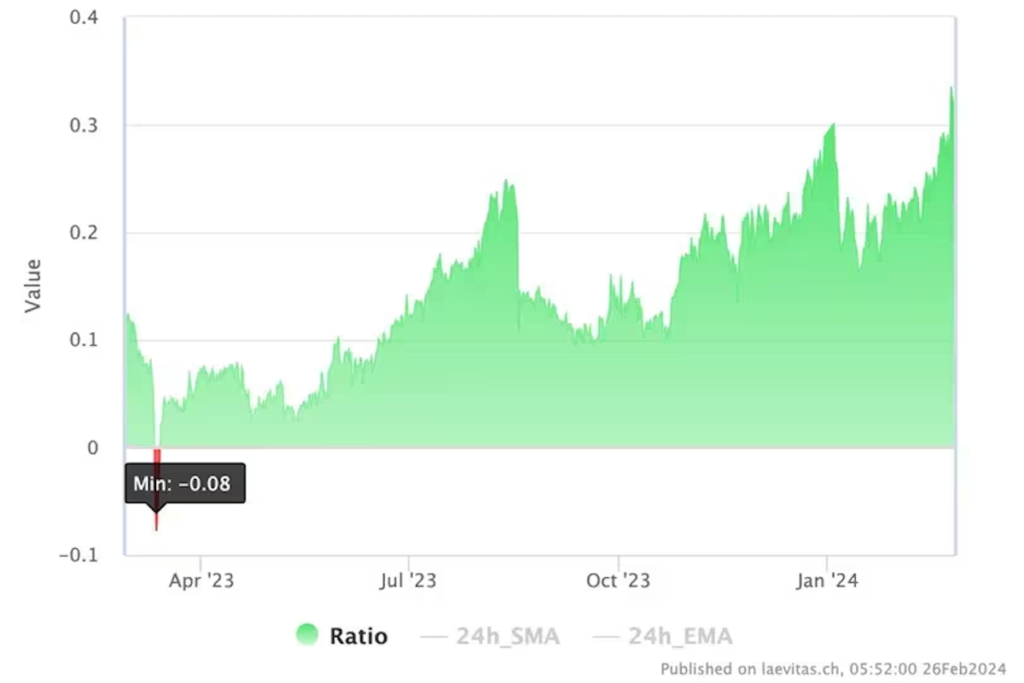

According to data tracked by STS Digital, a crypto structuring and trading solutions company, implied yield basis (the annualized spread between one-month futures price and spot market price) and options The ratio of one-month implied volatility (expected volatility) has more than doubled this year to about 0.34.

“If the implied yield basis is large relative to the volatility of the underlying asset, it means there is an unusually high level of leverage or speculation,” Jeff Anderson, senior trader at STS Digital, told CoinDesk. ” he said.

Excessively bullish speculation often leads to leverage washout, or the forced liquidation of leveraged positions due to insufficient margin. And the liquidation of longs will accelerate the price decline.

“The market appears to be trending higher, but given that spot flows are leading the market following the launch of exchange-traded funds (ETFs), suggesting that spreads may tighten, the market is “We're seeing some interesting developments,” Anderson added.

Bitcoin has rallied about 22% this year to $51,500, largely on the back of big inflows into spot exchange-traded funds (ETFs) approved last month. However, inflows slowed last week, with 10 ETFs attracting just 500 BTC on February 21st.

Ratio of Bitcoin implied yield basis and 1-month implied volatility by options (STS Digital)

Ratio of Bitcoin implied yield basis and 1-month implied volatility by options (STS Digital)As prop trader Julien pointed out on Price fluctuations have increased.

Waiting for breakout from range

Bitcoin has been trading in a narrow range between $50,500 and $53,500 in recent weeks. The market accumulates energy during these periods, eventually producing a large move in either direction.

“BTC is currently in the negative gamma profile range, but the spot price appears to be stuck between the $50,000 and $52,000 range. A move out of that is needed for momentum to build. '' said Greg Magadini, director of derivatives at Amberdata, in his weekly newsletter.

Negative gamma is a situation in which an options market maker trades in the direction of price, reinforcing the trend by buying high and selling low.

Bitcoin price chart (CoinDesk)

Bitcoin price chart (CoinDesk)|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: Bitcoin Indicator Suggests Potential for Leverage Washout

The post Key indicators suggest possibility of Bitcoin washout | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

78

1 year ago

78

English (US) ·

English (US) ·