The $79 billion sneakers (or “trainers,” for our U.K. readers) industry has spawned a lucrative resale market, expected to hit $30 billion by the end of the decade — up from $5 billion in 2020. Some have even called sneakers an alternative asset class, an investable product that can be bought and sold on for an inflated price — particularly for limited edition or otherwise hard-to-get sneakers.

Throw into the mix the prevalence of counterfeit sneakers, with some reports indicating that the fake footwear industry out-values the legitimate market five-fold at a staggering $450 billion, and it’s easy to see why there might be value in technology platforms designed to give sneakerheads peace-of-mind when parting with their hard-earned cash.

This is precisely the reason why long-established marketplaces have been investing in authentication services spanning all manner of luxury goods, such as eBay which acquired Sneaker Con Digital’s sneaker authentication business back in 2021.

It’s against that backdrop that U.K. startup Laced entered the fray five years ago, serving as a centralized platform for buyers and sellers to trade premium sneakers safe in the knowledge that everything is above board. The company today announced it has raised $12 million in a Series A round of funding, adding to the $1 million pre-seed round it raised some three years ago.

How it works

Founded out of London in 2018, Laced facilitates sneaker sales between sellers and buyers. Now, sellers might be individuals looking to offload hard-to-find sneakers for a profit after buying from the original brand, or they might be professional sellers dedicated to finding desirable footwear at volume.

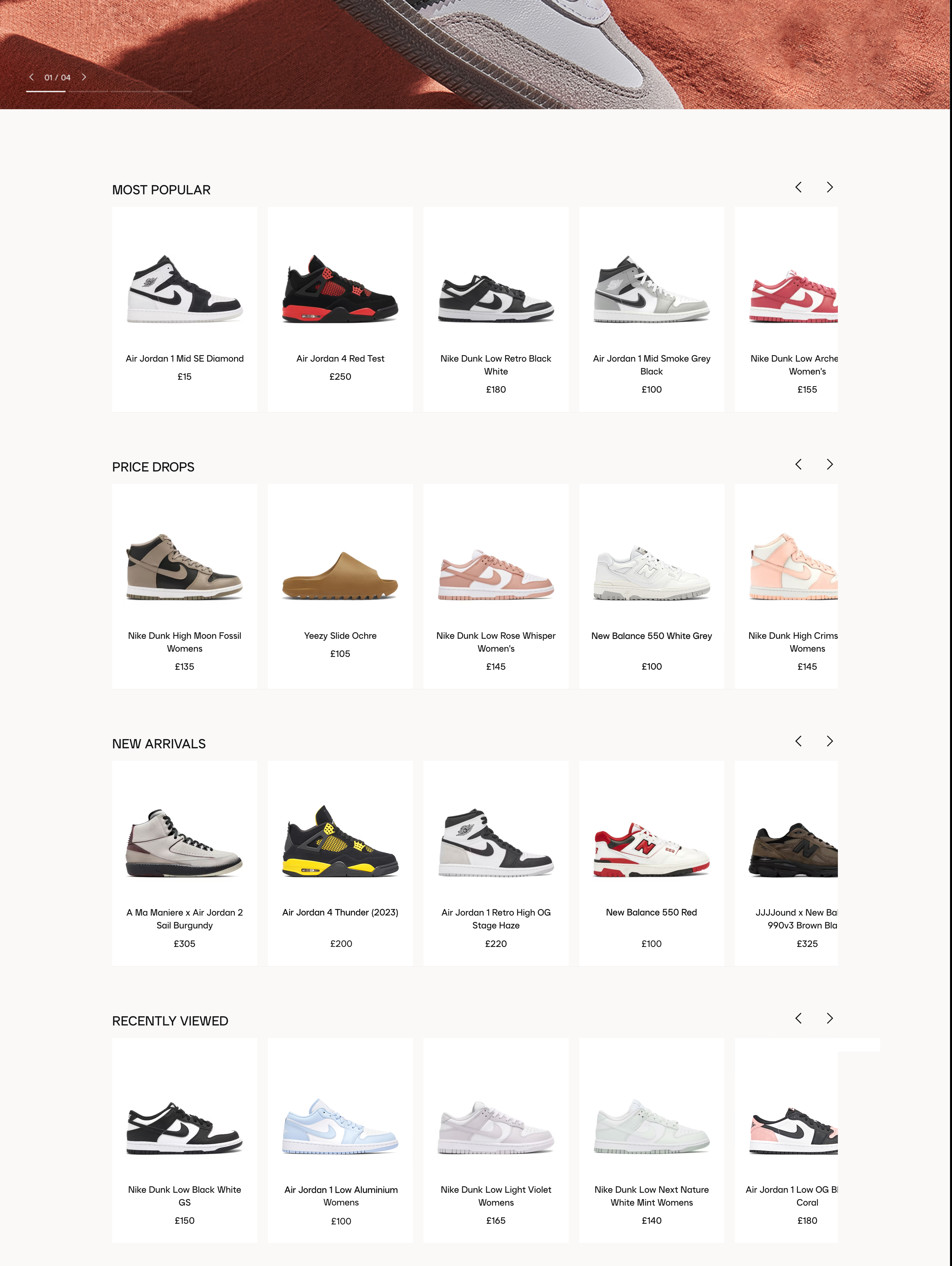

Laced homepage Image Credits: Laced

The seller sets a price, with no eBay-like auction element available, and the shoes are then placed in a queue which is prioritized by the lowest price first — this, according to Laced chief of staff Gareth Olyott, is designed to encourage sellers to set their goods at a reasonable price.

“To get to the front of the queue, and have the best chance of selling your item, the price must be the lowest,” Olvott told TechCrunch. “This disincentives sellers to list items at astronomically high prices in comparison to their value.”

There’s no escaping some of the similarities here with something like secondary ticketing marketplaces, whereby touts (maybe aided by bots) scoop up all the tickets for a concert from a primary ticketing outlet, and instantly sell them on “legitimate” secondary marketplaces for a hefty profit.

The arguments for these model are very similar too, insofar as having a properly authenticated, legitimate business managing the resale process ensures that buyers aren’t dealing with dubious merchants.

“Footwear accounts for 20 percent of the value of all counterfeit goods, and the counterfeit sneaker market is estimated to be worth five-times the legitimate market,” Olvott continued. “This shows that the proliferation of counterfeit items in this sector is a huge problem for collectors and enthusiasts alike. Laced removes the risk of buying an item from an unregulated marketplace, and for it to arrive and be inauthentic.”

All trainers should be new and in their original packaging, and after each completed transaction the seller ships their goods to Laced which uses in-house authenticators to check their veracity and forwards them to the buyer, taking a 15% cut on top of the list price.

And unlike something like eBay, buyers and sellers on Laced remain entirely anonymous — both to the public, and to each other.

“Laced operates purely as the middleman in the relationship between the buyer and the seller,” Olyott said. “We not only exist to ensure quality and authentication of the items but to also keep everyone involved anonymous and safe. We believe that for the customer at least, anonymity keeps things more streamlined and simple. Especially where high-value and highly desirable items are concerned.”

Laced is focused exclusively on the U.K., which does set it apart from many of its counterparts, while it also claims to have a unique authentication process, though it wasn’t at complete liberty to say exactly what this is.

“We’re of course limited to how much we can divulge through fear of giving the counterfeiters any information they could use to attempt to game the system here,” Olvott said. “But it’s the use of pattern identification alongside a huge database of variables specific to each ‘silhouette’ which we use as markers to identify the authentic against the counterfeit. This is then supported by a syllabus which we’ve developed internally for training our teams. As you can imagine, there are new items launching every day, so we’re in a perpetual state of updating these methods.”

Moreover, Laced says that while many others in the space rely heavily on third-party infrastructure such as that provided by Shopify, it has built its entire tech stack “with long-term scale and flexibility” in mind.

“Building our own tech stack, and not relying on third-party services, means that we can offer speed beyond our competitors at every point of the process,” Olvott said.

That all said, there is no getting away from the crowded space in which Laced operates, and there are plenty of companies doing something similar already, attracting sizeable chunks of venture capital (VC) money for their efforts. These include Californian unicorn Goat; the U.K.’s Edit Ldn; Japan’s Soda; Los Angeles- and Hong Kong-based Kicks Crew; and Michigan’s StockX, which is facing ongoing legal proceedings from Nike which accuses StockX of selling counterfeit goods.

Elsewhere, Indonesia’s Kick Avenue and India’s DawnTown have all raised investor cash this year for premium sneaker marketplaces.

All this is to say, of course, that despite economic headwinds and consumer trepidation, there remains an almost insatiable appetite for sneaker resale platforms. And with another $12 million in the bank, Laced is looking to capitalize on this trend by building out its platform including investing in technology, product, and data science.

“As the industry and model is so unique, there’s no tech that we can pull off the shelf, so we’ve had to invest heavily in proprietary technology to provide the best service to our buyers, sellers and our authentication model,” Olvott said. “We know that by doing this, we will unlock the ability to scale rapidly with clear purpose.”

Laced’s Series A round was led by London-based investment firm Talis Capital, with participation from H&M’s investment arm, H&M Group Ventures; B&Y Venture Partners; Truesight Ventures; and a handful of angel investors.

Laced, a UK-based resale marketplace for authenticated premium sneakers, raises $12M by Paul Sawers originally published on TechCrunch

English (US) ·

English (US) ·