Analyze lockup release events

Token Unlocks released its annual report in early February. This report focuses on 600 token unlocking events for the approximately 100 types of crypto assets (virtual currencies) tracked by the company, and analyzes how they affected prices. There is.

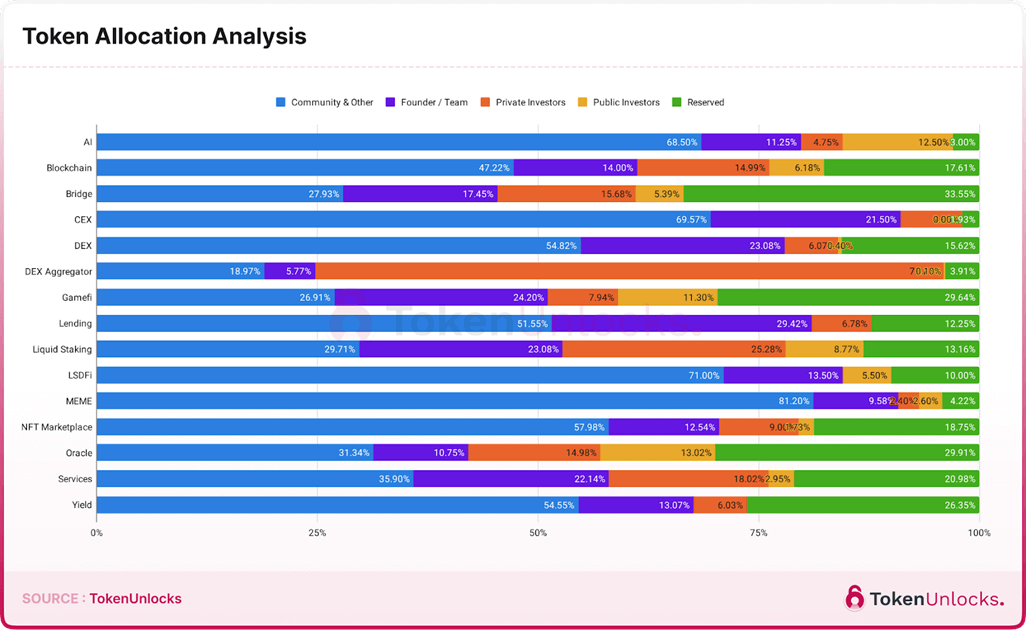

This research divided token allocation into five categories: “Community & Other,” “Founder/Team,” “Private Investor,” “Public Sale Investor,” and “Reserve.” The table below shows the average token allocation within each category.

Source: Token Unlocks (all below)

As a result, in 12 out of 15 genres, there was a tendency for token allocation to be concentrated in the “Community & Others” category. Additionally, all categories tend to have the lowest allocations to founders, teams, and general investors.

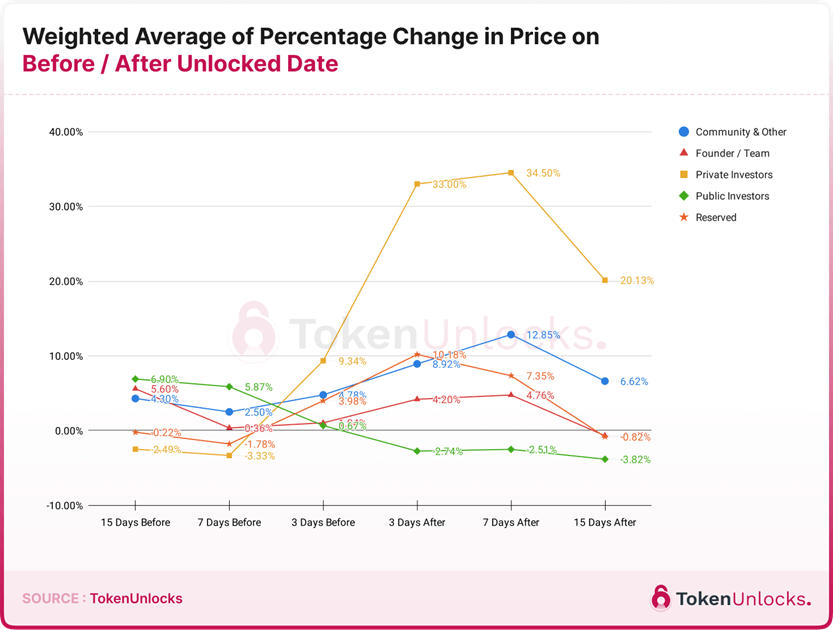

Price movements before and after lock-up release

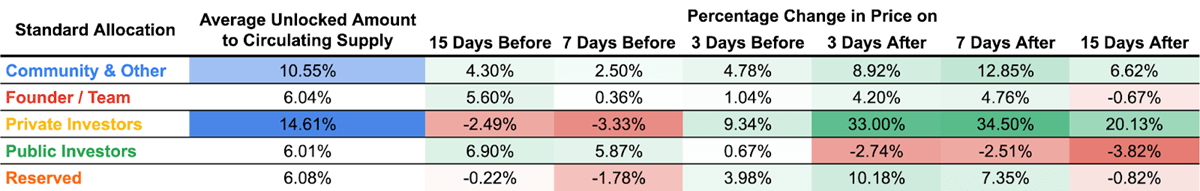

The report also examines the price impact of lock-up removal in detail for 15-day, 7-day, and 3-day periods before and after the unlock date. Our analysis shows that unlocking varies greatly depending on its size, so the impact on token prices is adjusted based on the ratio of unlocked volume to circulating supply.

According to Token Unlocks analysis, the market reaction after a token is unlocked varies by category. A brief summary of the main points is as follows.

- Public Sale Investors: Performed the worst after unlocking, with an average price decline of 3.8% after 15 days.

- Community & Others: Although the ratio of unlocked amount to distribution supply is high, the price increase rate after unlocking is remarkable, about twice as much as before unlocking.

- Founder and team: The impact of unlocking is relatively mild, with prices tending to rise around the unlock date.

- Private sale investors: The price increase is the highest after unlocking, with an average increase of 34.5% seven days after unlocking.

- Reserve: Since the reserve will be transferred to a decentralized autonomous organization (DAO) or multisig wallet, the future recipient is undetermined, so the price movement will be unstable around the unlock date.

Furthermore, the amount of tokens unlocked is the largest in the “Private Sale Investor (Venture Capital and Angel Investor)” category compared to other categories.

Due to this large amount of unlocking, general investors are concerned that these investors may sell their tokens in large quantities, and the price of the tokens tends to fall before the lockup is lifted.

connection:Bitcoin remains at $37,000 level, weak altcoin market warns of large-scale unlocking

Market environment and impact on initial token price

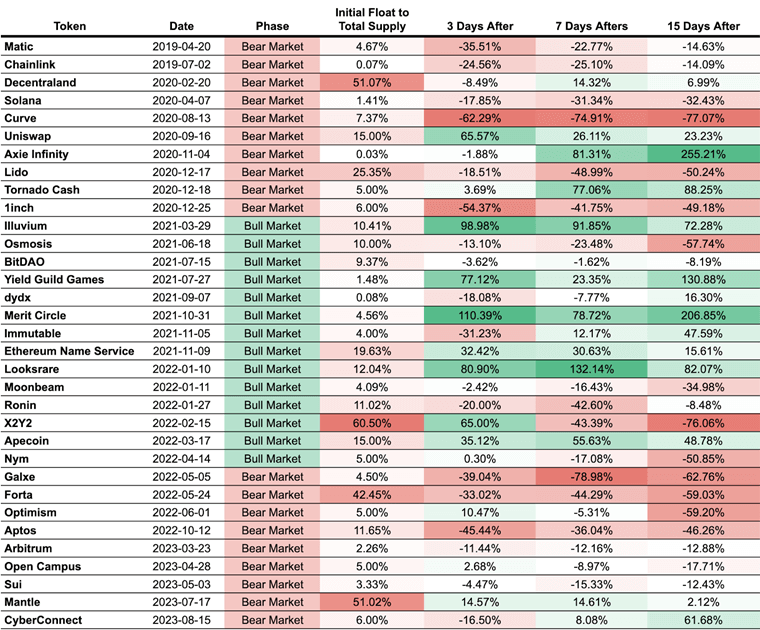

Furthermore, the market environment and price trends at the time of initial token distribution are also mentioned, and trends after initial token distribution in bull and bear markets are analyzed.

This analysis takes into account the initial float (amount of tokens circulating in the market) at the start of the project and the market environment at the time (bull or bear market).

In a bull market, prices often spike by 40% or more in the three days after the first price change, but over the next 15 days prices tend to decline and fall below the level on the day of the first price change.

In contrast, in a bear market, after an initial price movement, the price continues to fall further and is typically lower than the date of the first price movement, making it more difficult to issue tokens in a bear market.

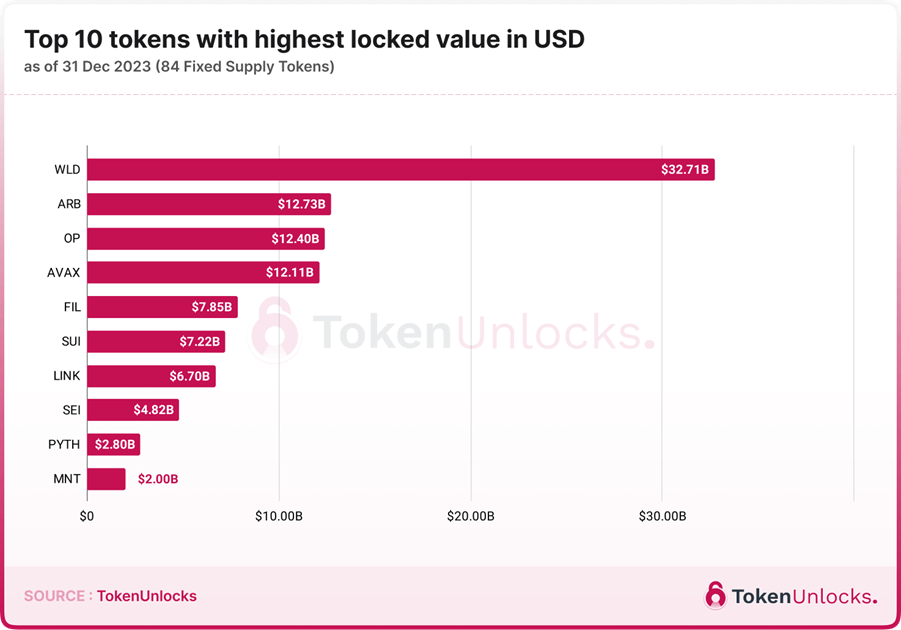

Projects with large lockup value (dollars)

Also, regarding the value of locked tokens, out of the 101 tokens tracked by Token Unlocks as of the end of 2023, we exclude 17 with infinite maximum supply (Aptos, Solana, Pokadot, etc.), and the remaining Top projects focused on 84 fixed supply tokens were listed. World Coin (WLD) topped the list with $32.71 billion.

Please note that some tokens, such as Ethereum Name Service (ENS), Chainlink (LINK), Arbitrum (ARB), and Optimism (OP), were not unlocked within the claim deadline. There is a possibility that there are.

connection:What is the distribution plan and impact of July's large token unlock Optimism, Aptos, and ApeCoin?

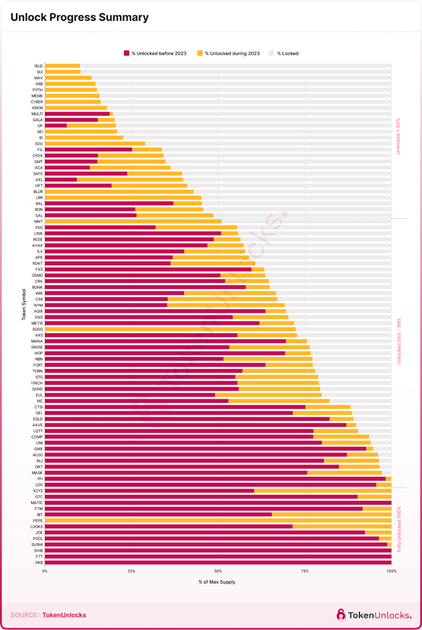

Lockup release progress by token

The figure below shows the token unlock status of 84 projects in a stacked bar graph. Tokens released before 2023 are shown in red, tokens released during 2023 are shown in yellow, and those that are still locked are shown in gray.

All nine types of tokens (POOL, PEPE, GTC, SUSHI, JOE, LOOKS, FTM, X2Y2) will be unlocked by the end of 2023. These are said to improve market stability and predictability, and reduce the risk of price declines related to token allocation.

connection:What is the impact on token unlock and virtual currency prices? TokenUnlocks report

The post Latest trends and market impact on unlocking crypto assets Token Unlocks appeared first on Our Bitcoin News.

1 year ago

75

1 year ago

75

English (US) ·

English (US) ·