Finding new profitable investments is a never-ending task faced by all investors. Bitcoin (BTC) and Ethereum (ETH) dominate the crypto buzz, but the opportunities for investors are much wider.

Role of Layer 2

Some of those opportunities stem from the need to extend the capabilities of the Bitcoin and Ethereum blockchains, and are inherently connected to them. The Bitcoin blockchain and Ethereum blockchain are called Layer 1 (L1), and those that extend (scaling) Layer 1 are called Layer 2 (L2).

The value of Layer 1 comes from “blockspace,” the area on the blockchain where information and smart contracts are stored. Layer 1 tokens such as BTC and ETH are valued based on demand. It’s like a ticket to a dance, the more people want to go, the higher the price. One of the reasons for buying is to buy in anticipation of the price going up.

Bitcoin enables peer-to-peer (P2P) transactions. BTC price goes up according to the demand for it. Ethereum and similar Layer 1s will enable smart contracts, decentralized finance (DeFi), and more in the future that we can’t even imagine today. The price of ETH and others fluctuates depending on the demand.

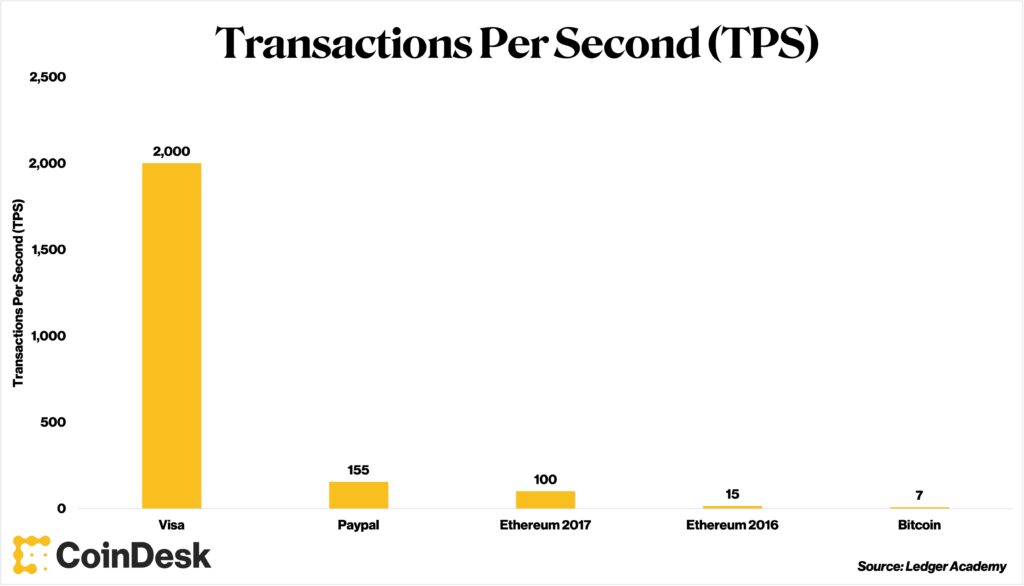

Block space is scarce. Even Ethereum, the largest layer 1 smart contract implementation, cannot handle all the transactions that exist in the financial world. It can process dozens of transactions per second, an order of magnitude lower than VISA or the New York Stock Exchange. This is a major hurdle for DeFi to replace traditional finance.

Transactions per second: VISA, PayPal, Ethereum 2017, Ethereum 2016, Bitcoin (Source: Ledger Academy)

Transactions per second: VISA, PayPal, Ethereum 2017, Ethereum 2016, Bitcoin (Source: Ledger Academy)So if the Layer 1 blockchain is the room everyone wants to enter, then there will be long queues at the door and skyrocketing admission prices.

new infrastructure

That’s where Layer 2 comes in. Layer 2 acts like a sub-venue for the event. In case you can’t enter the main venue, there is a large screen where you can watch the speech video, and it is a spare room where you can interact with the participants.

Layer 2 offloads the burden of Layer 1 and processes transactions faster and cheaper, but is essentially working with Layer 1 and sends processed transactions to Layer 1. Layer 2 enables wide access and congestion relief.

For the Ethereum blockchain, well-known Layer 2s are Polygon, Arbitrum, Optimism, etc. In the Bitcoin blockchain, Stacks is known.

Like Layer 1, Layer 2 also typically comes with its own native token, acting as an incentive to use the network.

As an investor, I see Layer 2 investments as infrastructure investments that provide a space for developers to build new and useful things. We don’t yet know what the convenience will be, but we do know that we need more entrances and spaces for development. We want to invest in things that bring new infrastructure.

Main layer 2

Let’s take a look at a typical Layer 2.

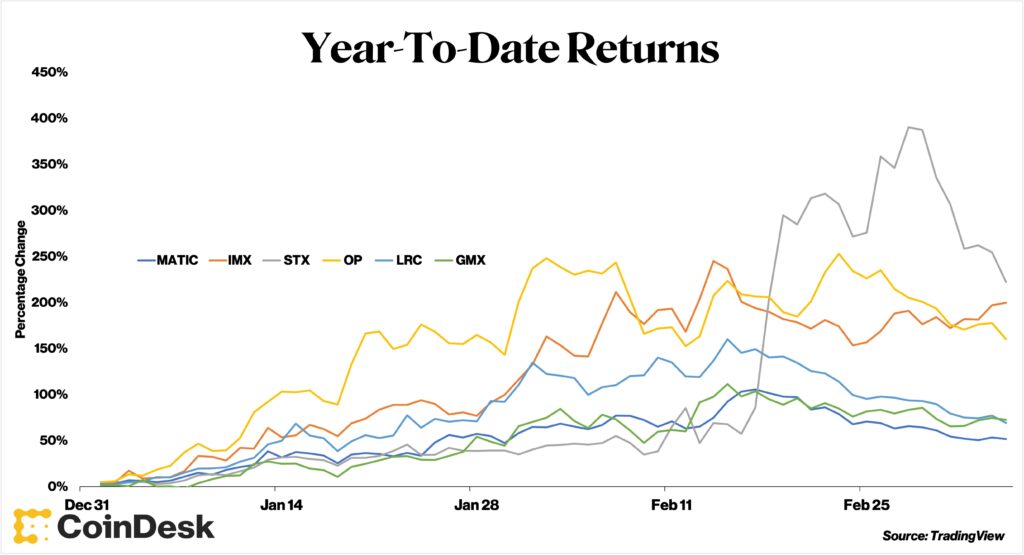

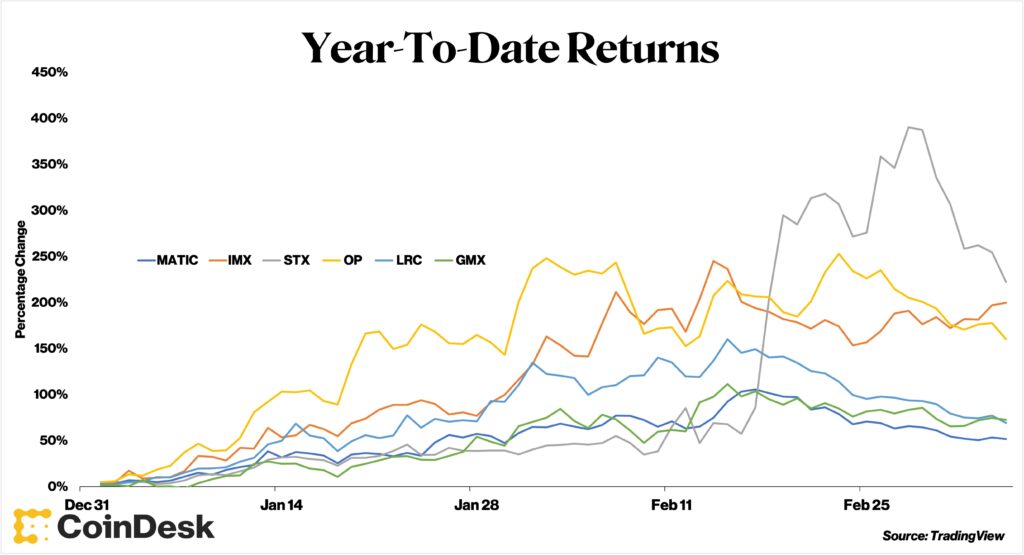

Layer 2 year-to-date returns

Layer 2 year-to-date returnsSource: TradingView

Polygon

Polygons are probably the first Layer 2 that comes to mind for many people. Acting as a scaling system, Polygon allows developers to develop decentralized applications on Ethereum.

Ethereum can process 30 transactions per second, while Polygon is much faster at around 65,000 transactions. JP Morgan made headlines last year with its DeFi deal using Polygon.

Native token MATIC currently has a market cap of $9.8 billion, up 48% year-to-date.

Immutable X

Immutable X functions as a scaling system for NFTs, aiming to solve the problem of high gas prices (transaction fees) and slow processing speeds.

Native token IMX is far behind MATIC in market capitalization at $880 million. The reason why the difference is so wide is due to the size of the market share of MATIC. The IMX is up 173% year-to-date.

Stacks

Stax has made quite a splash in the last few months. While Polygon and Immutable X are scaling solutions for the Ethereum blockchain, Stax is for the Bitcoin blockchain and enables NFT issuance called Ordinals.

Stax has captured the attention of the cryptocurrency community by extending Bitcoin beyond just peer-to-peer trading. Native token STX has surpassed $1 billion in market cap, up 254% year-to-date, leading other crypto assets.

Layer 2 is still numerous. Optimism, Loopring, etc. are designed and built to increase their utility in the crypto ecosystem.

The successes and failures of Layer 2 should be measured over time. But the implications, opportunities, and access that Layer 2 brings are something everyone should consider.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Crypto Long & Short: Why Layer 2 Protocols Matter

The post Layer 2, why is it important? | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

116

2 years ago

116

English (US) ·

English (US) ·