Tokenomics design is an important issue during development for Web3 games.

This is because Web3 games include elements in which the prices of FT and NFT fluctuate depending on the external economy and internal supply-demand balance, so it is necessary to design tokenomics so that prices do not fluctuate wildly.

The history of Web3 games is still short, and its history is also a series of successes and failures, and there is no model of “this is the correct answer of tokenomics!”.

However, while many Web3 games are undergoing trial and error, we are gradually seeing certain indicators that we should aim for in Tokenomics.

In this article, I will explain the importance of tokenomics and its basic design ideas.

* Basic terminology in the article

Web3 games

A general term for games that can be played and earned using blockchain technology. On the other hand, TV games and smartphone games in general are called Web2 games.

(There are also terms such as blockchain games, GameFi, and NFT games as synonyms, but in this article, we will use Web3 games as a unified term.)

utility token

Tokens that have various uses in the game, such as NFT Mint, trading, and level-up costs.

Plays the role of “in-game coins” in Web2 games.

governance token

A token with voting rights functionality for the Web3 project. It acts like a “stock” in the real economy.

In addition to the voting functionality of the Web3 project, there are also those with various functions such as utility tokens.

table of contents

- Why is tokenomics important?

1.1 Differences between Web2 and Web3 games

1.2 Poorly designed tokenomics can kill Web3 games - Three points that should be realized at least in tokenomics design

- The Genealogy of Tokenomics Seen in the History of Web3 Games

3.1 Phase I Dawn of Web3 games (2017-2020)

3.2 Phase II Web3 game prosperity period (2020-2022)

3.3 Phase III Post-Axie Era / Emergence of X To Earn (first half of 2022)

3.4 Phase Ⅳ Future ~Exploring Sustainable Tokenomics~ (Second half of 2022~)

3.5 Specific Measures to Grow Tokenomics

Why is tokenomics important?

Differences between Web2 and Web3 games

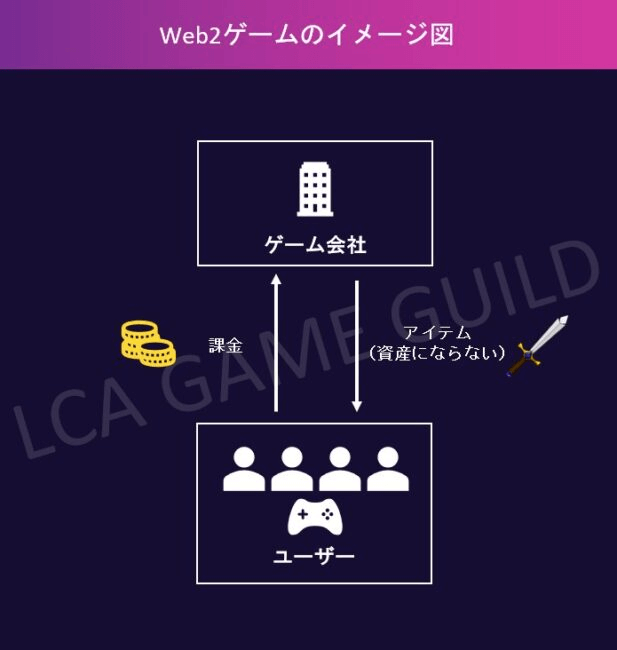

You can see why tokenomics is important by comparing Web2 and Web3 games.

Web2 games

- The game world and the real world are completely separated.

- The in-game economy has (almost) no effect on the real economy.

Web3 games

- The concept of “assets” exists in the game.

- Tokens and NFTs connect the in-game economy to the real economy.

In previous games, coins and items were all in-game.

Therefore, the flow of money is only one way, “users charge to purchase items”.

In order to generate sales, game companies only had to think about “how to charge for game items” (in the case of video games, “how to get them to purchase game consoles and software”).

On the other hand, in Web3 games, items and characters have “asset properties” as NFTs.

As long as it is an asset, it can be bought and sold, and the price is determined by supply and demand, just like in the real economy.

(Tokens and NFTs are just images)

In addition, tokens also fluctuate in price depending on supply and demand.

Therefore, the game development company that is the issuer needs to adjust the supply and demand balance and control the price movement.

How to do this control is a new problem for Web3 games.

This control method (supply amount, supply timing, etc.) can be done either by creating a mechanism and leaving the rest to market movements, or by having the development company centrally control everything.

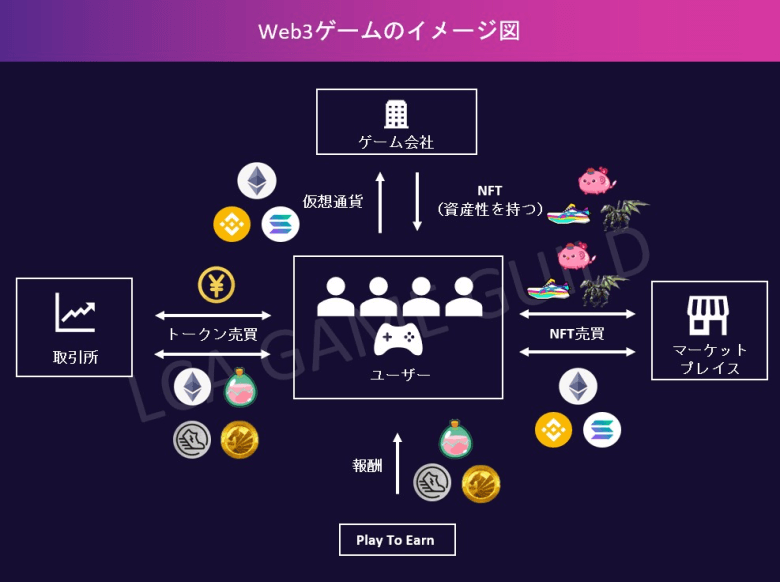

However, the world of Web3 is based on autonomous decentralization and dislikes centralization.

Image of Web2 world (left, centralized type) and image of Web3 world (right, decentralized type)

Therefore, it is necessary to respond in a way that minimizes the intervention of the development company.

The concept that emerges here isTokenomicsis.

Poorly designed tokenomics will do fatal damage to Web3 games

A poorly designed tokenomics results in a highly volatile, volatile game with no ability to adjust FT or NFT prices.

A large number of users will lose money due to the drop in the token price, and the distrust of the game will increase, and many users will leave the game.

Once the economic zone collapses and users leave, it is extremely difficult to revive from there.

Let’s take a look at the case of “Pegaxy” as a Web3 game that actually collapsed due to poor tokenomics.

Source: https://pegaxy.io/

Source: https://pegaxy.io/ Pegaxy is a competitive racing Web3 game in which you run a horse NFT called Pega.

It was a big topic from January to February 2022, as a big profit can be obtained just by “just running” the horse.

However, the tokenomics were not built to sustain high profitability, and as early as mid-February, the price of the utility token $VIS fell (see chart below).

VIS price change (Source: CoinMarketCap)

VIS price change (Source: CoinMarketCap)(The reason for the collapse of Pegaxy is similar to the collapse factor of Axie Infinity, which will be described later. You can jump to the case of Axie Infinity from here.)

When developing a Web3 game, the focus tends to be on “how to make a fun game”, such as graphics and gameplay, just like a Web2 game.

Of course, these factors are also important.

- Let more people enjoy the game

- Achieve the vision and mission of the development company through the game

For this reason, Tokenomics must be designed firmly as its foundation.

Summary of the importance of tokenomics

- Tokenomics is essential for FT/NFT price control in Web3 games

- With solid tokenomics, it will be a game that many people can play for a long time

- Conversely, games with poor tokenomics tend to be short-lived.

Three points that should be realized at least in tokenomics design

So, how should we design tokenomics when there is no correct answer?

The specific solution varies depending on the concept of the game, but through a lot of trial and error, we were able to see the direction we should aim for.

In conclusion, the following three points are indicators that can be said to be universal points of view that apply to any Web3 game at present.

Three points that should be realized at a minimum in tokenomics design

- Utility token price stabilization

- Governance token price increase

- Controlling the supply and demand balance as the number of DAUs increases

We will unravel the reason for these three indicators from the history of Web3 games so far.

The Genealogy of Tokenomics Seen in the History of Web3 Games

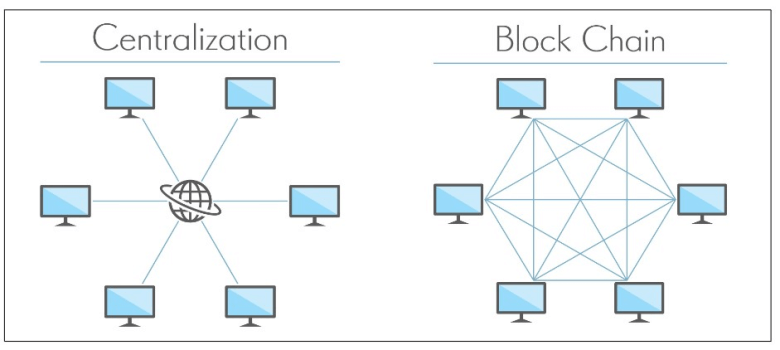

(The chart in the background is the price transition of Bitcoin (quoted from CoinMarketCap)

(The chart in the background is the price transition of Bitcoin (quoted from CoinMarketCap)In this chapter, we will look at the history and evolution of Web3 games.

If you unravel this history, you will understand how the concept of tokenomics was recognized.

Phase I Dawn of Web3 games (2017-2020)

Source: https://www.cryptokitties.co/

Source: https://www.cryptokitties.co/The first Web3 game is CryptoKitties, released in November 2017.

It was a simple breeding-type game in which cat NFTs were bred and traded, but it attracted attention as NFTs were traded at a high price of 20 million yen.

Around this time, the concept of NFTs emerged, and attention was focused on the fact that digital data can be used as assets, and CryptoKitties was one of them.

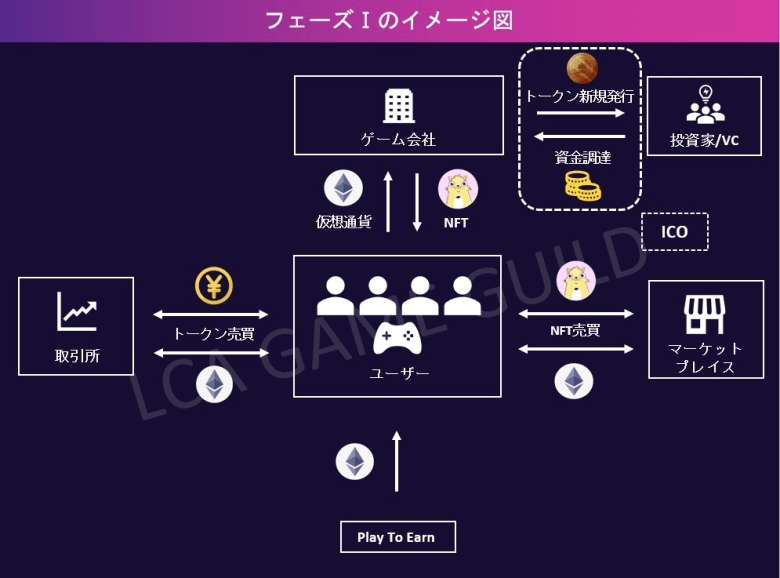

In addition, the concept of ICO appeared and attracted attention as a new method of raising funds.

This is a similar idea to an initial public offering (IPO) of stock, which is a means of raising funds by newly issuing tokens to investors.

The first wave of Web3 games such as Sorare, JobTribes, My Crypt Heroes, etc.

The focus during this period was on “how high NFTs can be bought and sold”.

On the other hand, tokens at that time were more of a means to raise funds for new issuance, and did not have the same functions as utility tokens today.

The concept of “getting tokens in games and earning money” was still weak, and there was no concept of tokenomics.

At the Phase I stage, there were many games that did not issue their own tokens, and it was a simple game economic zone.

Phase II Web3 game prosperity period (2020-2022)

Source: https://axieinfinity.com/

Source: https://axieinfinity.com/In 2020, in the realm of Web3governance tokenbegins to permeate.

Governance tokens have a role like stocks in a corporation, and have roles such as voting rights for projects and means of raising funds.

Also at the same timeDEX (Distributed Exchange)also appeared, bringing about a major revolution in Web3 games.

DEX is a virtual currency exchange without a central administrator. (On the other hand, a cryptocurrency exchange with a central administrator is called CEX. Coincheck, Binance, etc. are CEX.)

Until now, listing tokens on CEX required strict screening, making it a difficult method of raising funds.

In that respect, listing on a DEX without a central administrator is relatively easy, so it quickly spread as a funding method for Web3 projects such as game companies.

In addition, DEX has made it easier to exchange tokens for tokens (swap), so the liquidity of tokens has increased dramatically.

This gives Web3 games a strong financial character.

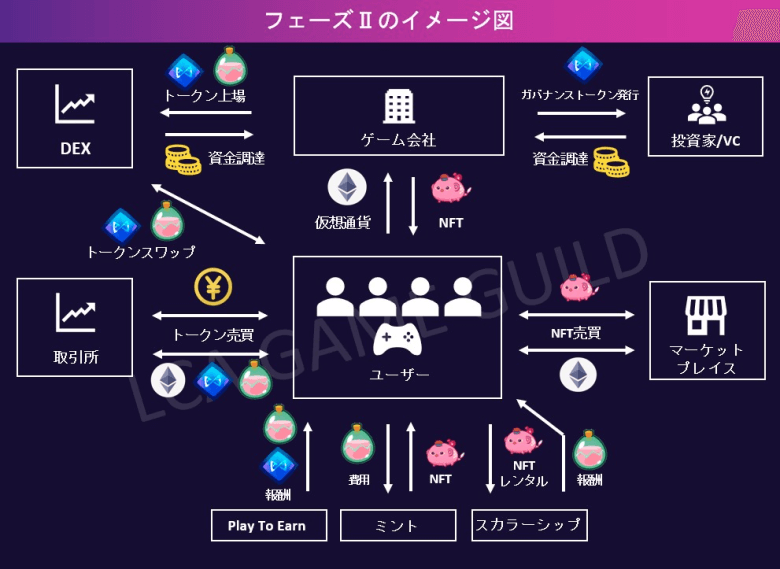

- How to design the three basic elements of Web3 games, “NFT”, “utility token” and “governance token” in the game

How to control a Web3 game with a strong financial characterFrom the point of view ofTokenomics

The concept has emerged.

*There is also a single token system that integrates the functions of utility tokens and governance tokens.

Scholarship inventions and their drawbacks

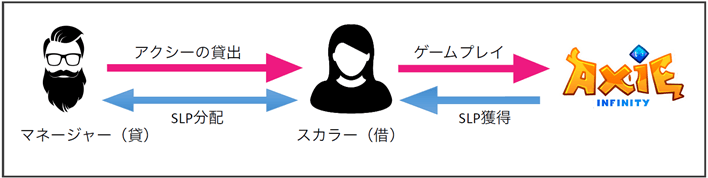

From the user’s point of view, the concept of “Play To Earn” has been recognized by many people since Axie Infinity introduced a scholarship and exploded in popularity in 2021.

Scholarship is a system in which the NFT owner (owner/manager) lends the NFT to non-owners to make it a scalar, and the tokens earned by the scalar are distributed between the owner and the scalar.

Scholarship is a system in which the NFT owner (owner/manager) lends the NFT to non-owners to make it a scalar, and the tokens earned by the scalar are distributed between the owner and the scalar.Axie Infinity Scholarship Model (Quote: CT Analysis NFT “Axie Infinity Overview and Trend Survey Report”)

The owner/manager has the advantage of getting paid without having to play.

Also, for scalars, there is the advantage of being able to Play To Earn for free.

The scholarship seemed like a win-win for both parties, but Axie Infinity collapsed once.

Basically, the scalar was a user in the economically troubled Southeast Asian region, so he immediately sold the tokens he earned without using them to purchase NFTs or reinvest in the game.in short,Scalars have inevitably been a catalyst for token inflation, with strong selling pressure

It is.

If you can spend more tokens than the scalar sells, there is no problem, but Axie Infinity was designed with few token consumption points other than breed

.

In Phase II, the concepts of DEX and Governance Token will appear. On the other hand, you can see that mint is the only way to consume tokens.As a result, the balance between supply and demand will collapse, and the economic zone of Axie Infinity will decline at once.Although the concept of tokenomics has emerged,

Insufficient concept of token inflation and deflation

It can be said that it was

In addition to Pegaxy, which was explained in the previous chapter, notable titles such as CyBall, CRABADA, and Thetan Arena, which were developed by imitating the success of Axie Infinity, will follow a similar ending.

* Bleed: Consuming NFTs to create new NFTs. Also called mint.

Phase III Post-Axie Era / Emergence of X To Earn (first half of 2022)

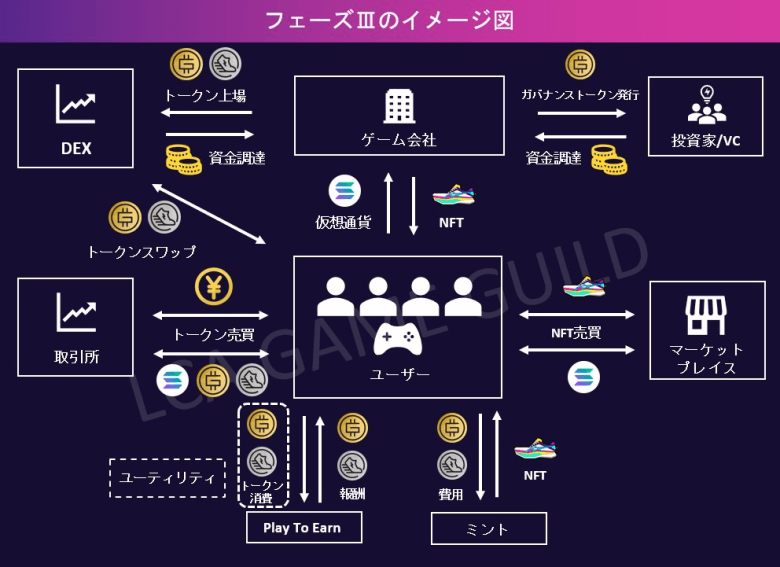

The reason for Axie Infinity’s failure was the lack of token consumption design, and since then many Web3 games have been created with this in mind.

The representative example was “STEPN”.

It features a friendly UI/UX and a revolutionary concept of Move To Earn, but the tokenomics was also very well thought out.

It is that the utility token $GST has a large number of consumption points and is skillfully designed, and a mechanism has been built to prevent token inflation.

The consumption point of this token is what is called “utility”. (In STEPN they were called use cases.)

STEPN was very good at this utility design, and it was designed to make users want to consume tokens.

It is a tokenomics that is more conscious of token consumption (= utility) than Phase II.

It was during this period that many X To Earn appeared.STEPN, which was thought to be the perfection of tokenomics, has collapsed as an economic zone and is currently in a slump.The cause of the collapse isLack of NFT Burn designand the introduction of the BNB chain

Failure to balance supply and demand

is.

Immediately after the introduction of the BNB chain, a bubble of NFT shoes and utility token $bGST occurred.

Even though NFT and $bGST (utility tokens in the Binance economic zone) were clearly priced far from the actual demand, they did not come up with a concrete countermeasure, causing user FUD and causing a bubble. I collapsed.

For more information on the STEPN economic zone, see “[Permanent Preservation Version]Everything about the STEPN economic zone | Behind the scenes of growth and decline”.

Phase Ⅳ Future ~Exploring Sustainable Tokenomics~ (Second half of 2022~)

The history of Web3 games so far can be summarized as follows.

[Phase I]

NFT-centric product, no concept of tokenomics

[Phase II]

Emergence of Governance Tokens and DEXs, Birth of the Concept of Tokenomics

[Phase III]

Evolution of Tokenomics – Concept of Inflation and Deflation –

With the crash of Terra (LUNA) in May 2022 and the collapse of STEPN, the crypto industry is once again entering winter.

On the other hand, Web3 game development has not stopped, and it can be said that each company is steadily advancing the development of Web3 games in preparation for the next big wave.

However, as symbolized by the collapse of STEPN, we are beginning to see the limits of the tokenomics model so far.The present, which can be called Phase IV, can be rephrased as a period in which everyone is searching for tokenomics that will grow over the medium to long term.Among them, we are starting to realize that

Utility token price stabilization

is.

Utility tokens are originally intended to be used as a medium of exchange, such as buying and selling items and leveling up.

Therefore, we can conclude that if the price is not stable, the tokenomics will not be stable.

It’s the same logic that makes it difficult to use when the value of the Japanese yen fluctuates wildly in the real world.

However, in Web3 games and the X To Earn project so far, the price fluctuation range of utility tokens is too large, so the main purpose of users is to earn the difference.Utility tokens are becoming more recognized as something that should not be aimed at raising prices, but should only serve functions within the game.Instead, as a value judgment criterion for the project,

How to increase the price of governance tokens

are also becoming more important.

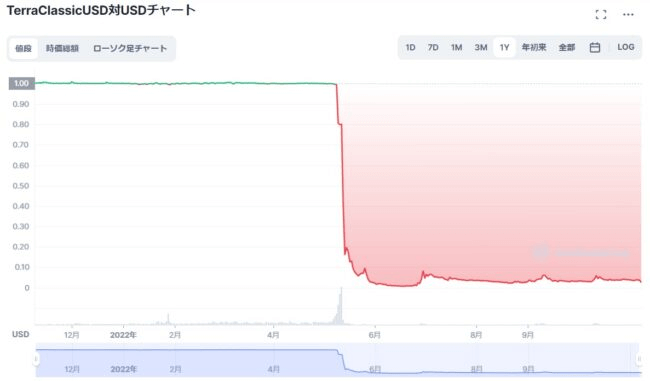

[Supplementary commentary]What is the crash of Terra (LUNA)?

Terra (token symbol LUNA) was a stablecoin project that issued a stablecoin called Terra Classic USD (USTC) linked to the US dollar.

LUNA was a cryptocurrency that stabilized its USTC price.

The UST, which should have been fully pegged to the US dollar, suddenly de-pegged in May 2022 and began to fall.

The collapse of the “safety myth” of stablecoins, which had been believed to be stable, caused a great deal of shock and anxiety to investors and users, and the entire cryptocurrency market plummeted.

Both Terra and USTC have fallen by more than 99.9%, and most cryptocurrencies such as Bitcoin and Ethereum have also fallen.

Both Terra and USTC have fallen by more than 99.9%, and most cryptocurrencies such as Bitcoin and Ethereum have also fallen.Even now, the market has not yet recovered to the level before May.

USTC price change (against the dollar) (Source: CoinMarketCap)

It has been stably at $ 1, but it has plummeted since May 2022.

Concrete Measures to Grow Tokenomics

- From the above history, we have derived what tokenomics should achieve at a minimum.

- Three points that should be realized at a minimum in tokenomics design

- Utility token price stabilization

Governance token price increase

LCA Game Guild (LGG)  LCA Game Guild is a Web3 consulting company whose mission is to increase the number of adults who take on challenges. In addition to the consulting business, we operate LGG RESEARCH, which publishes business development know-how obtained through Web3 consulting and the latest information that can be used in the field of business development, and ESG business using NFT.

LCA Game Guild is a Web3 consulting company whose mission is to increase the number of adults who take on challenges. In addition to the consulting business, we operate LGG RESEARCH, which publishes business development know-how obtained through Web3 consulting and the latest information that can be used in the field of business development, and ESG business using NFT.

The post Learning from the history of Web3 games, the importance of tokenomics and proposed solutions (Part 1) | Contributed by LGG appeared first on Our Bitcoin News.

2 years ago

166

2 years ago

166

English (US) ·

English (US) ·