How to stabilize the token price?

Click here for the first part of this article.

- 1. Price stabilization of utility tokens

4.1 (1) Provide many usage points (functions)

4.2 ② Incorporating NFT Burn design

4.3 ③ Incorporating soft peg design

4.4 ④ Increase liquidity with staking

4.5 ⑤ List utility tokens on multiple exchanges and DEXs - 2. Governance token price increase

5.1 ① Listing on major CEX

5.2 ② Token Burn (Buyback)

5.3 ③ Utility settings (set up a lot of consumption points)

5.4 ④ Set appropriate lockup and vesting

5.5 ⑤ Maintain momentum (topic and heat) - 3. Controlling the supply and demand balance as the number of DAUs increases

6.1 Relationship between new inflow and utility token price

6.2 More DAUs for Web3 games isn’t always better

6.3 Fostering consumption motivations other than “earning” - summary

1. Price stabilization of utility tokens

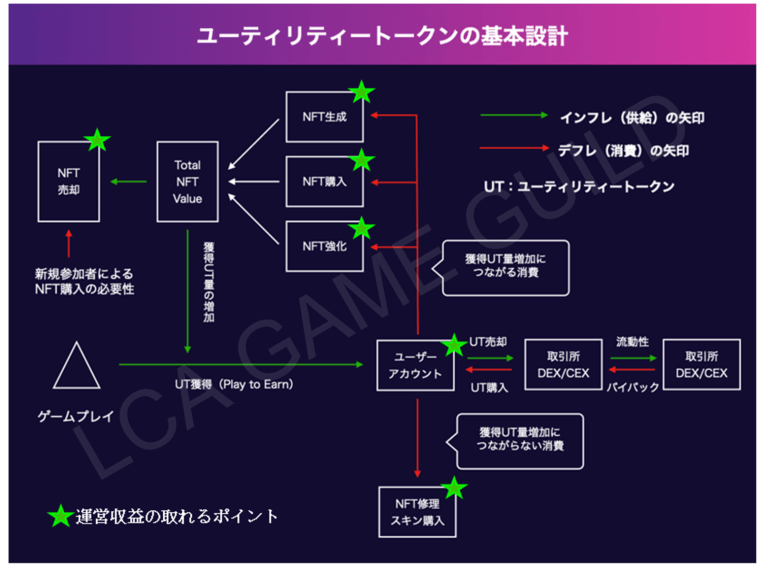

First, I would like to introduce the measures adopted by many BCGs regarding the stabilization of the price of utility tokens, which has recently become conscious.

Summary of utility token price stabilization measures

- Provide many usage points (functions)

- Incorporate NFT Burn design

- Incorporates a soft peg design

- Increase liquidity with staking

- Listing utility tokens on multiple exchanges and DEXs

① Provide many points of use (functions)

As the saying goes, “money makes the world go round,” and its fundamental role is to use utility tokens, which are in-game currency.

Conversely, if there are few usage scenes, profits will be taken immediately and the supply of tokens will increase excessively (= inflation effect / price drop), or conversely, users will accumulate in anticipation of price increases (= deflation effect/price spike).

In any case, it does not produce a good effect as tokenomics.

If we do not create an environment where “it is natural to be used” by setting up a large number of usage points, it will not be able to demonstrate its primary role as a utility token.

② Incorporate NFT Burn design

If the UT is designed to increase as you progress through the game, the supply of utility tokens will greatly exceed the demand and the price will drop.

For example, in the case of STEPN, it was designed to increase the utility tokens that can be obtained as the level of shoes (NFT) is raised.

In addition, the more existing users play, the more NFTs will be bred and the more NFTs will be supplied to the market.

If new users do not buy and support this continuously supplied NFT, it will continue to inflate and the economy will not turn around. (This is why it is said to be a so-called “Ponzi scheme”.)

Therefore, NFT burn design is necessary to encourage existing users to consume NFTs (increase demand for NFTs) without relying on new users’ buying support.

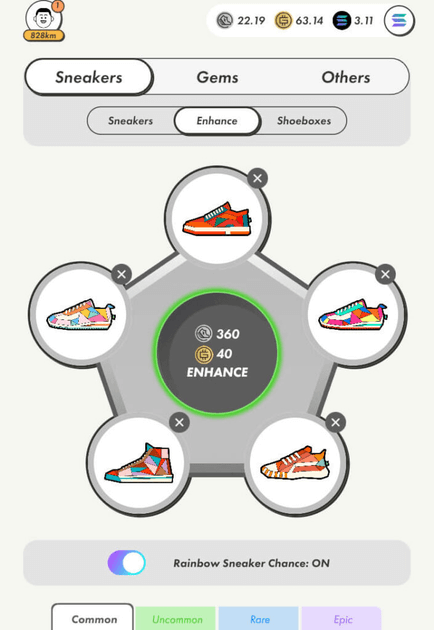

In STEPN, the NFT Burn design (synthesis) was incorporated after the collapse of the economy

③ Incorporate soft peg design

A soft peg is a mechanism that automatically adjusts the token price according to market conditions.

The specific design varies depending on the project.

For example, in SPLINTERLAND, we have introduced a mechanism to adjust the amount of tokens discharged as a reward according to the price of tokens ($DEC).

[Splinterlands soft peg system]

The daily reward pool of $DEC that can be earned in regular battles is up to 1,000,000 DEC per day when 1DEC = $0.001.

If the price of $DEC falls to $0.0005, the next day only 500,000 DEC will be automatically added to the reward pool.

Squeezing the supply of $DEC relieves selling pressure and causes deflation.

Conversely, if the price of $DEC rises to $0.005/DEC, 5 million DEC will be added to the reward pool the next day.

In this case, increasing the supply of $DEC will cause inflation and try to drive the price down.

For details on the Splinterlands soft peg system, please refer to “Mechanism” and “Challenges” for making the “SPLINTERLANDS” soft peg work.

④ Increase liquidity by staking

Staking is a system in which tokens are locked (unsold) for a certain period of time, and rewards are paid as interest when the deadline comes.

From the point of view of token holders, there is an advantage that they can receive rewards just by depositing tokens, so there is an incentive to hold tokens without selling them.

On the other hand, the more tokens that are locked, the greater the amount that goes into the pool and the higher the liquidity of tokens in the exchange.

High liquidity allows users to exchange tokens immediately when they want to trade, which reduces price volatility and stabilizes prices.

However, spitting out rewards means that tokens will circulate in the market for that amount, so it can be said that it encourages future inflation, so it is necessary to be careful when introducing it.

⑤ List utility tokens on multiple exchanges and DEXs

Listing tokens on multiple exchanges and DEXs gives users more opportunities to touch them.

As a result, the trading volume increases and the liquidity increases, contributing to the stabilization of the token price.

In particular, it can be said that CEX and DEX, which have a large trading volume, are more effective in listing.

2. Governance token price increase

Unlike utility tokens, which require stability, the market capitalization of governance tokens, which have a role similar to stocks, is regarded as the value of the project, so the higher the price, the better.

Here are some ways to increase your prices. (However, even if these measures are taken, it may not respond at all depending on the market conditions.)

Summary of measures to raise the price of governance tokens

- Listing on major CEX

- Token Burn (Buyback)

- Utility settings

- Set proper lockup and vesting

- Maintain momentum (popularity and heat)

(1) Listing on major CEX

Listing on CEX, which has strict listing screening, is directly linked to the reliability of the token.

Conversely, listing on DEX, which can be easily listed, may lead to an increase in trading volume, but it is weak in authoritative authority and is unlikely to be a factor in raising prices.

If you can list on global Binance, OKEx, KuKoin, Huobi Global, etc., it will be a hot topic and will greatly increase trust, so it is especially effective.

$GMT price change after Binance listing (from CoinMarketCap)

$GMT price change after Binance listing (from CoinMarketCap)② Token Burn (Buyback)

Governance tokens are mostly issued in a limited number, so reducing the market circulation (buying back) will relatively increase the price.

The amount and timing of Burn by buyback can be centrally determined by the operation, or it can be designed to burn periodically and automatically like Bitcoin.

For example, in the case of Axie Infinity, the $AXS used as a cost when minting an Axie (NFT) is designed to be automatically burned, so the more Axie a user mints, the more AXS in the market ( If the supply does not increase, it will decrease.

On the other hand, in the case of STEPN, the $GMT used as the cost of minting shoes (NFT) becomes the revenue of the operation, and when and how much to burn $GMT is left to the discretion of the operation.

Regardless of which policy is adopted, it is easier to prevent the token price from plummeting if you assume that the operation will burn the token as necessary.

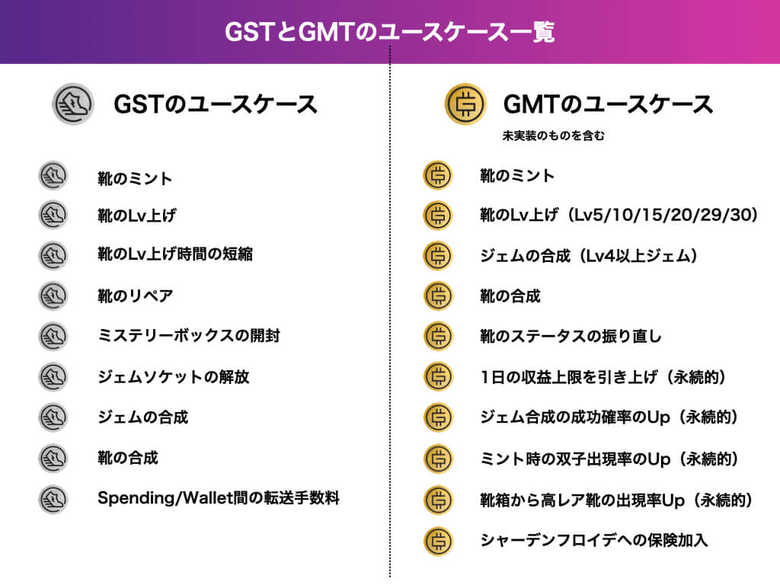

③ Utility settings (set up a lot of consumption points)

Also, even if the operation does not buy back, if the consumption points increase in the ecosystem, it will lead to token burn.

Therefore, it is an effective method to add functions similar to utility tokens to governance tokens.

STEPN had as much utility in its governance token, GMT, as it did in its utility token, GST.

It is a direct method to reduce the amount of supply to the market and increase the value by having users actively consume tokens.

④ Set appropriate lockup and vesting

Lock-up (cliff vesting) will be applied to stakeholders who have many tokens under special conditions, such as investors who invested in Seed Sale or Private Sale and management teams.

Tokens can be cashed out more quickly than stocks, so if you don’t lock them up, there will be a sudden big selling pressure and the token price will plummet.

The longer the lockup is, the more the selling pressure of tokens can be dispersed, so it is positive for the economic zone and tends to be prolonged.

Around 2020, there were many projects for half a year to several years, but now there are projects that lock up for eight years or more, such as Star Atlas.

*For details on token allocation, please see “[Original Survey of Top 100 GameFi Stocks]Why Token Allocation Decides Project Success”.

⑤Maintain momentum (popularity and heat)

Perhaps the most influential and most difficult is maintaining momentum.

The value of a governance token essentially reflects the value of the product, but as long as it has an investment aspect, the anticipation of “I’ll buy it because it looks amazing” has a huge impact on buying pressure. is.

Continuing to give users (both existing and new) this sense of “expectation” is essential for the continued rise in the value of governance tokens.

However, since the Web3 project connects with the external economy, it cannot go against major trends such as the virtual currency market and the global stock market.

Negative news such as the recent bankruptcy of FTX will have a negative impact on the Web3 industry as a whole.

Nonetheless, if the project continues to be trusted and supported by users, and if the community’s enthusiasm continues, it will be possible to gradually recover the lowered price.

Therefore, community building utilizing Discord, etc., and marketing strategies that understand the Web3 market are absolutely essential in order to create a solid economic foundation.

*For community management using Discord, please refer to “Design document of Discord community that no one tells you”.

3. Controlling the supply and demand balance as the number of DAUs increases

Relationship between new inflow and utility token price

The relationship between the number of new inflows and the utility token price is in the balance between the following two opposing axes.

- How much do you want new users to earn per day?

- What is the price range for new users to buy new shoes?

If the utility token is too high, number 1 will be positive for users, but number 2 will be negative for the economy, so we need to adjust.

Therefore, in order to control the economic zone, it is necessary to (1) control the number of new inflows, (2) adjust the supply and demand balance of NFTs in the market, and (3) manage to keep the token price at an appropriate value.

More DAUs for Web3 games aren’t always better

A high number of DAUs generally has the following benefits:

- Vigorous transactions take place, revitalizing the economic zone

- Active trading leads to increased management fee income

- Increased liquidity, increased token consumption, and stabilized economic zone

For this reason, a large number of users is desirable for medium- to long-term growth of the game, and management will aim to attract new users.

However, on the other hand, when the project is in the growth stage, there is also a disadvantage of having too many.

- Increase in number of DAUs = Increase in token profit margin = Decrease in token price

- Excess demand for purchase of NFT = Soaring NFT price = Barrier to new entry

Therefore, many games limit the number of people who can participate in the test or use an invitation system to control the number of new inflows.

Fostering consumption motives other than “earning”

At many BCGs today, most of the utility of tokens consists of economic incentives to increase the amount of tokens acquired through “Play to Earn”.

The motivation of “I want to earn more” is a strong motivation to consume tokens.

However, the greater the number of DAUs, the greater the amount of tokens that will be minted each day, and the greater the amount of profit that will be secured.

In other words, if the token’s utility is composed only of those tied to economic incentives, it will not be able to withstand huge selling pressure in the future.

In order to maintain a sustainable economic zone, a “consumption design that does not lead to economic incentives” is necessary.

★ Consumption design that does not lead to economic incentives

☆ Elements that satisfy the desire for self-disclosure and approval (collectibles, skins)

☆ Elements that can advance the competition in the game (enhancement items, time reduction)

☆Consumption that contributes to society, such as donations and carbon credits

The key to maintaining the supply and demand balance of tokens is how many consumption points “unrelated to user revenue” can be set up and how much demand can be generated to actively consume them.

summary

The above has explained the minimum requirements for tokenomics design.

Three points that should be minimized in tokenomics design

- Utility token price stabilization

- Governance token price increase

- Controlling the supply and demand balance as the number of DAUs increases

Again, keep in mind that tokenomics is still young and this is not the best solution.

These points are nothing more than ideas for creating a sustainable economic zone, born from trial and error in existing games.

Various products are being developed day and night around the world, and Tokenomics still has room to evolve.

LGG Research will continue to introduce cutting-edge tokenomics cases.

We hope that this article will help you understand the basics of tokenomics and design it.

On this site, you can experience how Tokenomics transforms by setting the actual reward amount and token consumption amount.simulation sheetare available.

If you want to understand how the number of new inflows and the amount of UT earned every day affects tokenomics, please try the free version of Tokenomics Simulator.

Please use it as a practical learning tool when developing a new Web3 game.

Click here for details of the simulation sheet.

Click here for the first part of this article.

The post Learning from the history of Web3 games, the importance of tokenomics and solutions (Part 2) | Contributed by LGG appeared first on Our Bitcoin News.

2 years ago

163

2 years ago

163

English (US) ·

English (US) ·