Preparing for the Shanghai upgrade

On the 25th, a proposal was submitted on the liquid staking platform Lido Finance (LDO) on how to withdraw crypto assets (virtual currency) Ethereum (ETH).

Ethereum plans to implement its first upgrade after the merge, “Shanghai,” in March-April 2023. At the time of writing, 16.2 million ETH (equivalent to approximately 3.18 trillion yen) locked up in the staking contract and staking rewards will be available for withdrawal for the first time.

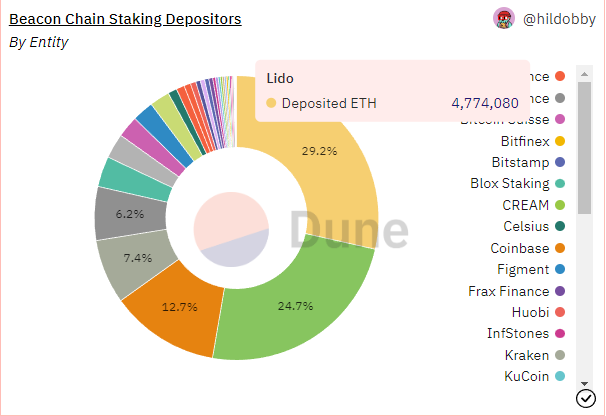

Lido has gained support for a service called liquid staking, which allows you to manage the alternative asset (stETH) while receiving Ethereum staking rewards, and has the top share of the Ethereum staking service market (29%: 4.77 million ETH). ing.

Source: DUNE

Relation:Ethereum “Shanghai” public testnet to be held in February

Lido ETH Withdrawal Methods

The proposed ETH withdrawal process for Lido is complicated in line with Ethereum’s own network mechanism. After receiving community feedback, it will be put to a LidoDAO (Decentralized Autonomous Organization) vote.

In order to prevent a large number of validators from withdrawing at the same time and destabilizing the Ethereum network, Ethereum has set an upper limit on the number of validators that can withdraw in a certain period of time. This also limits the total amount of ETH that can be de-staked.

In addition, 256 epochs (~27 hours) will be provided as a withdrawal waiting period for validators. Validators who have received a node operational penalty (slash) are designed to have a longer waiting period up to 8192 epochs (~36 days).

Even in Lido, it is not expected that all ETH withdrawal requests will be passed at once. There are two types of withdrawal spans, a “turbo” mode that allows you to withdraw at the fastest speed, and a “bunker” mode that is activated in an emergency when a large amount of slash occurs.

In Ethereum, when the slash is activated, the amount of validators held will be reduced for every 32 ETH. Lido therefore needs extra time to even out this loss across stakers. According to the data site Rated, there are 148,902 ETH validators on Lido at the time of writing, but they have never experienced a slash in the past.

With staked ETH available for withdrawal after Shanghai, there is growing market interest in the impact on ETH price. According to a trial calculation based on the aforementioned epoch, the amount of ETH that can be withdrawn from a staking contract per day is from 10 billion yen (32 x 1,575 = 50,400 ETH + commission income) at the time of writing.

Lido’s proposal envisions at least approximately 200,000 ETH to be withdrawn within a week after the hard fork.

Relation:What impact will the Shanghai upgrade scheduled for March have on the Ethereum market?

The post Lido ETH withdrawal method to be voted for Shanghai appeared first on Our Bitcoin News.

2 years ago

117

2 years ago

117

English (US) ·

English (US) ·