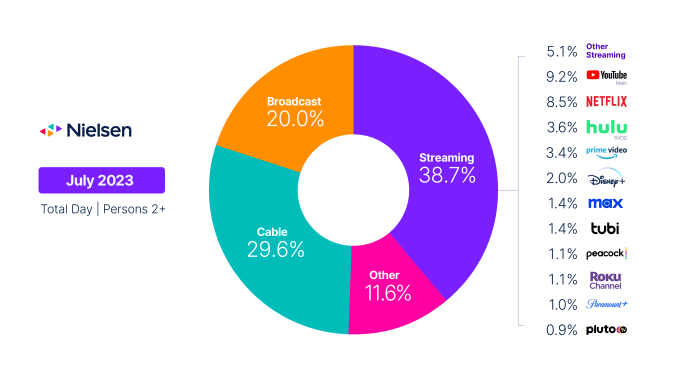

In a first for linear TV viewing, cable and broadcast usage fell below 50% in terms of total share among U.S. viewers, according to Nielsen’s July 2023 report. Cable viewing dropped below 30% for the first time at 29.6%, down 12.5% year-over-year. Broadcast usage decreased to 20%, down 5.4% YoY.

Streaming services, on the other hand, accounted for 38.7% of total U.S. TV usage– a new record-high for the category. Streaming usage has sky-rocketed 25.3% in the past year.

Moreover, there are three streaming platforms in particular that accomplished notable shares of TV usage in July. YouTube and Netflix were top contributors to the rise in streaming viewership, with shares climbing to 9.2% and 8.5%, respectively. Also, Prime Video recorded a personal best in terms of share; viewing was 3.4%, up 5% compared to June.

Streaming has occupied the TV usage throne for years now. For instance, streaming viewership exceeded cable usage for the first time last year, according to Nielsen, representing a 34.8% share of total TV viewing in the U.S. However, this doesn’t make the new milestone for broadcast and cable any less bleak. To further put things into perspective, linear TV’s share of viewing represented 63.6% of total TV usage in June 2021, per Nielsen. Now, it only represents 49.6%.

Previously, cord-cutters pointed to streaming services’ low prices as the reason for dropping their cable TV packages. However, this may no longer be the case.

The Financial Times recently published data that showed the top U.S. platforms will cost $87 per month in total this fall. The average cable subscription is cheaper at $83 per month, according to the FT.

In order to limit billion-dollar streaming losses, many companies have implemented subscription price hikes.

Last week, Disney announced yet another round of price increases for Disney+, Hulu and ESPN+. Additionally, Netflix removed its basic ad-free plan in the U.S., the U.K. and Canada in an effort to drive customers to its $15.49/month standard tier.

Disney’s price hike comes as Disney+ continues to drop in subscribers for the third consecutive quarter. The company also said that it would follow in Netflix’s footsteps regarding password-sharing rules.

Subsequently, tons of users are turning to free ad-supported TV streaming services to get their entertainment fix. Samba TV recently reported that 1 in 3 U.S. users subscribes to FAST services such as Freevee, Pluto TV, Tubi, the Roku Channel and Crackle.

As FAST viewing continues to be a growing trend, it’s likely that major subscription video streaming services will have a difficult time convincing customers that they’re worth the hefty price tag.

English (US) ·

English (US) ·