litecoin halving

With the half-life of the cryptocurrency Litecoin (LTC) approaching in about 60 days, growing interest is reflected in the number of Google searches and on-chain data. Litecoin’s next halving is scheduled for August 7, 2023, according to calculations by BitDegree.

Halving is an event where mining rewards are halved. To prevent inflation, Litecoin is set to halve the amount of LTC granted as a reward to miners every four years (every 840,000 blocks).

The August 2023 halving will reduce the mining reward for Litecoin miners from the current 12.5 LTC per block to 6.25 LTC per block.

What is a miner

A miner is a business that repeats massive calculations on a computer, verifies and approves virtual currency transactions, and generates new blocks containing them. In return for this work, we will receive newly issued virtual currency and transaction fees as rewards.

Cryptocurrency Glossary

Cryptocurrency Glossary

According to the market data site CoinMarketCap, the maximum issuance limit of Litecoin is 84 million, and the circulation volume as of June 6, 2011 was 73,082,064.23 LTC. With each halving, the pace of new Litecoin issuance decreases, resulting in Litecoin scarcity increasing as it approaches the cap.

Historical LTC Half-Life

Litecoin has had two halvings so far, in 2015 and 2019.

| October 7, 2011 | 0 | 50 LTC | – |

| August 25, 2015 | 840,000 | 25 LTC | $2.95 |

| August 5, 2019 | 1,680,000 | 12.5 LTC | $94.37 |

| August 7, 2023 (assumed) | 2,520,000 | 6.25 LTC | $87.59 (as of June 6, 2011) |

When Litecoin was launched in 2011, the mining reward for Litecoin was 50 LTC, but has since fallen to 12.5 LTC per block.

LTC/USD log scale data: Kraken Source: TradingView

As the demand for Litecoin increases with the expansion of the virtual currency market, the new circulation volume has been halved. This trend may have had a positive effect on price trends over the long term.

Litecoin Halving Interest Increases

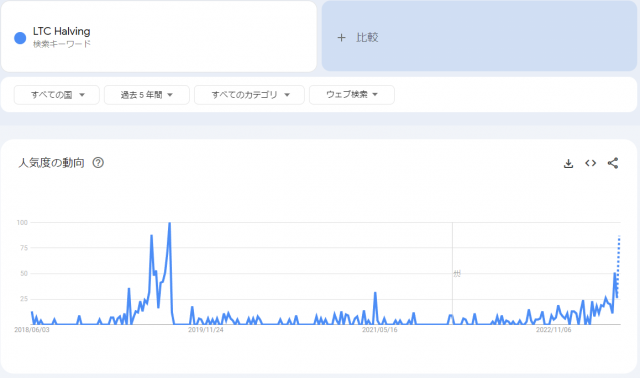

Historical data shows that debate and anticipation for the halving of Litecoin (LTC) often builds months before the planned date. Now, looking at Google trend data, we can see that searches for “Litecoin, Halving” have steadily increased over the past few weeks.

Search trends for Litecoin, Halving Source: Google Trends

Litecoin remittances are also on the rise, according to research by data analytics firm Santiment. Since April 2011, 500 to 600 transactions of $1 million (about 140 million yen) or more have been constantly recorded every day. This suggests that large investors may be entering the market.

Litecoin Whale Transactions Source: Santiment

In addition, the number of unique addresses sending Litecoin has also increased significantly. Based on these data, Santiment pointed out that users may be accumulating Litecoin before the halving.

Impact on LTC prices

Looking at historical trends, we see a pattern in which Litecoin begins to rise in price about 200 days before the halving and ends about 40-45 days before the event.

In the case of the LTC halving on August 25, 2015, the price rose 270% from $1.89 on February 6, 2015, to a maximum of just over $7 on July 9, and was about $3 on the day of the half-life. Ahead of the LTC halving on August 5, 2019, the price rose 350% from $31 on January 17, 2019, to a maximum of $140 on June 26, reaching $94 on the day of the half-life.

This time, the Litecoin (LTC) price started to rise from January 16, 2023 (with the overall crypto asset market improving), and as of June 6, a 15% price increase has been confirmed. In addition, over the past year, a price increase of about 34.21% has been recorded.

LTC/USD Data: Kraken Source: TradingView

Based on historical patterns, the cycle of rising prices leading up to the August 7th halving could reach its climax around June 25th. However, since there are only two historical half-life data, these assumptions require caution.

It will be necessary to continue to monitor Litecoin price trends while always taking into account overall market trends and the development status of Litecoin.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

The post Litecoin Halving Scheduled Around August 7th, On-Chain Data Suggests Major Investor Trends appeared first on Our Bitcoin News.

2 years ago

99

2 years ago

99

English (US) ·

English (US) ·