Litecoin (LTC), the 12th largest cryptocurrency by market cap, is trading at a discount, according to on-chain indicators.

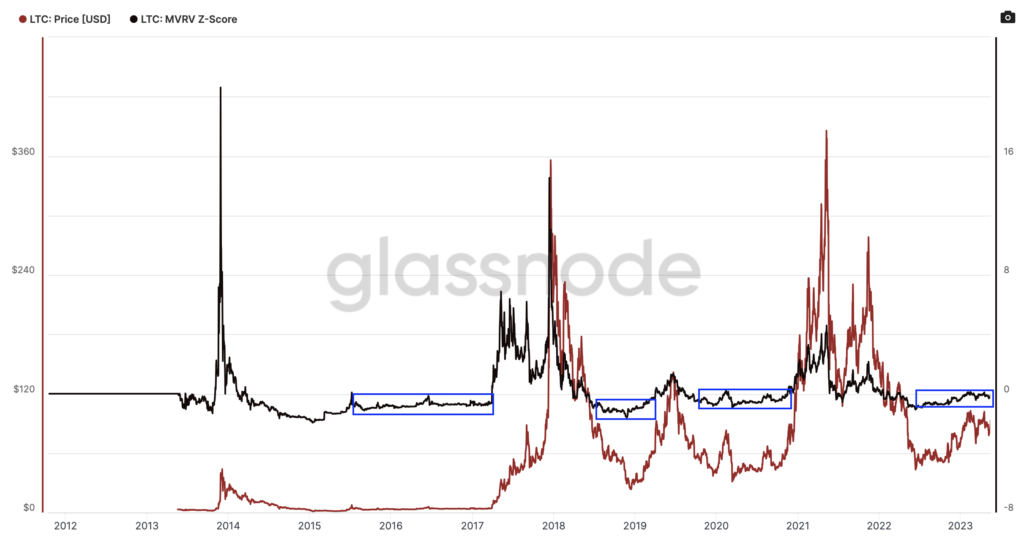

Litecoin’s MVRV (market value to realized value) Z-score was negative at the time of writing. A score below zero indicates that a crypto asset is undervalued relative to its fair value, according to analytics firm Glassnode.

Market capitalization is calculated by multiplying the total number of Litecoins in circulation by the market rate. Realized value is a variation of market capitalization, calculated as the market value of a coin the last time it moved on the blockchain. It is said to reflect fair value by excluding all coins (over 15%) lost from circulation.

The Z-score indicates how much the market value differs from the realized value in standard deviations.

Historically, a Z-score above 8 is overpriced and represents the top of a bull market, while a negative Z-score represents a cheap and bottom of the market.

The Z-score continues to be negative, indicating that Litecoin is trading cheaply compared to historical norms. (Glassnode)

The Z-score continues to be negative, indicating that Litecoin is trading cheaply compared to historical norms. (Glassnode)Looking at the chart, we can see that the Z-score has been consistently negative since July last year. This is nothing new. The metric has hovered below zero many times in the past, eventually paving the way for a surge.

If history leads, the path of least resistance seems to be on the high side. That said, Litecoin and the cryptocurrency market as a whole remain vulnerable to macroeconomic headwinds such as monetary tightening and global economic conditions.

At the time of writing, LTC is trading at $92, up about 31% so far this year. It hit a one-month high of $95 earlier this week, according to data from CoinDesk.

Litecoin will implement its third mining reward halving in early August, with the per-block reward paid to miners going from 12.5 coins to 6.25 coins.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

|Original: Litecoin Is Undervalued, Onchain Indicator Suggests

The post Litecoin is still cheap ─ on-chain indicators suggest | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

82

2 years ago

82

English (US) ·

English (US) ·