Unlock a total of 130 billion yen

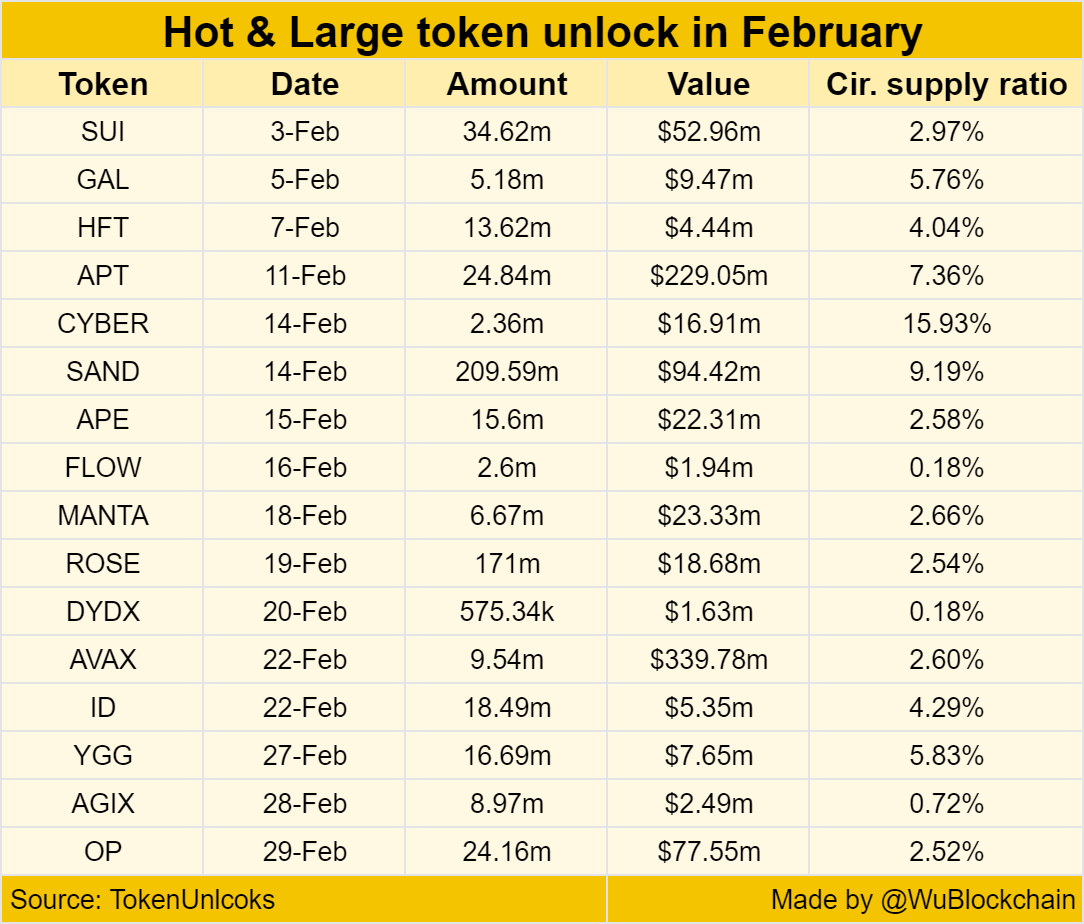

According to TokenUnlocks, when the lockup expires in February, the total amount of crypto assets (virtual currency) distributed to investors is expected to be $870 million (130 billion yen).

Of these, there are six projects that will unlock more than $10 million in value. These assets are also handled by Japanese crypto asset exchanges, and are attracting a lot of interest, especially among traders who engage in leveraged trading.

- SUI: $34.62 million

- Aptos (APT): $24.84 million

- Sandbox (SAND): $210 million

- Ape Coin (APE): $15.6 million

- Avalanche (AVAX): $9.54 million

- Optimism (OP): $24.16 million

Source: WuBlockchain

Token unlock is an event in which tokens allocated to initial investors and key members who contributed to development are distributed on the market after a set period of time. To prevent mass sales during periods of low liquidity, these systems often include “vesting” agreements, where ownership of the tokens is vested after certain conditions are met.

connection:Large token unlock Optimism and Sui Network circulation volume expected to increase rapidly

Be wary of price fluctuations

A statistical analysis published by TokenUnlocks in January 2023 points out that the token price tends to decline by up to 15% on average before the unlock event, and the price remains generally flat after the unlock event. . If you take a short position 30, 15, and 7 days before unlock, the probability of a 5% loss is 27%, the probability of a 10% loss is 20%, and the probability of a 7% loss is It is said to be 6%.

However, despite the increase in supply due to token unlocking, there are cases where prices rise. This is because unlock events have a positive impact on the market and can be interpreted as a bullish signal.

While some traders take short positions expecting the price to drop right before unlocking, there are also cases where project teams announce positive news, triggering a short squeeze.

A short squeeze is a phenomenon in which traders with large short positions buy back assets all at once, causing the price to rise sharply. Combined with these movements, token unlocking could cause an increase in volatility beyond a simple increase in supply.

connection:What is the impact on token unlock and virtual currency prices? TokenUnlocks report

The post Lock-up expired assets totaled 130 billion yen in February, including Sui, Sandbox, Aptos, etc. appeared first on Our Bitcoin News.

1 year ago

105

1 year ago

105

English (US) ·

English (US) ·