The post LTC Halving Triggers Market Turmoil: Price Plunges by 10% in One Week and Mining Profits Take a Hit! appeared first on Coinpedia Fintech News

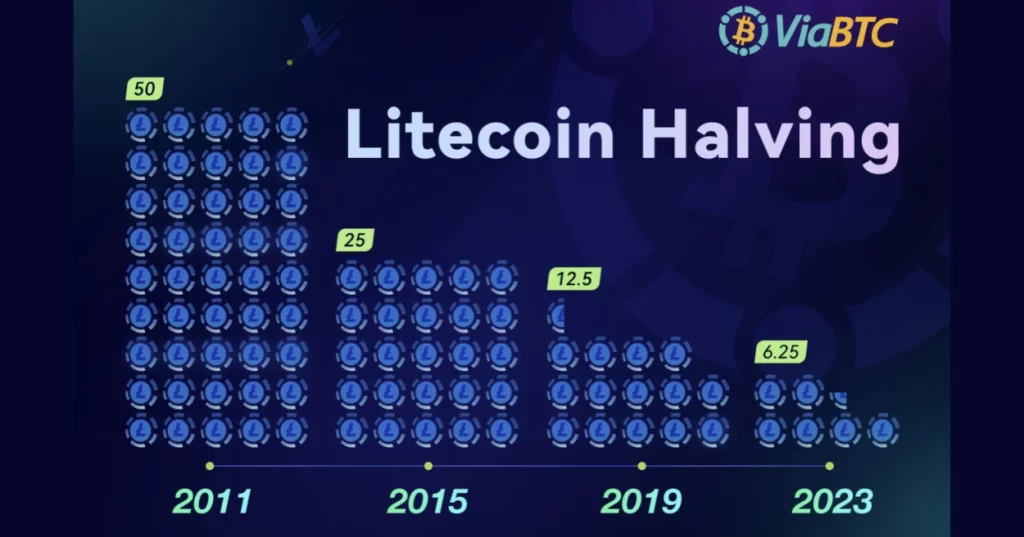

Litecoin experienced its first halving at block 840,000 on August 25, 2015, which cut the block reward from 50 LTC to 25 LTC.

Then, on August 5, 2019, the crypto underwent its second halving at block 1,680,000, further reducing the block reward to 12.5 LTC.

As Litecoin’s third halving happened as expected on August 2, 2023, the block reward dropped from 12.5 LTC to 6.25 LTC. At the same time, the daily mining output was also halved, going from 7,200 LTC to 3,600 LTC. Although the halving slowed down the influx of new LTC into the market, Litecoin’s annual inflation rate has fallen from 3.64% to 1.75%.

Source: Coingecko

Unfortunately, the halving failed to drive a price surge. According to Coingecko, the LTC price plummeted by over 10% over the past week. This downward trend, compounded by the halved block reward, has dealt a major blow to LTC miners. Data from OKlink suggests that at the price of $82.07, LTC miners earn a mere $0.00038 per hashrate unit, the lowest in nearly a month.

Source: OKlink

ViaBTC’s Mining Profit Rankings underscore a sobering reality: factoring out the DOGE revenue, not a single LTC mining machine in the present market landscape can register positive returns at the electricity price of $0.05 per kWh. Again, we must credit the merged mining mechanism proposed by Litecoin founder Charlie Lee. Through persistent lobbying, Lee showed the DOGE community the perks of merged mining with LTC and convinced DOGE to pass the proposal and adopt merged mining via a hard fork. In hindsight, merged mining was a wise decision, which yielded win-win results. For miners, without the DOGE revenue, LTC mining would generate almost no profit; for DOGE, the hashrate from LTC miners has been crucial to its survival, as it protected the coin from various attacks.

The current LTC price is not appealing for miners, even when the DOGE revenue is considered. Only a handful of mainstream ASIC miners, including ANTMINER L7, Hammer D10+, Inno A6+, and Goldshell LT5, manage to generate daily revenues of over $1, and many other models are approaching or have already reached the shutdown price.

Source: https://www.viabtc.com/tools/miner

Source: https://www.viabtc.com/tools/minerThe LTC mining revenue dived. As of August 6, the daily LTC miner revenue stood at $290,000, a 60.8% decline from the $740,000 recorded on August 1, the day before the third halving.

Source: messari.io

Source: messari.ioWhile halvings are typically perceived as a bullish signal, for LTC miners, the third halving was bad news, as the market did not welcome it. The sharp decline of the LTC price can be attributed, in part, to a series of sell-offs by investors and whales. According to on-chain statistics, before and after the halving, approximately 70,000 litecoins, with a total worth of around $5.81 million, were sold by whales holding between 1,000 and 100,000 LTC. The massive sell-offs aggravated the market downturn, yet another blow to the LTC price.

Based on the current market dynamics, LTC’s price trajectory has failed to match the rising mining costs. This predicament exposes miners to potential losses. LTC miners must make a difficult choice in today’s market: keep mining and wait for market revival or turn to alternative crypto with more profitable prospects.

2 years ago

123

2 years ago

123

English (US) ·

English (US) ·