The overall macro environment has been a low profile in the crypto world over the past nine months. Cryptocurrency prices were largely driven by numerous company and project bankruptcies (FTX, Terra’s LUNA/UST, BlockFi, Genesis) and success stories (Ethereum blockchain Merge, various Layer 2 ), it was hidden behind them.

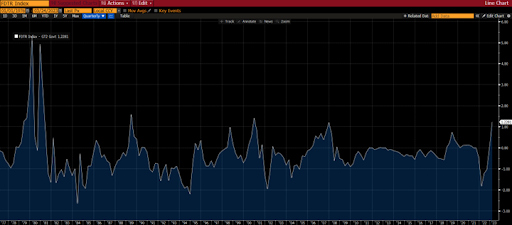

In recent weeks, however, macros have returned to the center stage. The banking crisis and its policies have taken the lead, positively impacting crypto assets while other assets have suffered. Comparing the US Regional Bank ETF (KRE) to Bitcoin (BTC) will tell you all there is to know about the winners and losers from the first week of March onwards.

Bloomberg

BloombergCrypto assets are on the rise, but macro investors are looking for recession strategies. in short,

- Short-term interest rates fall sharply while long-term rates fall slightly (bull steepening: typical recession)

- Gold is in great shape, nearing all-time highs

- crude oil is bad

- Small caps and growth stocks are weaker than large caps and value stocks, while defensive stocks lead cyclical stocks (economically sensitive stocks)

- Falling interest rates support valuation of IT stocks

Loss of confidence in the Fed and Treasury

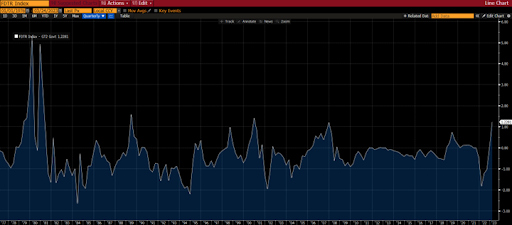

The US Federal Reserve (Fed) has lost credibility. Yields on 2-year government bonds have fallen from a March high of 5.08% to 3.75% at the time of writing. That’s a shocking move in itself, but it’s even more shocking when you consider that the Fed has decided to raise the federal funds rate by 0.25 percentage points to 5%.

This shows that the market is resisting the Fed’s threats. The federal funds rate, which was lower than the two-year Treasury yield at the beginning of March, is now 1.25% higher. The gap between the federal funds rate and the 2-year Treasury yield is now at its widest since 2007, and that widening gap has historically led to quick and aggressive rate cuts.

Difference between FF interest rate and 2-year government bond yield

Difference between FF interest rate and 2-year government bond yieldSource: Bloomberg

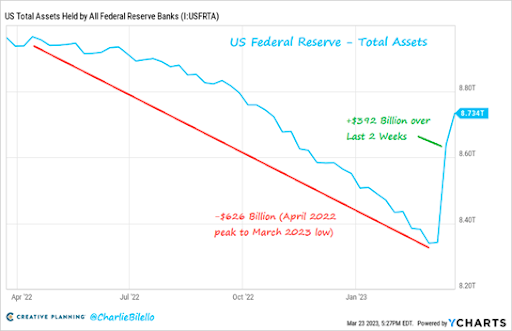

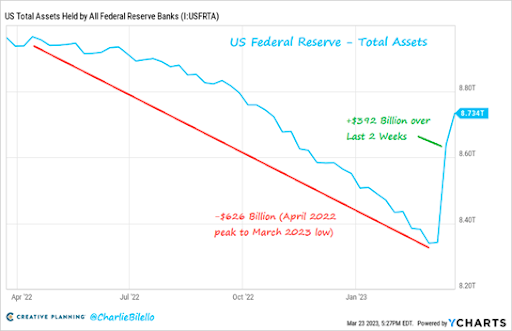

Furthermore, the “Fed put” is making a comeback. Assets on the Fed’s balance sheet have risen by $392 billion over the past two weeks, wiping out 60% of the quantitative tightening since April last year.

Fed Total Assets

Fed Total AssetsSource: Twitter @charliebilello

The US Treasury has also lost credibility. After agreeing to fully protect depositors at some failing local banks, along with the Fed and the Federal Deposit Insurance Corporation (FDIC), Treasury Secretary Yellen will either explicitly offer full support or avoid moral hazard. I’m not sure if I should avoid it.

Over the past few days, Treasury Secretary Yellen has repeatedly spoken about the level of deposit insurance increases. His earlier statements about the economic situation have also lost credibility. The Treasury Secretary said in 2017 that it was unlikely that another financial crisis would occur “in our lifetime.”

global banking crisis

Don’t forget Credit Suisse. Though its takeover by UBS was devastating to shareholders and many contingent convertible bond (CoCo) holders, Credit Suisse has been in trouble for at least 15 years. Bloomberg reports:

“Credit Suisse’s blunders included a criminal conviction for letting a drug dealer launder money in Bulgaria, its involvement in corruption in Mozambique, its involvement in a former employee espionage scandal, , including the leak of customer data to the media, linked to discredited businessman Lex Greensill and failed New York investment firm Archegos Capital Management. This has also exacerbated the impression that the organization does not have enough control: many disgusted customers have made their mark by not doing business with them, leading to unprecedented customer exodus in the second half of 2022. rice field”

Against the backdrop of a lost control Fed, a lost Treasury secretary and an accelerating global banking crisis, crypto app downloads rose 15% last week, while banking app downloads fell about 5%. It should come as no surprise.

Strengthening of SEC enforcement

Markets are showing distrust of governments and the financial system in the form of interest in cryptocurrencies as potential alternatives to them. Interestingly, the proliferation of crypto assets coincides with the U.S. Securities and Exchange Commission (SEC) waging war on crypto assets.

The SEC recently issued a warning to investors, urging them to exercise caution when investing in crypto assets. It’s perfectly fine and a valid warning. Investing in crypto assets should be done with caution.

But the timing, in the middle of a string of enforcement actions since the beginning of the year, seems somewhat disingenuous given the much bigger problems facing global financial markets. The SEC has also warned Coinbase of possible lawsuits.

No matter how hard the SEC, Treasury, White House, and Fed try, there is no going back. With banks closing and depositors and investors leaving, it’s clear to everyone why we should be bullish on crypto.

Banking issues are troublesome for crypto investors and for business and capital flows. The impact is already starting to come as liquidity is being sucked out of the crypto spot market.

The battle between banks and stablecoins

But the real battle is not between crypto investors and regulators, but between banks and stablecoin issuers. Stablecoin issuers still rely on banks to store their reserves, and banks are largely reluctant to help an industry that would put them out of business. It is a matter of course.

Former CEO of cryptocurrency exchange BitMEX, Arthur Hayes, gave a great insight into the friction between banks and stablecoins at the end of 2022, before the banking crisis began.

At the heart of the problem is that stablecoin issuers can keep all of the interest income without giving it to holders, so a rate hike is something the issuers should be happy about, whereas if they don’t return it, depositors It’s a big problem for banks that lose money and have unrealized losses on long-term loans.

“Can you understand why banks hate the monster of a stablecoin? When you read statements that fuel fear, uncertainty and suspicion, remember that banks are just jealous,” Hayes said.

Getting rid of existing stablecoins and using Central Bank Digital Currencies (CBDCs) won’t make things much better. In a 2022 report, McKinsey estimated that banks worldwide would lose $2.1 trillion in annual revenue if retail CBDCs were successful.

The reality is that the cryptocurrency ecosystem is strongly tied to the traditional banking system, even as we try to build a digital infrastructure that operates in parallel with the existing financial system. So, ironically, trying to save crypto while trying to save banks ultimately saves crypto as well. It’s a win-win situation for blockchain advocates right now.

Mr. Jeff Dorman: Co-Founder and Chief Investment Officer of Arca, a crypto asset management company.

*This column is for general information purposes only and is not intended to be investment advice, investment research, legal advice, tax advice, research reports, or advice.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

| Image: Federal Reserve exterior (Jesse Hamilton/CoinDesk)

|Original: Macro Is Back to Moving the Digital Asset Markets

The post Macro moves the cryptocurrency market again[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

93

2 years ago

93

English (US) ·

English (US) ·