Macroeconomics and financial markets

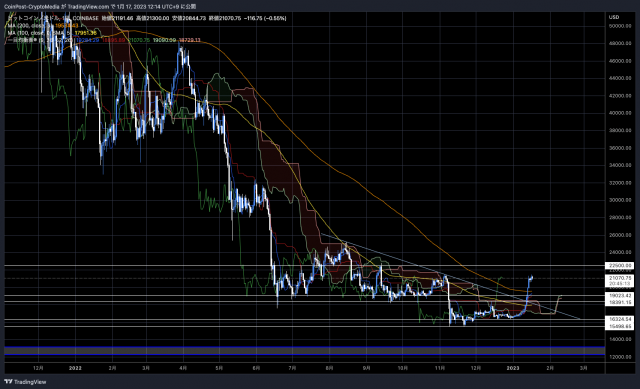

In the crypto asset (virtual currency) market, Bitcoin fell 0.52% from the previous day to $21,079.

BTC/USD daily

Contrary to most expectations, the price remained high at the $21,000 level, with the price rising toward 5:00 on the 17th Japan time.

Some altcoin stocks, which surged due to the recent overheating, fell back due to strong selling, but according to data from CoinMarketCap, the total market capitalization of the cryptocurrency market remains close to $1 trillion ($986 billion). are doing.

On the 16th, CNBC cited “the prospect of monetary policy easing against the backdrop of weak macroeconomic data and low valuations” as the reason for the rise in bitcoin since the beginning of the year. It is reported that the desire to buy is increasing. It covers the views of analysts and others based on data from the cryptocurrency analysis site Kaiko.

According to Kaiko, the average trading volume within the largest exchange Binance has surged from $700 to $1,100 since the 8th.

Happy Monday! Let’s start the day with a quick market update  $BTC is trading above $20k for the first time since Nov. 8th.

$BTC is trading above $20k for the first time since Nov. 8th.

Trade volumes have soared, reaching their highest levels since the FTX collapse.

1/4 pic.twitter.com/pItUYaWr0J

—Kaiko (@KaikoData) January 16, 2023

The recent rebound in the Bitcoin and altcoin markets is correlated with the rebound in the US stock index as expectations of a slowdown in inflation in the US Consumer Price Index (CPI) were positively received as expectations of a slowdown in the pace of US interest rate hikes.

A World Economic Forum survey found that about two-thirds of chief economists expect a global recession is likely this year, with economic trends putting inflation first. It also affects the monetary policy decisions of the Fed (US Federal Reserve System).

The US Federal Open Market Committee (FOMC) is approaching the week after next, and it is possible that the market will again take a wait-and-see approach from late January to early February.

On the other hand, according to the analysis of Mr. MAC_D, a certified analyst of the data analysis company CryptoQuant, institutional investors’ buying is limited in the rebound phase up to 1 BTC = $ 21,000 level. This suggests that the rise was due to buybacks mainly by individual investors. Due to the bankruptcies of FTX and Alameda Research, etc., “market uncertainty” has increased to an unprecedented level, so it seems that there is no choice but to be more cautious than major companies.

The reason for this is the sluggishness of two indices, the Fund Volume, which indicates the trading volume of institutional investors, and the Fund Holdings, which indicates the amount of holdings. Also, no signals were detected in OTC (counter-to-counter) trading data that is not done through a cryptocurrency exchange. This is provided as regulated fund (institution) disclosure data, not on-chain data.

CryptoQuant

altcoin market

Among individual stocks, Aptos (APT) rose 67.2% from the previous week and rose 100% from the previous month.

Aptos is an L1 blockchain with a focus on security and scalability, and is also known to have been founded by former developers of Diem (formerly Libra), which was developed by Meta (formerly Facebook).

It uses the blockchain programming language “Move”, which is superior to Ethereum’s “Solidity” in terms of security and scalability, and its mainnet was launched in October 2010.

Relation:What is “Aptos” developed by former Meta engineers?

The development company Aptos Labs was once valued at $4 billion, and has raised a total of over ¥45 billion from major industry investment institutions such as Binance and a16z.

In April 2022, we also announced a partnership with Google Cloud, and in December 2022, Mo Shaikh, co-founder of Aptos, launched DeFi (decentralized finance) that enables parallel transaction processing in 2023. It also mentioned and attracted interest.

In PancakeSwap, a major DEX (distributed exchange) based on BNB Chain, the Total Value Locked (TVL) on the Aptos blockchain reached just under 60%.

DeFi Llama

TVL is data that shows the total amount deposited into the DeFi protocol. On the 6th, PancakeSwap voted to continue multi-chain development in Aptos, and it seems that the announcement of additional invitations for competitive Aptos-based projects to be deployed on PancakeSwap was also taken into consideration.

Proposal for PCS farm emission confirmation vote on Aptos

Proposal for PCS farm emission confirmation vote on Aptos

Chefs have been monitoring and optimizing the liquidity levels on Aptos. Based on the initial deployment, we propose to continue our multichain deployment on Aptos

Chefs have been monitoring and optimizing the liquidity levels on Aptos. Based on the initial deployment, we propose to continue our multichain deployment on Aptos

Read the proposal and Vote: https://t.co/l4RK1ZKfug pic.twitter.com/EUEJRbsT5q

Read the proposal and Vote: https://t.co/l4RK1ZKfug pic.twitter.com/EUEJRbsT5q

— PancakeSwap  #Multichain (@PancakeSwap) January 6, 2023

#Multichain (@PancakeSwap) January 6, 2023

On the 13th, it announced that “Atomic Wallet”, which is equipped with atomic swaps, also supports Aptos.

Welcome, @Aptos_Network to @AtomicWallet! Aptos is a layer 1 blockchain created for safe development and built with user experience as a core focus.

Manage $APT tokens with private keys with ease. pic.twitter.com/p7zm7EO5OU

— Atomic – Crypto Wallet (@AtomicWallet) January 13, 2023

Relation:Newly listed Aptos (APT), Tokenomics details

GM radio archive release

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

[Announcement]

CoinPost Hosts One of Asia’s Largest International Conferences

Date: July 25th and 26th, 2023

Venue: Tokyo International Forum

Press release https://t.co/vvgzhfPOVb

[Specified]Accepting pre-whitelist registration that can be completed in 2 seconds https://t.co/bigJoFNBvh pic.twitter.com/5FfHvqKppB

— CoinPost-virtual currency information site-[app delivery](@coin_post) December 26, 2022

Click here for a list of market reports published in the past

The post Maintaining the market capitalization of the virtual currency market close to $ 1 trillion, is buying by institutional investors limited? appeared first on Our Bitcoin News.

2 years ago

201

2 years ago

201

English (US) ·

English (US) ·