This week’s attention!

Can you do something positive a week after the big news?

Binance’s settlement with the US government is good for both the crypto industry and Binance, JPMorgan said in a research report on November 23.

The US Department of Justice does not want Binance founder Changpeng Zhao, also known as CZ, to remain in prison until he is sentenced, but it also does not want him to leave the US. In the new filing, it says there is a “manageable flight risk.”

Binance and its founder Changpeng Zhao, also known as CZ, are being treated this way in the US by the crypto exchange and other central Arthur Hayes, former CEO of exchange BitMEX, said in a new post on his Substack account that centralized exchanges pose a threat to the traditional American-led global financial system. argued in the essay.

The Philippine Securities and Exchange Commission (SEC) has warned users in the Philippines that access to Binance may soon be blocked, saying it operates without a license in the country. ing.

Crypto asset (virtual currency) exchange Binance has announced that support for the stablecoin Binance USD (BUSD) will end on December 15th. Binance announced in August that it would phase out support for the Binance USD after its publisher, Paxos, was ordered to stop issuing Binance USD in February.

Bitcoin

The bullish outlook continues.

According to a research report released by JPMorgan on November 23, the U.S. Securities and Exchange Commission (SEC) has approved the conversion of Grayscale Bitcoin Trust (GBTC) to an exchange-traded fund (ETF). In anticipation of this, a significant number were purchased on the market at a significant discount to the standard value (NAV).

Standard Chartered Bank said on the 28th that the situation is progressing as expected, and that Bitcoin (BTC) will reach $100,000 (approximately 14.5 million yen, equivalent to 145 yen per dollar) by the end of 2024. Prediction maintained.

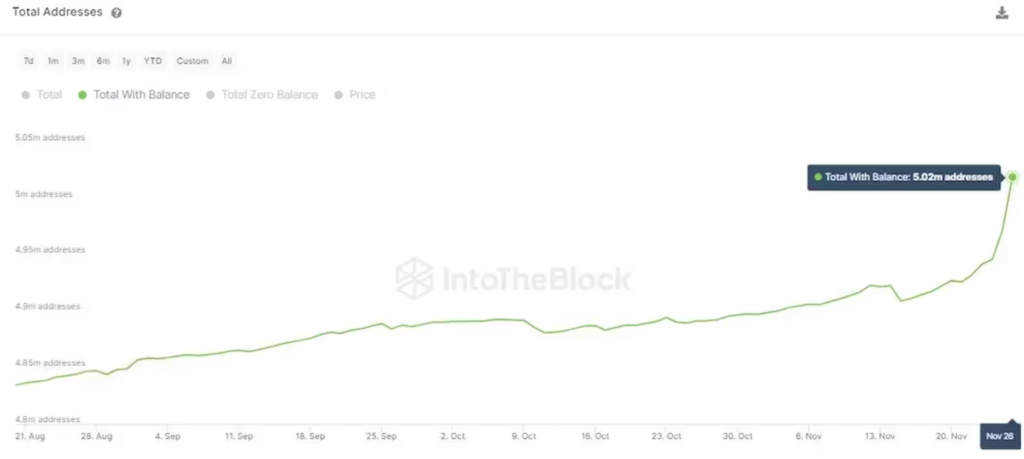

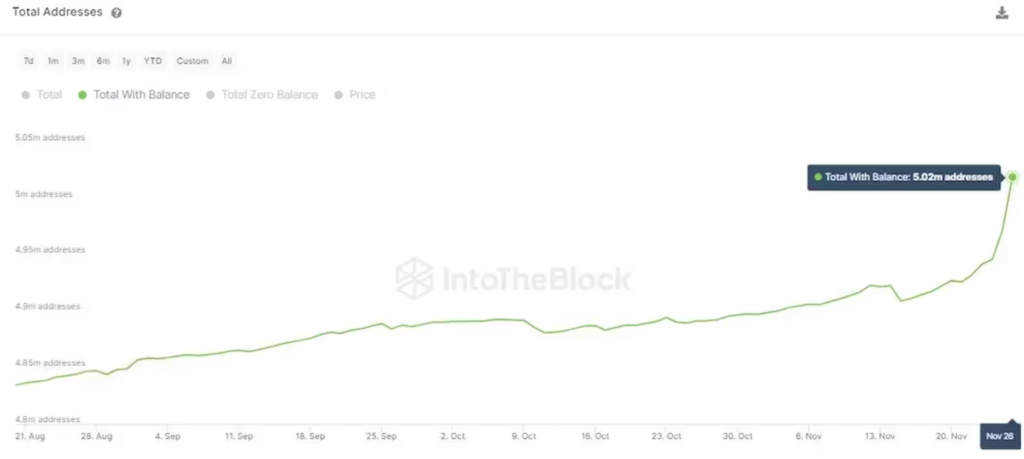

Centralized crypto asset (virtual currency) exchanges have recently seen large amounts of Bitcoin withdrawn, as there is a growing belief that Bitcoin (BTC) will continue to rise to over $40,000 by the end of the year.

Bitcoin ETF

Movement toward approval is gaining momentum.

So far, there hasn’t been much competition to provide custody services, a critical infrastructure for Bitcoin ETFs (exchange traded funds). Coinbase, a major U.S. crypto asset trading company, has the upper hand, and most of the companies that wish to list ETFs include BlackRock, the world’s largest asset management company, Franklin Templeton, and WisdomTree Investments. All companies are requesting custody.

Grayscale, the administrator of the Grayscale Bitcoin Trust (GBTC), plans to renew its trust agreement for the first time since 2018. This was revealed in a filing on the 29th.

The objective is to optimize the structure of GBTC in preparation for the expected listing of a Bitcoin spot ETF (exchange traded fund), and to improve competitive conditions with other ETF applicants such as BlackRock, the world’s largest asset management company. It’s about being equal.

Market trends

Crypto asset funds are also showing strong movement.

Some of the major altcoins such as blockchain native tokens dYdX (DYDX), Optimism (OP), and Sui (SUI) announced on the 27th that large-scale unlocks are on the horizon as the overall cryptocurrency market declines. The situation weighed on it and caused the decline.

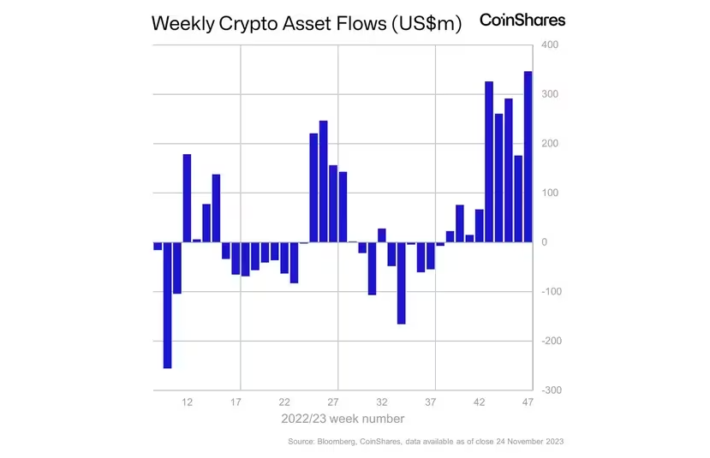

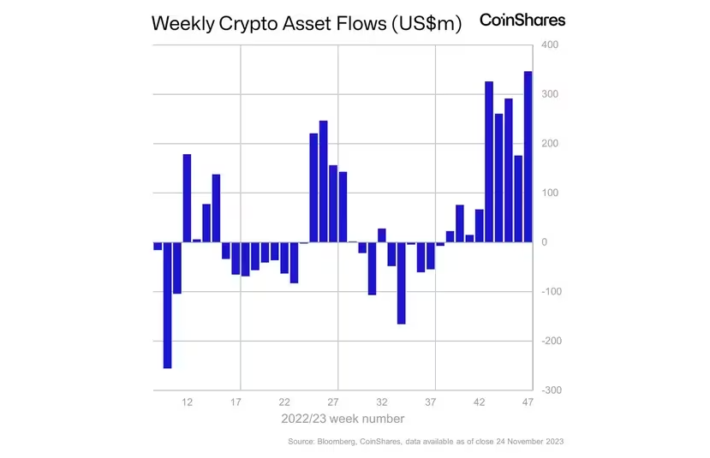

Cryptocurrency investment funds last week posted their biggest net inflows of the year, the strongest since the 2021 bull market, as expectations for Bitcoin spot exchange-traded funds (ETFs) continue to attract investors. kept moving. This was revealed in a report on the 27th by CoinShares, one of Europe’s largest asset management companies.

Two years after the coronavirus outbreak, the joke cryptocurrency Dogecoin (DOGE) remains popular. Initially, it was thought that people were trying to overcome lockdown boredom by betting millions of dollars on non-serious crypto assets.

An unusual pattern has recently emerged in the Chicago Mercantile Exchange (CME) futures market for Bitcoin (BTC) and Ethereum (ETH), indicating a strong investment trend with long positions in major crypto assets (virtual currencies). has been done.

Bitcoin (BTC) hit $38,000 early Asian time on November 29 as hopes around spot exchange-traded fund (ETF) approval revived earlier this week and traditional market watchers expected interest rate cuts. broke through.

While crypto assets (virtual currencies) are inching closer to bull market territory, NFTs (non-fungible tokens) have not been able to benefit from the market’s euphoria.

Industry trends

In Japan, movements surrounding stable coins are becoming more active.

Customers are so comfortable using their money now that there is no justification for central bank digital currencies (CBDCs), says Ashok, head of blockchain and digital assets for Asia Pacific at payments giant Mastercard.・Ashok Venkateshwaran told CNBC.

SBI Holdings and Circle Internet Financial, which issues the stablecoin “USD Coin (USDC),” have announced a comprehensive initiative aimed at distributing USDC in Japan, opening bank accounts for Circle, and disseminating Web3-related services. The two companies announced on November 27 that they have entered into a basic agreement for a business partnership.

Mitsubishi UFJ Trust and Banking, Progmat, and JPYC announced on November 28th that they have begun a joint study toward the issuance of a stable coin “JPYC (trust type)” that complies with the revised Payment Services Act. The “Progmat Coin” platform will be used to issue and manage stable coins.

Cathie Wood’s investment management company ARK Invest acquired an additional $5 million in Coinbase stock on November 29th. At the same time, he sold $2 million (approximately 300 million yen) worth of shares in trading platform Robinhood and $1.5 million (approximately 225 million yen) worth of online bank SoFi Technologies. ) purchased.

MicroStrategy, the US company that holds the largest amount of Bitcoin (BTC) among companies, bought more in November, and the current price is approximately $608 million (approximately 91.2 billion yen, 150 yen per dollar) I purchased approximately 16,130 BTC, which is equivalent to (conversion).

Daiwa Securities Group Inc., Daiwa Securities, Fintertech, and Ginco announced on November 30th that they will conduct a proof of concept (PoC) to develop Japan’s first public chain security token issuance and issuance platform.

Thirdverse, which develops VR games in Japan and the United States, announced on November 30th that it has raised a total of 1.2 billion yen through third-party allotment. The total amount raised, including the amount raised before the company split in May, has reached 5.7 billion yen.

One More Thing

There were articles that reported on the difficult situation for NFTs, but with the recovery of the crypto asset market, there are also signs of recovery for DeFi (decentralized finance) and NFTs.

Decentralized finance (DeFi) and NFT activity has revived in recent months, as sentiment in the crypto asset (virtual currency) market has improved on expectations for the approval of a Bitcoin physical exchange traded fund (ETF) in the United States. JPMorgan announced this in a research report on November 30th.

|Written and edited by Takayuki Masuda

|Photo: Shutterstock

The post Maintains bullish forecast of $100,000 by the end of 2024/$2.7 billion will flow out due to GBTC ETF conversion[Weekly Review: 11/25-12/1]| CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

125

1 year ago

125

English (US) ·

English (US) ·