Prioritize USDC

MakerDAO, which manages the major DeFi (decentralized finance) Maker protocol, seems to be solidifying its policy of prioritizing USDCoin (USDC) as a reserve for the stablecoin “DAI”.

In response to the USDC bank run caused by the US Silicon Valley Bank (SVB) bankruptcy that occurred around March 10, MakerDAO took measures to reduce the share of USDC, which accounts for about 50% of DAI’s reserves. An urgent proposal was passed on the 11th. There is a history of lowering the daily upper limit of USDC-collateralized DAI from 950 million DAI to 250 million DAI.

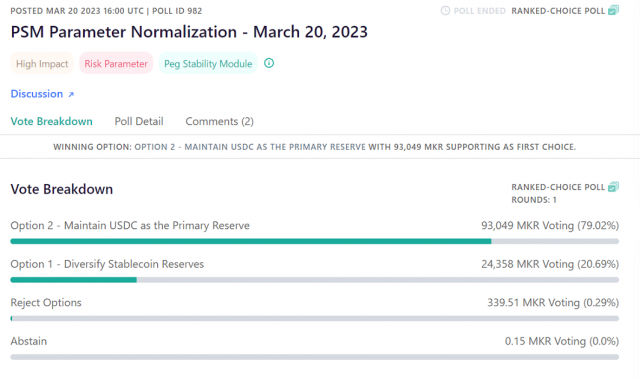

However, in a community poll that started on the 20th, “Option 2: Keep USDC as the primary reserve” received 79% support (as of the 24th).

Source: MakerDAO

If passed, an executive vote will be held on March 24. After that, the daily limit of USDC-collateralized DAI will be raised to 400 million DAI, and the USDC to DAI swap fee will also return to the previous condition (0%).

The stablecoin “DAI” issued by the Maker Protocol is designed to be linked to the value of the US dollar and maintain 1 DAI ≒ 1 dollar. DAI has a market capitalization of $5.4 billion (approximately ¥700 billion), boasting the fourth largest market capitalization in the stablecoin field (at the time of writing).

DAI can be issued with cryptocurrencies locked in smart contracts as collateral, but half of the collateral assets are made up of USDCoin (USDC). USDC is a stablecoin linked to the value of the US dollar issued by US Circle.

After Circle announced on the 11th that about 445 billion yen ($3.3 billion) had been detained by SVB Bank, the USDC de-pegged more than 10% from its $1 base. At this time, the prevailing price of DAI was also below $0.9 at one point.

connection:US Circle puts transfer of $3.3 billion USDC reserves pending at Silicon Valley Bank

Option 2

On the other hand, another vote option, “Option 2: Diversify your stablecoin reserves,” received only 20.59% support. According to the proposal filed on the 20th, Option 2 will benefit from Gemini Dollar (GUSD) issued by U.S. crypto exchange Gemini (Gemini Trust Company LLC) and Paxos (USDP) issued by Paxos National Trust. to increase the share as the DAI reserve.

The USDP, in particular, was a contender for its reserves managed by insured bank deposits (which are diversified to avoid FDIC caps).

However, both GUSD and USDP issuance amounts are below $1 billion, and increasing the weighting of DAI as a reserve would mean that if a short-term withdrawal or redemption event occurs, the issuer’s operations will be hindered. There is a risk that it will come,” he said.

The proposal acknowledges that GUSD and USDP have lower potential counterparty risk and higher resilience than USDC. On the other hand, he pointed out operational advantages such as USDC’s much higher liquidity and MakerDAO’s US Treasury investment strategy being optimized for ‘USDC’. “USDC risk has declined significantly since last week and no further solvency concerns or dipeg are expected at this time,” it concludes.

connection:MakerDAO (MKR) invests in US Treasuries to improve earnings and consider additional investments

The post MakerDAO May Refocus USDC as Reserves for DAI Stablecoin appeared first on Our Bitcoin News.

2 years ago

107

2 years ago

107

English (US) ·

English (US) ·