MakerDAO Investment Strategy

At the governance forum of “MakerDAO”, which manages the major DeFi (decentralized finance) Maker protocol, a proposal was submitted on the 5th to allocate a new investment budget of about 100 billion yen ($750 million) to US Treasury bonds. rice field.

The Maker Protocol is an issuing, managing and lending platform for the stablecoin “DAI”. MakerDAO is a DAO (Decentralized Autonomous Organization) that manages the operational policy of the protocol through voting on governance tokens (MKR).

From October 2010, MakerDAO started the investment strategy (MIP65) of the stablecoin “USCCoin (USDC)”, which accounts for about 50% (580 billion yen: at that time) of the DAI reserve. The strategy at the time was to invest 72.5 billion yen (500 million DAI) in US short-term bonds (80%) and corporate bonds (20%).

connection:MakerDAO invests 72.5 billion yen in US Treasuries, etc.

By the end of January 2023, MIP65’s $500 million short-term bond investment strategy has provided ~$2.1 million in lifetime fees to MakerDAO.

This investment strategy currently represents more than 50% of MakerDAO’s annualized revenues.

→ https://t.co/fa2JVuvWEo pic.twitter.com/D3mZfgd6pZ

— Maker (@MakerDAO) March 7, 2023

According to MakerDAO’s report on the 7th, the cumulative interest income earned from the short-term bond investment strategy is about 288 million yen ($2.1 million), accounting for more than 50% of MakerDAO’s annualized income. In addition, the current portfolio of this strategy (MIP65) consists only of “U.S. Treasury Bills Less than 1 Year ETF” and “U.S. Treasury Bills 1-3 Years ETF” provided by the investment company BlackRock at a ratio of 7:3. ing.

In the proposal on the 5th, 750 million yen is divided into a total of 12 times, and a strategy is being considered to purchase short-term US Treasury bonds (6 months) over 6 months. This method optimizes costs and tax efficiencies and secures liquidity through gradual maturities.

If the new proposal is passed in a governance vote, the maximum investment limit for US Treasuries and other securities will total 171.8 billion yen ($1.25 billion), which is expected to lead to further earnings expansion for MakerDAO.

US Treasury market

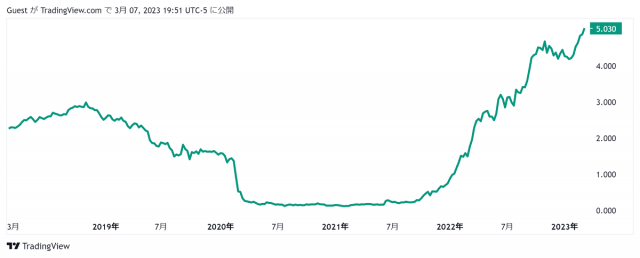

In the US financial markets on the 7th, Fed Chairman Jerome Powell said, “It is highly likely that the policy interest rate’s terminal rate (ultimate point) will be higher than expected.” At the FOMC meeting on March 22, expectations for an interest rate hike of 0.50 points soared, and the two-year US Treasury bond yield, which easily reflects changes in policy interest rates, rose to the 5% level for the first time in 15 years since 2007.

Source: TradingView

For investors, government bonds are considered “risk-free assets” in the sense that they are safe assets with guaranteed principal. Investors tend to move to risk-free assets when the yield they can earn (risk-free rate) is more attractive than the expected yield on risky assets.

connection:Nasdaq and other U.S. stocks fall across the board Disgusted by chairman Powell’s congressional testimony, dollar yen to 137 yen level | 8th financial tankan

connection:Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

The post MakerDAO (MKR) invests in US Treasuries to improve earnings and consider additional investments appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·