Release of option contract (inscription)

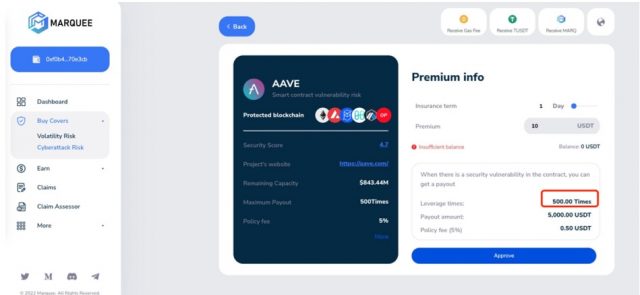

Marquee Insurance provides an extensible platform for on-chain options and insurance, and has introduced two types of products: price volatility insurance and smart contract vulnerability insurance.

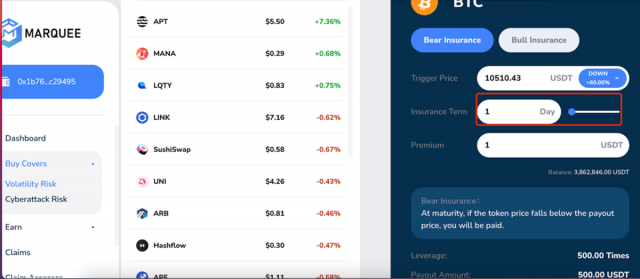

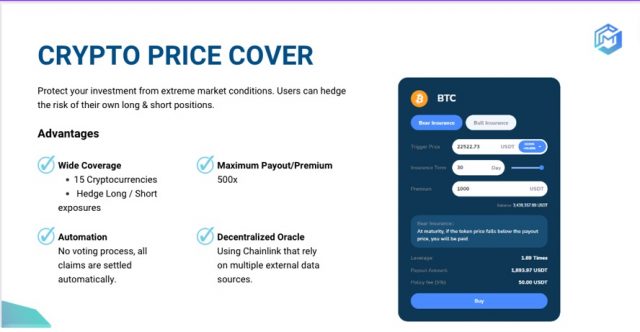

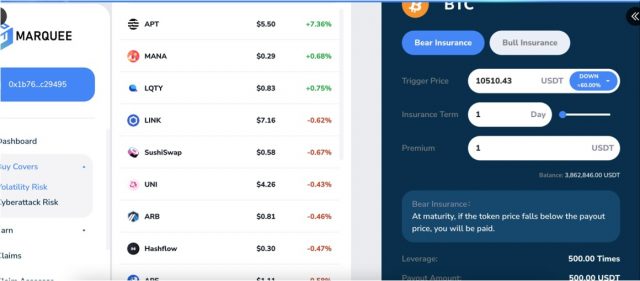

The company will newly launch “Marquee Token Price Options”. Users will be able to effectively hedge both long and short risks for 15 popular cryptocurrencies with contract periods of 1 to 30 days and leverage of up to 500x.

Furthermore, Marquee is also planning to expand into the Bitcoin ecosystem. It plans to deploy risk hedging tools and infrastructure such as decentralized finance (DeFi), insurance, and option derivatives in the Bitcoin ecosystem.

Marquee predicts that developments in decentralized finance similar to those seen with Ethereum in 2020 will occur in the Bitcoin ecosystem. In the future, the company plans to work on strategic products such as savings accounts, staking, and liquidity mining.

Early adopters of the Marquee option will also receive exclusive benefits, including Bitcoin subscription whitelisting, Launchpad whitelisting, priority testing rights for Bitcoin ecosystem products, and participation in governance voting. At the end of this article, we will introduce a special campaign for our readers, so please check it out.

1. Disadvantages of traditional options

An option is a financial derivative that gives the holder the right to buy or sell a specific asset (underlying asset) under specific conditions (strike price, expiration date, etc.). This product limits losses to the option fee (premium) and allows you to pursue profits from future price fluctuations.

Approximately 33 billion option contracts will be traded in 2021, and the need is increasing. However, the current total value locked (TVL) in the decentralized finance (DeFi) options market is only $500 million, and the majority of crypto options are traded on the centralized platform Deribit.

This is because option design in traditional capital markets is complex and difficult for many users to fully understand. This limits the user base for option trading, leading to a lack of market liquidity and a lack of appropriate trading tools.

To address these issues, Marquee offers a unique options product design, aiming to eliminate the barriers that exist in the traditional options market and develop the market.

2.Marquee option features

simple

Unlike conventional complicated options, Marquee uses a user-friendly mechanism. Users simply select a time period from 1st to 30th, set a target price, and place an order. In the future, longer term coin price options will be designed.

Source: Marquee Finance (all below are the same)

Virtual currency stocks handled

Initially, Marquee will offer price insurance for 15 popular cryptocurrencies in the market, including Bitcoin (BTC), Ethereum (ETH), Build and Build (BNB), and Arbitrum (ARB).

High leverage perpetual contract

Coin Price Option offers up to 500x leverage, allowing you to move large leverage with small capital. Available to both hedge and long users. Currently, it exceeds the maximum leverage (120x) of Bybit, one of the major options markets.

low fees

Marquee’s fees are 30% to 50% lower than mainstream options platforms. This will be attractive to existing options traders.

No forced liquidation

Marquee’s option contracts provide a mechanism that allows them to remain liquidated within a set period of time, regardless of price fluctuations. “Liquidation” in perpetual futures refers to the process that occurs when a trader’s position falls below the minimum margin required to maintain it. The lack of liquidation is a major advantage for users, as the cryptocurrency market frequently experiences wild price fluctuations.

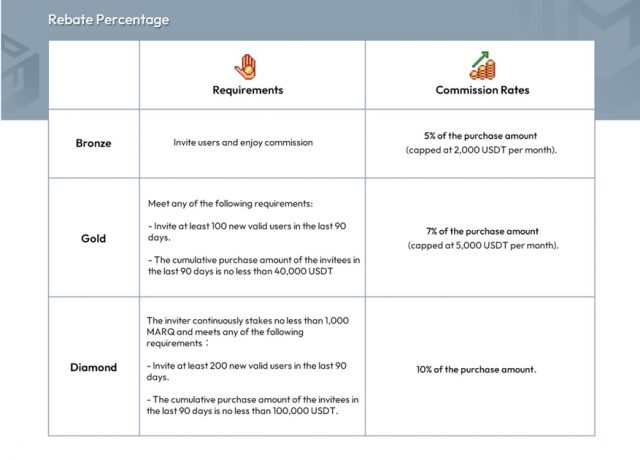

Referral mechanism

Marquee develops an on-chain referral fee mechanism and deploys strategies to engage global influencers to actively promote the platform. Most of the fee income is allocated to incentives.

3.Basic structure of Marquee option

Based on the basic options pricing model, users register and pay fees in their own wallets. Marquee will then issue an NFT insurance contract to the user containing the following information:

- Optional start time

- Contract execution price (strike price)

- Exercise deadline (expiration) date and time

- Expected payout rate (varies depending on the difference between current price and strike price)

- Payout amount (amount received by the holder upon exercise of the option)

4.Marquee’s Option Derivatives Inscription

“Inscription” is a new NFT issuance standard that was born in Bitcoin and similar mechanisms are occurring frequently in other blockchains. Capitalizing on this trend, Marquee has created a total of 21,000 “Marquee OG Passes” as option derivative subscriptions, providing users with further earning opportunities.

Issuance rules

80% (16,800 OG passes) will be allocated to “ticket” qualification holders obtained by using the option contract.

Ticket points are calculated based on the amount of invested funds, and you can get 1 point for investing 1 USDT, and 1 ticket for 100 points. Once issued, it can be immediately listed for trading on OpenSea. Since the total quantity is limited, it will be on a first-come, first-served basis.

The remaining 20% (4,200 OG passes) will be distributed to holders of “ticket” qualifications obtained by depositing into the LP (liquidity pool). You can earn 1 point by depositing 1 USDT per day, and 1 minted “ticket” by depositing 10,000 points. Once issued, it can be immediately traded on OpenSea. Since the total quantity is limited, it will be on a first-come, first-served basis.

Having a Marquee OG Pass gives you even more rights:

A. Airdrop reward: Users with an inscription can qualify for rare airdrops based on their activity level. You can get the right to more wealth by depositing your assets into the corresponding liquidity pool.

B. Opportunities to participate in equity financing: By participating in Marquee’s on-chain equity financing, you can access higher percentage asset growth opportunities.

C. Exclusive Benefits: Priority right to participate in Bitcoin subscriptions, right to pre-purchase new tokens, priority right to test Bitcoin ecosystem products, participation in governance voting, etc.

D. Scarcity value: Marquee will also use a portion of its profits to buy back subscriptions, adding scarcity value to digital assets in circulation.

5. Three advantageous trial campaigns

To celebrate the launch of Marquee Coin Price Options, $1 million worth of gifts are being made available to both new and existing users to say thank you.

First step: 100% loss compensation for Marquee options (total compensation of $1 million)

If a loss occurs after placing an order, the platform will provide a 100% subsidy for the loss during the activity period. You can experience trading with your principal protected. If you incur a loss through trading the contract, it will be covered by clicking on the “Claim” button in the orders section.

Note: Rewards will be released in fixed amounts over 6 months based on MARQ’s real-time price. Please refer to future rules for details.

Second round, trading campaign with total prize money of $100,000

reward

1st place: 20,000 USDT

2nd place: 15,000 USDT

3rd place: 10,000 USDT

4th place 5,000 USDT

5th place 4,000 USDT

6th place 3,000 USDT

7th place: 2,000USDT

8th to 48th place: 1,000 USDT each

rule

During the activity period, the participant with the highest cumulative trading profit for any cryptocurrency price option will receive a reward of 20,000 USDT. The top 48 participants will be awarded rewards based on their ranking.

Note: Rewards will be released in fixed amounts over 6 months based on MARQ’s real-time price. Please refer to future rules for details.

Third round, total incentive for liquidity providers of 100,000 USDT

During the activity period, the liquidity provider accumulates points based on the deposit amount and deposit period. Based on these points, a reward of 100,000 USDT will be prorated. Rewards will be released in fixed amounts over 6 months.

Calculation formula Liquidity reward = (deposit amount * deposit period) / total (deposit amount * deposit period) * total number of tokens

Furthermore, if the cumulative payout of the liquidity pool reaches 20% within 30 days, the payout from the liquidity pool will be stopped and the payout payment will be replaced with compensation in MARQ tokens. Please refer to future rules for details.

6.Funding status

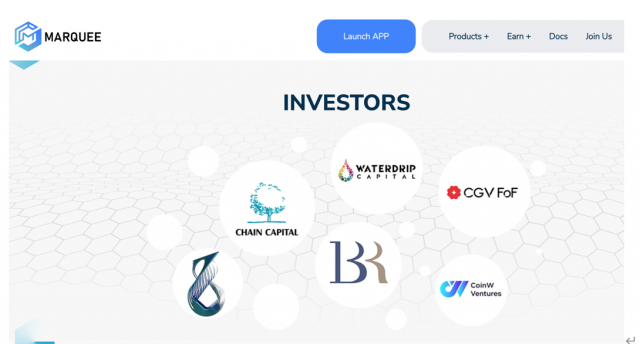

Marquee has attracted investment from multiple institutions, including WATERDRIP CAPITAL, due to the expertise and extensive experience of its members. WATERDRIP CAPITAL is an international investment institution founded by Chinese blockchain pioneers in 2017 and has invested in over 50 blockchain projects around the world, including Polkadot and the COSMOS ecosystem.

Other major investors include Cryptogram Venture (CGV), an Asia-based fund of funds (FoF) headquartered in Japan, Chain Capital, Bitrise Capital, ZC Capital, and CoinW Ventures.

According to Dr. Joe, Marquee has been recognized by many prestigious institutions for its superior product and technical performance despite the bear market. Marquee aims to work with these investors to build decentralized financial applications and ecosystems, sharing a common vision and passion.

In particular, Dr. Joe said that CGV’s crypto and Web3 industry expertise, as well as its diverse and synergistic resources in Japan, Asia, and North America, will help Marquee quickly and effectively achieve its goals. Emphasized.

7.Marquee’s code passes knowledge creation audit

A third-party audit by China-based security firm Knownsec gave Marquee an overall “passing” rating. This certification includes over a month of active and passive audits of Marquee’s code, with comprehensive analysis of common smart contract vulnerabilities as well as contract-specific business security items.

Contact Us:

Website: https://marquee.fi/

Telegram: https://t.me/MarqueeGroup

Website:https://twitter.com/Marquee_fi

The post Marquee releases option contract (inscription adoption) and holds three campaigns including loss compensation appeared first on Our Bitcoin News.

1 year ago

125

1 year ago

125

English (US) ·

English (US) ·