*This article was contributed by Tetsushi Hisada, CEO of Datachain, a startup focused on interoperability that connects different blockchains. In accordance with coindesk Japan’s editorial policy, this article does not endorse the economic value of any particular cryptocurrency or company.

This time, even in the context of web3, it is not actually talked about in detail,Mass adoption in the financial field by integrating decentralized finance and traditional financeI would like to touch on.

From around the end of 2021, the word web3 has been seen more and more on various occasions, but I feel that there are many references to crypto assets and NFTs, especially in Japan.

I will mention it later,The initial and largest use case for blockchain will be social implementation in the real world in finance.. Perhaps it should be a common understanding, but I think there is limited information about what is actually happening and what the possibilities are.

At Datachain, we have been working on research and development of public-derived Trust-Minimized technologies such as IBC, and technical/business partnerships for enterprise projects. I believe that there is a point of view that I can convey because I have actually stepped into the business by facing both the public and the enterprise.

Assuming that it will be widely read not only by the financial domain and web3, but also by Web2 and investors, I will write it as easy to understand as possible.

Summary of this article

- As a mass adoption of web3, such as assets and rights“All values” are “digital assets (tokenization)”the future will come

- Over the next 10, 20, 30 years, they willDouble-digit Kyoyen globallyThere is a possibility that it will be a huge market change like

- In Japan, financial institutions and tech companies representing JapanBuilding national infrastructure in the digital asset marketjointly considering the establishment of a joint venture, Progmat

- Advanced regulations and technologyBy putting it into practical use based onGreat Opportunity to Export Financial Infrastructurethere is

- Datachain isIn IBC, the number of modules contributing to development is the largest in the world, excluding 1st partyis a company that develops LCP that solves the challenges to commercialization of IBC

Rather than general explanations and considerations, I will talk from the perspective of how the parties see it, referring to Datachain and the projects that Datachain is working on.

I will touch on this later, butJapan has a great opportunity in this mass adoption of finance in web3I think. In major countries,It is possible to export the core financial infrastructure based on the results of practical application by advanced laws and regulations and technology.I think it’s because

Nonetheless, we can export because we are ahead of the curve, so such timing will be limited.

Whether or not this small chance can be realized depends on the current parties involved in the financial domain and tech, as well as investments and joining the team.Depends on how many people believe in the possibilities and get involvedI think. It’s such a big opportunity, but I don’t think there’s enough understanding of it and too few players.

I will continue to write, thinking that it will be one of the triggers for change.

A future where all values become digital assets

Deep tech will revolutionize the huge market so that all energy becomes renewable energy and all cars become self-driving.

Along with these changes, in the future,The future will come when “all values” such as assets and rights will be “digitalized assets (tokenized)”I guess. The same applies not only to financial assets such as stocks, bonds, real estate, and derivatives, but also to currencies, rights such as shareholder benefits and membership cards, and NFTs, which we often hear about these days.

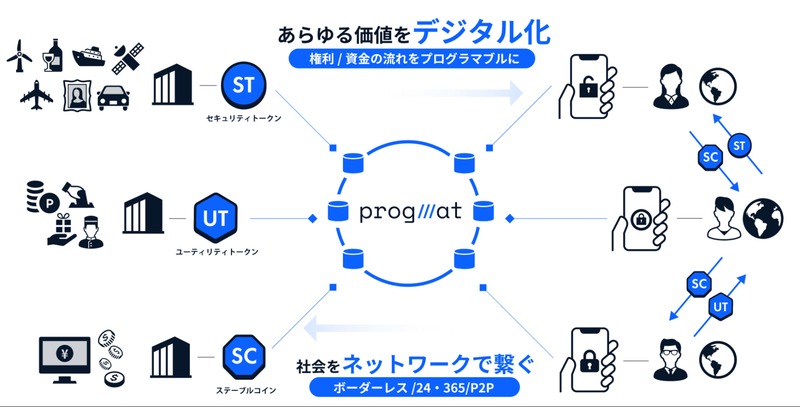

Source: https://www.tr.mufg.jp/progmat/

Source: https://www.tr.mufg.jp/progmat/I think that there are still few people who have a real feeling about this and believe it.

I don’t think there is such a concept yet, but like the EC rate and the cashless rate,Digital asset conversion rateThat’s what will be said.

Use cases such as security tokens, stable coins, NFTs and their cross-chain payments are already emerging.

When web3 and the Metaverse became a hot topic, many people intuitively believed that all assets in the Metaverse space would be converted into digital assets, which was often talked about.

Also, by changing the level of abstraction a little, many people feel that in the context of DX, all processes will become programmable and automated.

Recently, I think that many people were impressed by the ChatGPT experience and felt that it could replace people in various themes.

All processes are becoming programmable, and we are still at the beginning of that process.In addition, the financial sector, where technology is incorporated most quickly, is seeing use cases.Digital assets are the earliest and most critical long-term theme in blockchainI believe it is.

Along the way, there are many issues that need to be resolved.

It is difficult to predict when and with what impact a major change will occur, but I believe that increasing the number of people who believe in it, even just a little, will lead to attracting even a little more of the future that will surely come.

Current location of digital assetization

Now, let’s take a look at some of the value that has been turned into digital assets at the moment.

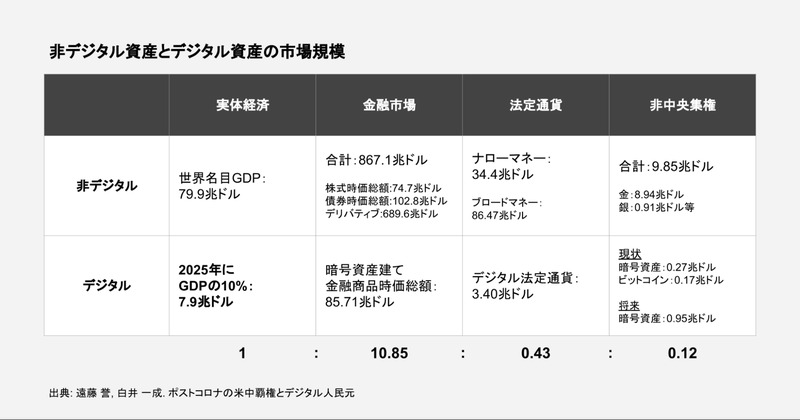

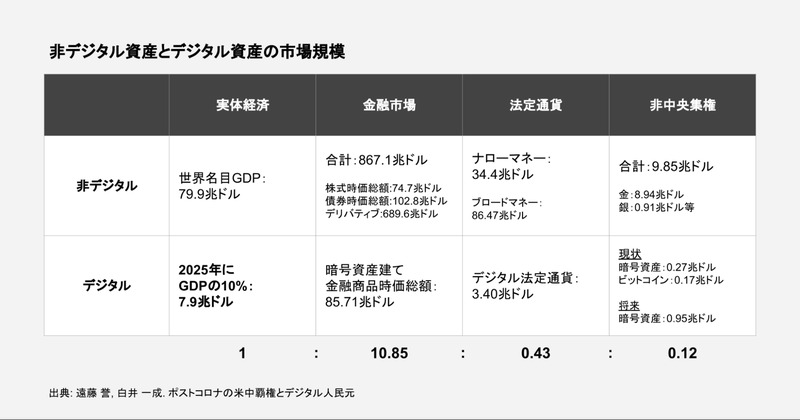

Created from the book “Post-Corona U.S.-China Hegemony and the Digital Yuan”

Created from the book “Post-Corona U.S.-China Hegemony and the Digital Yuan”Although it is a little old data, it is referenced from the above book as an easy-to-understand chart.

In the report “Deep Shift Technology Tipping Points and Societal Impact” published by the World Economic Forum in September 2015, 57.9% of executives and industry expertsBy 2025, 10% of global GDP will be stored on the blockchain.”There is a description that he answered.

Please read this as a set of assumptions, assuming a digital asset conversion rate of 10% in 2025. See footnotes for newer global nominal GDP, financial markets, fiat currencies and decentralized assets.

Based on thisLet’s simply calculate the current digital asset conversion rate.I think there will be discussions on how to define each asset, so please understand it as a reference value.

first,decentralized assetsAssuming that the total market capitalization of crypto assets in the world is approximately $1 trillion, the digital asset conversion rate isless than 10%. If it was $3 trillion during the bull market,about 23%be captured.

Legal tenderAs for the market capitalization of stablecoins at around $0.15 trillion,less than 0.5%.

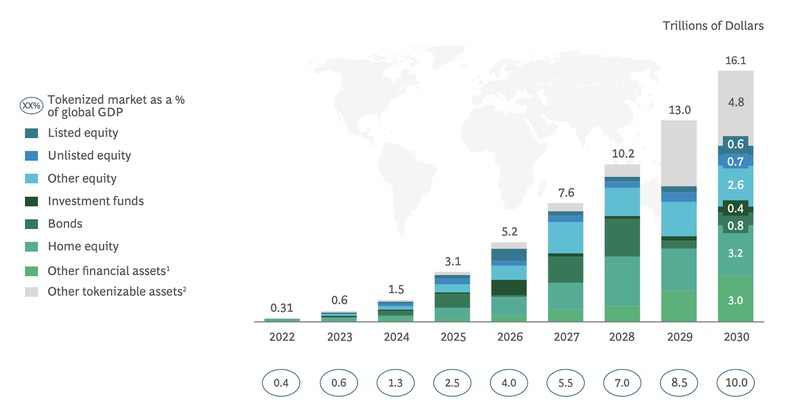

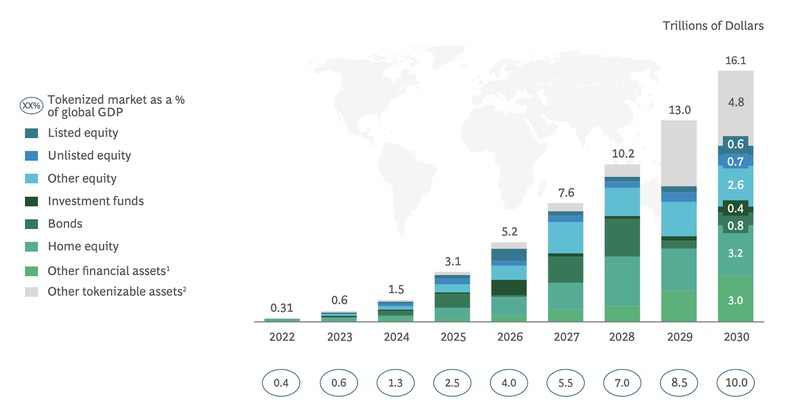

financial marketAs for , referring to the BCG and ADDX reports below, assuming $0.31 trillion,About 0.03%.Furthermore, looking at the graph in this report, the forecast for 2030 is conservatively $16.1 trillion.less than 2%and as a best case $68 trillionover 7%becomes.

Relevance of on-chain asset tokenization in ‘crypto winter’ (2022/9/12)

Relevance of on-chain asset tokenization in ‘crypto winter’ (2022/9/12)As I touched on earlier, it is extremely difficult to predict when and to what extent it will come. The current location is only a rough estimate, but I think I got a rough idea.

Over the next 10, 20, 30 years, all of these values will become digital assets. The numbers above are primarily for assets,More room for rights and moreThere will be

Although there are many elements including regulations, if I dare to express it in an easy-to-understand manner,Over $1,000 trillion in the future, that is, a huge market transformation of double-digit Kyoyen is possibleyou might say.

Public and enterprise are merging

As I mentioned at the beginning, the integration of decentralized finance and traditional finance will progress.

Until now, in most blockchains, “public” and “enterprise” were talked about separately.2023 will be the year that these public and enterprise “technologies” and “use cases” begin to merge.

The signs are already emerging. For example, Polygon and Avalanche are beginning to adopt enterprise products. On the other hand, Progmat, which is based on digital assets, is considering permissionless stablecoins in anticipation of multi-chain compatibility.

Technology will have a greater impact from the public, and use cases from the enterprise.

Market Size of RWA (Real World Assets)is huge compared to current crypto. As mentioned above,While the market capitalization of crypto is around $1 trillion, stocks, bonds, derivatives, and real estate alone are hundreds of times moreWe recognize that there is a scale of

In the future, tokenization of such a huge amount of RWA will proceed. From the public’s point of view, it is how to attract it, and from the enterprise’s point of view, it is how to incorporate technology that connects with the public.

As Datachain, for such a future,Incorporating trust-minimized technologies like IBC into enterprise use casesI have been working on that.

I feel that our R&D over the past few years has finally made a major contribution to the major transformation that brings together the public sector and the enterprise sector.

The rise of national infrastructure

Japan will be the first major country to implement laws and regulations related to stablecoins in 2023. There are many topics related to the first year of the year,The First Year of a Genuine StablecoinIt can be said that

Also, at the end of last year, there was a release that Japan’s leading financial institutions and tech companies, as shown in the chart below, are considering establishing a joint venture to build a national infrastructure for the digital asset market.

Progmat, which was originally promoted by Mitsubishi UFJ Trust and Banking, was spun out from the company.A group that strongly expresses its intention to make it a common infrastructure for JapanIt can be said.

Source: Mitsubishi UFJ Trust and Banking

Source: Mitsubishi UFJ Trust and BankingCommencement of Joint Study on Establishing a Joint Venture to Build a “National Infrastructure” in the Digital Asset Market

So far, we have discussed the possibilities of digital assets. How many Web2 and web3 players knew that there was such a big move in a market with so much potential?

How many people will answer Progmat when asked which startup will make the most leaps in the next few decades?

Even if it is taken into consideration that the company has not yet been established, I think there is a big gap between the actual potential and the recognition of the current situation.

As can be seen from the above regulations,Cross-chain settlement (DVP settlement) of digital securities and stablecoins using Progmat is a highly novel initiative worldwide.is.

Datachain is also conducting this technical verification at Progmat.

Datachain started technical partnership with Mitsubishi UFJ Trust and Banking.Aiming for commercialization by 2024 in cross-chain settlement of digital securities using the stablecoin platform “Progmat Coin”

What are Japan’s big opportunities?

As I touched on in the previous chapter, practical application will progress under advanced laws and regulations.

As an advantage of being able to regulate in advance, by showing the track record of commercialization corresponding to it, it will be a good benchmark for countries that can regulate from now on, and it will be an opportunity to export as a proven product. thinking about.

The big opportunities for Japan that I mentioned at the beginning are, along with this advanced regulation,Trying to incorporate advanced “technology”there is.

Depending on the characteristics of assets and regulations, PFs will be established on multiple blockchain platforms, and interoperability will be required to connect them.

For example, Progmat is looking to issue stablecoins on public chains as a multi-chain, and it will also support cross-chain transactions on different types of chains as a cross-chain.

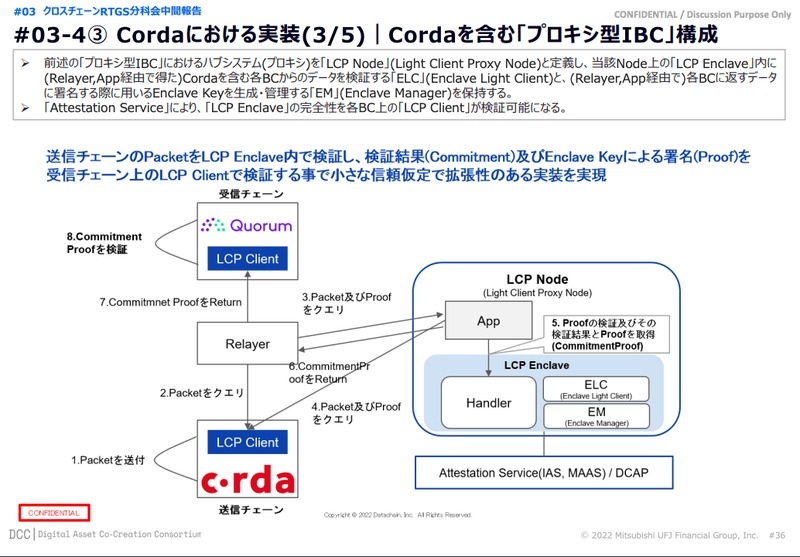

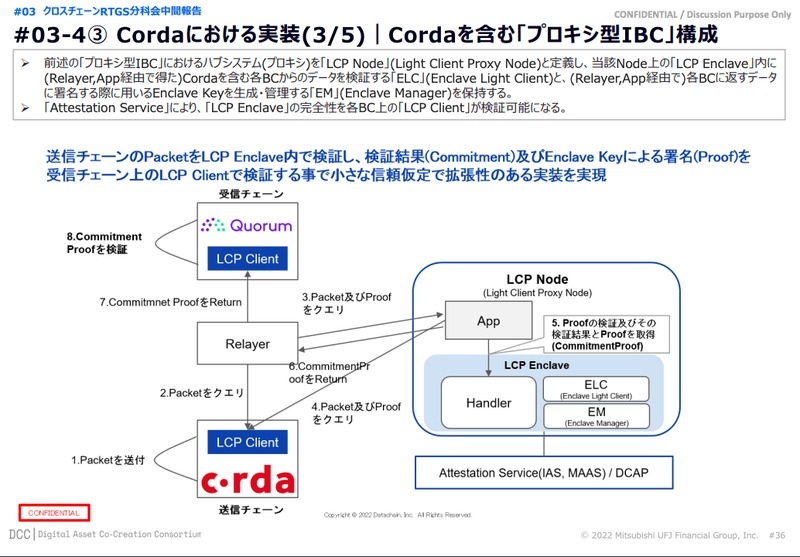

Progmat is whereTechnologies such as public trust-minimized IBC and LCPare considering hiring.

Source: Digital Asset Co-Creation Consortium (DCC) Fund Settlement WG | Interim Report

Source: Digital Asset Co-Creation Consortium (DCC) Fund Settlement WG | Interim ReportWe believe that IBC is the most prominent standardized cross-chain protocol and will become the de facto one in the future.

Talking about Progmat in the global IBC community is met with positive surprise. For example, see the Ledger Insights article and Cosmos tweet below.

MUFG partners with Datachain to explore Progmat stablecoin interoperability

#IBC is expanding to the enterprise space. @cosmosIBC for cross-chain payments between Corda and Quorum, supported by @datachain_enhttps://t.co/uU1QhbI2j9

— Cosmos – Internet of Blockchains  (@cosmos) September 29, 2022

(@cosmos) September 29, 2022

The fact that technologies like IBC are about to be adopted in use cases that can be called national infrastructure in major countries can be said to be a keen eye.

We believe that general-purpose platforms will become more similar in functionality as they mature, leading to competition on price or network effects. As mentioned above, in web3, in the future where the public and enterprise are merging, it will be essential to connect the enterprise and public foundations.

in short,Multi-chain and cross-chain are the core of general-purpose platform strategy in web3It will become

Ahead of the world, a product born from a traditional Japanese financial institution is about to incorporate such technology.I am proud of the fact that I feel that the more global and public Progmat is, the more it will be appreciated.

As I have touched on so far, I believe that this short timing is a great opportunity for Japan, as it is about to be put into practical use under advanced laws and advanced technology.

As Datachain, we are happy to be able to compete in such an opportunity, and we would like to do our best to contribute.

Datachain technology

As mentioned in the summary, Datachain is the world’s largest company in terms of the number of modules that contribute to the development of IBC, excluding the 1st party.

Among them, IBC-Solidity is an implementation of IBC’s Solidity and can run on a blockchain equipped with EVM (Ethereum’s smart contract execution environment). We have also donated modules to support Hyperledger Fabric, Quorum, Hyperledger Besu, and Corda to the Hyperledger Foundation under the Linux Foundation under the name “YUI” and continue to develop them.

In addition, the Cross Framework, which is middleware for safely performing DvP/PvP payments between multiple blockchains, has been patented in Japan, and is in the process of applying for patents in other OECD member countries such as the United States. increase.

In addition, LCP (Light Client Proxy) will solve the problems of scalability and verification cost (gas cost), which are major issues in realizing Light Client method such as IBC.

Datachain would like to do our best to support the realization of the future of digital assets with these technologies.

Datachain: Website/Tetsushi Hisada’s note

|Text: Datachain

|Editing: Coindesk JAPAN Editorial Department

The post Mass Adoption of Web3 | The Future of Digital Assets: Datachain | coindesk JAPAN appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·