For an asset class that should be reinventing itself all the time, it is surprising to see how resistant some venture funds are to change.

As a partner in a fund of funds, I attend a lot of annual meetings, talk with a lot of venture fund general partners and review a lot of investor decks.

What has particularly surprised me is how many funds tell exactly the same story and invest in exactly the same areas: B2B SaaS, cybersecurity, cloud infrastructure tech, e-commerce brands and crypto/fintech.

As I have written many times before, venture is about elephant hunting. Great funds have at least one, and ideally a few, enormously successful, fund-returning investments. Ownership and letting the great companies “ride” (and not selling them early) is crucial to getting outsized returns.

But, the outsized returns only come from companies that are market leaders in enormous markets. The second-place company, and sometimes, the third-place company can win, too, but of course will not be as large. But the companies that end up at #300 or #99 or even #20 in a market do not end up as good investments.

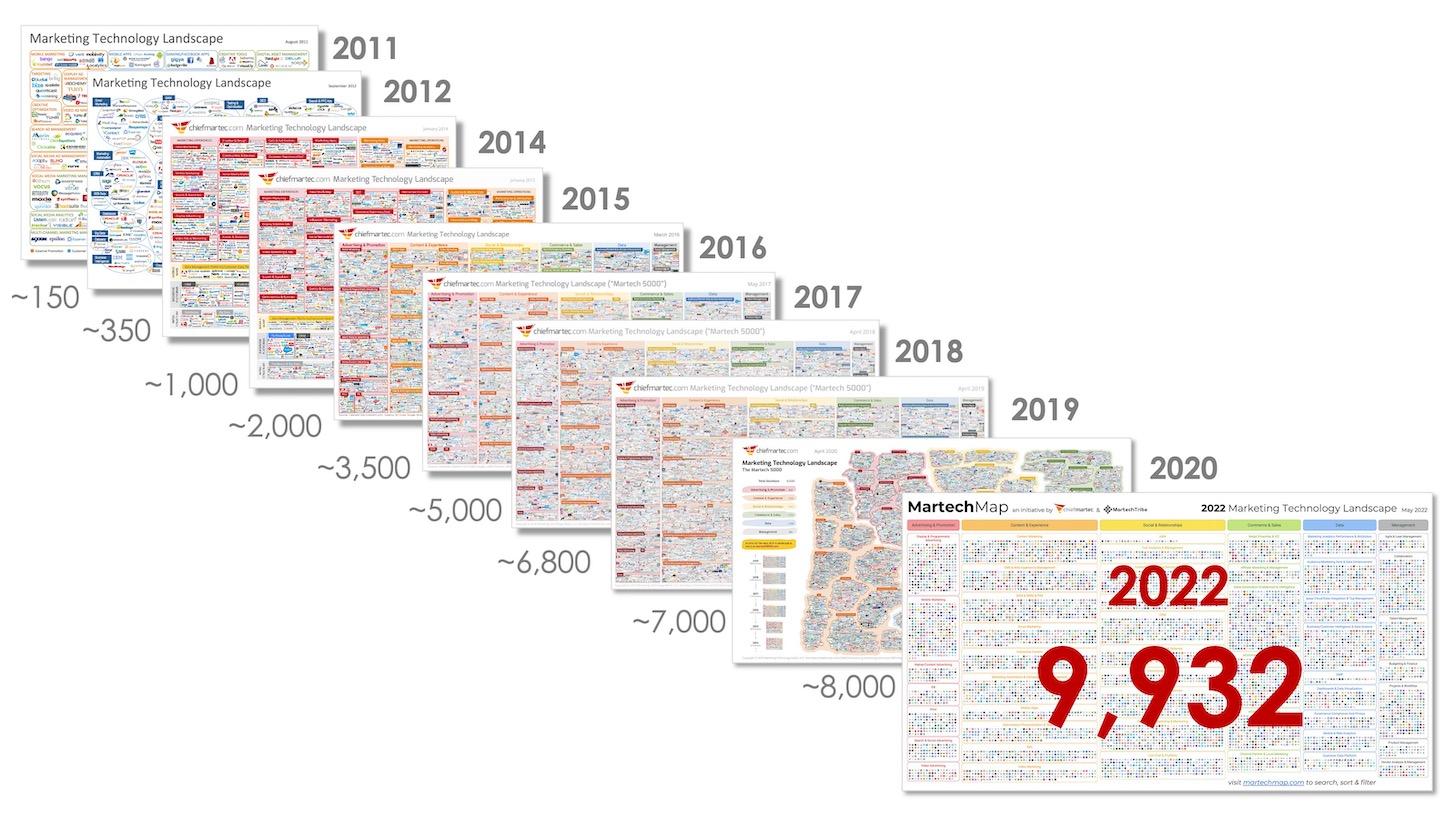

I was thinking about this recently when I looked at a map of martech SaaS companies that chiefmartec and MartechTribe prepared recently. What is amazing is how many marketing SaaS companies still get funded:

Image Credits: Scott Brinker of chiefmartec and MartechTribe

While not nearly as bad as marketing tech, we are seeing a huge inflation in the number of cybersecurity and fintech companies as well.

A comment that I increasingly hear in my conversations with CISOs, for example, is that they are not looking as much for new point solutions as much as a broader platform that will replace tens of the many cybersecurity applications they have in their systems. In a market where capital will be increasingly difficult to raise, many of the thousands of “me too” cybersecurity companies will find themselves becoming increasingly “insecure.”

The same is true for some areas of fintech. How many more payment companies can be created? How many more e-commerce finance companies can survive and flourish?

Marc Andreessen once said that “software is eating the world.” Unfortunately, me-too investing is eating returns.

So, what should venture funds do?

As an early-stage VC, it’s not important to invest in what is hot today, but investing what will be hot in five to 10 years from now. The VCs that invest in the leaders of tomorrow’s markets will be the ones who generate outsized returns.

That does not mean one needs to stop investing in SaaS, cybersecurity or fintech. There will always be disruptive companies in those segments, but the balance needs to shift to the massive markets ripe for disruption by technologies that are underfunded.

In my view, there are four relatively underfunded areas that could produce huge winners over the next 10 years:

‘Me too’ investing is eating returns by Ram Iyer originally published on TechCrunch

English (US) ·

English (US) ·